Sallie Mae 2010 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

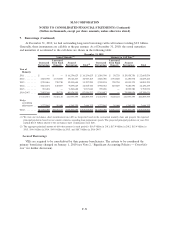

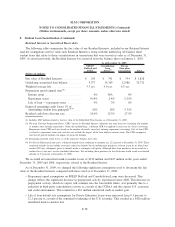

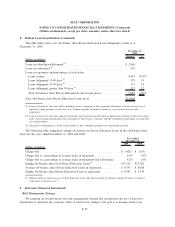

7. Borrowings (Continued)

acquisition of student loans guaranteed under the Higher Education Act. The bonds are limited obligations of

the Company and are secured by and payable from payments associated with the underlying secured loans.

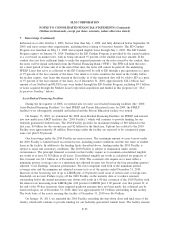

Federal Home Loan Bank of Des Moines (“FHLB-DM”)

On January 15, 2010, HICA Education Loan Corporation (“HICA”), our subsidiary, entered into a lending

agreement with the FHLB-DM. Under the agreement, the FHLB-DM will provide advances backed by Federal

Housing Finance Agency approved collateral which includes federally-guaranteed student loans (but does not

include Private Education Loans). The amount, price and tenor of future advances will vary and be subject to

the agreement’s borrowing conditions as then in effect determined at the time of each borrowing. The

maximum amount that can be borrowed, as of December 31, 2010, subject to available collateral, is

approximately $9.6 billion. As of December 31, 2010, borrowing under the facility totaled $900 million and

was secured by $1.2 billion of FFELP Loans. We have provided a guarantee to the FHLB-DM for the

performance and payment of HICA’s obligations.

Other Funding Sources

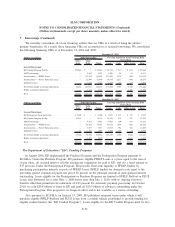

Sallie Mae Bank

During the fourth quarter of 2008, the Bank, our Utah industrial bank subsidiary, began expanding its

deposit base to fund new Private Education Loan originations. The Bank raises deposits through intermediaries

in the brokered Certificate of Deposit (“CD”) market and through direct retail deposit channels. As of

December 31, 2010, bank deposits totaled $5.9 billion of which $4.5 billion were brokered term deposits,

$1.4 billion were retail and other deposits. In addition, the Bank had deposits from affiliates totaling

$440 million that eliminate in our consolidated balance sheet. Cash and liquid investments totaled $2.0 billion

as of December 31, 2010.

In addition to its deposit base, the Bank has borrowing capacity with the Federal Reserve Bank (“FRB”)

through a collateralized lending facility. Borrowing capacity is limited by the availability of acceptable

collateral. As of December 31, 2010, borrowing capacity was approximately $650 million and there were no

outstanding borrowings.

Senior Unsecured Debt

During the year, we issued $1.5 billion of senior unsecured notes that bear a coupon of 8.00 percent. The

notes were swapped to LIBOR with an all-in cost of LIBOR plus 4.65 percent. On January 11, 2011, we

announced and priced a $2 billion five-year 6.25 percent fixed rate unsecured bond. The bond was issued to

yield 6.50 percent before underwriting fees. The rate on the bond was swapped from a fixed rate to a floating

rate equal to an all-in cost of one-month LIBOR plus 4.46 percent.

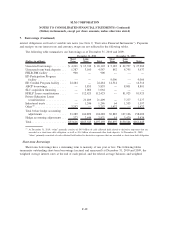

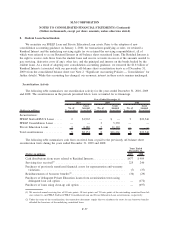

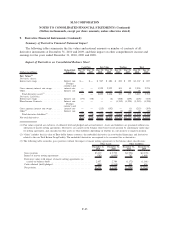

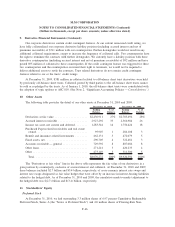

The following table summarizes activity related to the senior unsecured debt repurchases for the years

ended December 31, 2010, 2009 and 2008. “Gains on debt repurchases” is shown net of hedging-related gains

and losses.

2010 2009 2008

Years Ended December 31,

Unsecured debt principal repurchased ................ $4,868,201 $3,447,245 $1,910,326

Gains on debt repurchases ........................ 316,941 536,190 64,477

Unsecured Revolving Credit Facility

In 2010 we terminated our $1.6 billion revolving credit facility that was scheduled to mature in October 2011.

F-56

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)