Sallie Mae 2010 Annual Report Download - page 179

Download and view the complete annual report

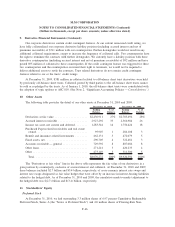

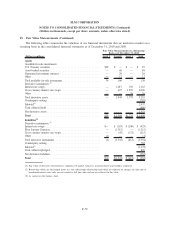

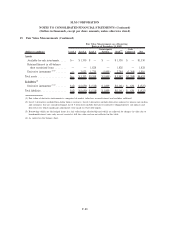

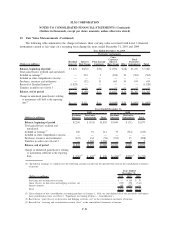

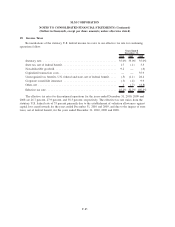

Please find page 179 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15. Fair Value Measurements (Continued)

collateral. In addition, adjustments and assumptions were made for credit spreads, liquidity, prepayment speeds

and defaults. A number of significant inputs into the models are not observable.

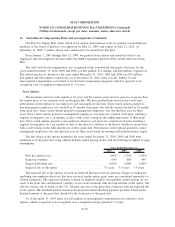

Cash and Investments (Including “Restricted Cash and Investments”)

Cash and cash equivalents are carried at cost. Carrying value approximated fair value for disclosure

purposes. Investments classified as trading or available-for-sale are carried at fair value in the financial

statements. Investments in U.S. Treasury securities consisted of T-bills that trade in active markets. The fair

value was determined using observable market prices. Investments in mortgage-backed securities are valued

using observable market prices. These securities are primarily collateralized by real estate properties in Utah

and are guaranteed by either a government sponsored enterprise or the U.S. government. Other investments

(primarily municipal bonds) for which observable prices from active markets are not available were valued

through standard bond pricing models using observable market yield curves adjusted for credit and liquidity

spreads. These valuations are immaterial to the overall investment portfolio. The fair value of investments in

Commercial Paper, Asset Backed Commercial Paper, or Demand Deposits that have a remaining term of less

than 90 days when purchased are estimated at cost and, when needed, adjustments for liquidity and credit

spreads are made depending on market conditions and counterparty credit risks. No additional adjustments

were deemed necessary.

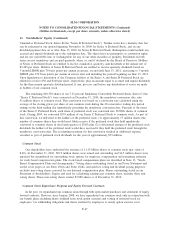

Borrowings

Borrowings are accounted for at cost in the financial statements except when denominated in a foreign

currency or when designated as the hedged item in a fair value hedge relationship. When the hedged risk is

the benchmark interest rate and not full fair value, the cost basis is adjusted for changes in value due to

benchmark interest rates only. Foreign currency-denominated borrowings are re-measured at current spot rates

in the financial statements. The full fair value of all borrowings is disclosed. Fair value was determined

through standard bond pricing models and option models (when applicable) using the stated terms of the

borrowings, observable yield curves, foreign currency exchange rates, volatilities from active markets or from

quotes from broker-dealers. Fair value adjustments for unsecured corporate debt are made based on indicative

quotes from observable trades and spreads on credit default swaps specific to the Company. Fair value

adjustments for secured borrowings are based on indicative quotes from broker-dealers. These adjustments for

both secured and unsecured borrowings are material to the overall valuation of these items and, currently, are

based on inputs from inactive markets.

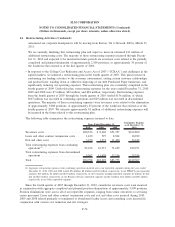

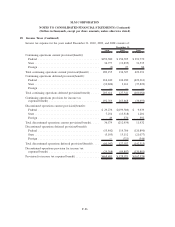

Derivative Financial Instruments

All derivatives are accounted for at fair value in the financial statements. The fair value of a majority of

derivative financial instruments was determined by standard derivative pricing and option models using the

stated terms of the contracts and observable market inputs. In some cases, we utilized internally developed

inputs that are not observable in the market, and as such, classified these instruments as level 3 fair values.

Complex structured derivatives or derivatives that trade in less liquid markets require significant adjustments

and judgment in determining fair value that cannot be corroborated with market transactions. It is our policy

to compare our derivative fair values to those received by our counterparties in order to validate the model’s

outputs. Any significant differences are identified and resolved appropriately.

When determining the fair value of derivatives, we take into account counterparty credit risk for positions

where it is exposed to the counterparty on a net basis by assessing exposure net of collateral held. The net

exposures for each counterparty are adjusted based on market information available for the specific counter-

party, including spreads from credit default swaps. When the counterparty has exposure to us under derivatives

F-76

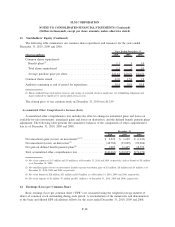

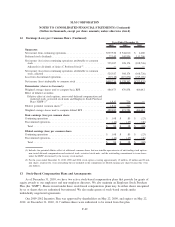

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)