Sallie Mae 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

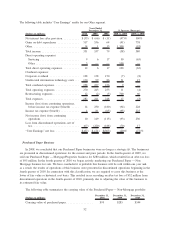

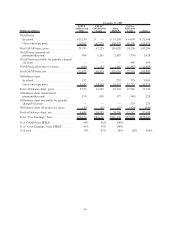

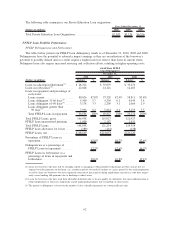

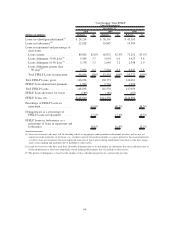

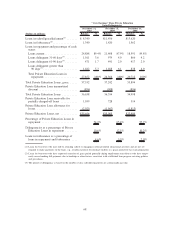

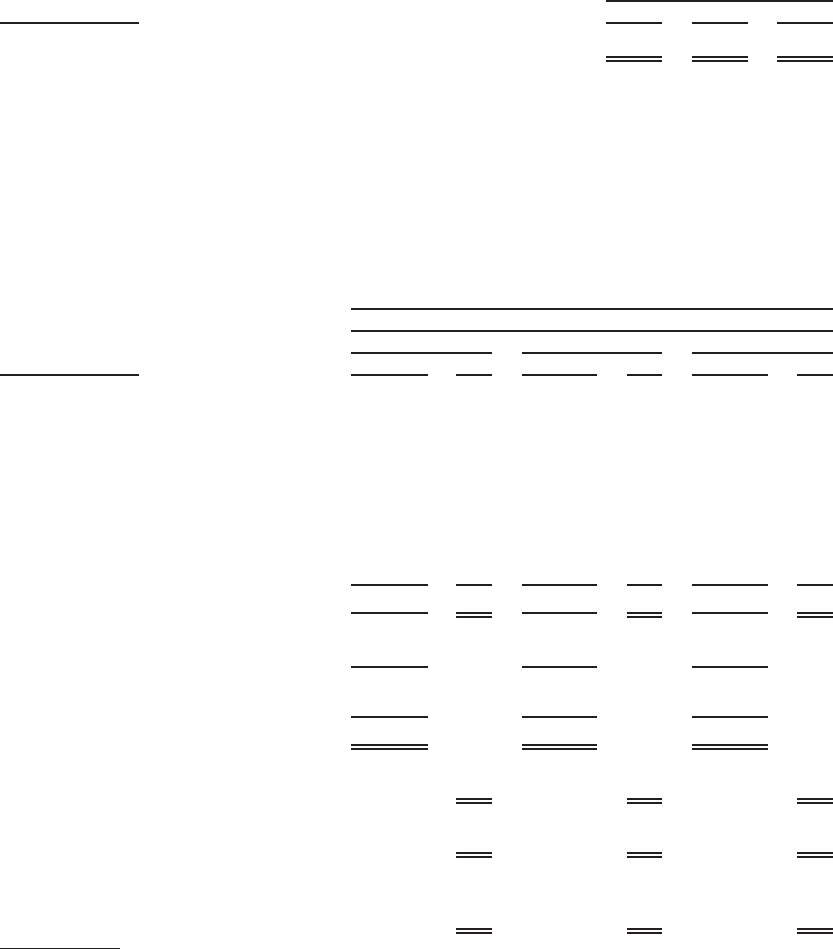

The following table summarizes our Private Education Loan originations.

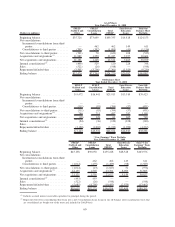

(Dollars in millions) 2010 2009 2008

Years Ended December 31,

Total Private Education Loan Originations . . . ................... $2,307 $3,176 $6,336

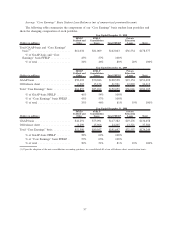

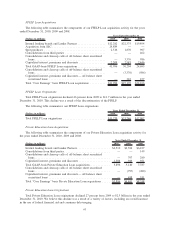

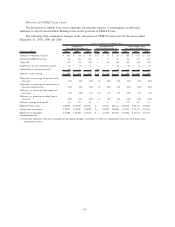

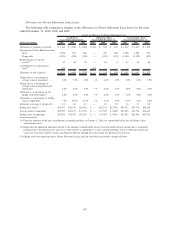

FFELP Loan Portfolio Performance

FFELP Delinquencies and Forbearance

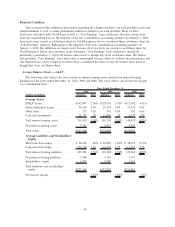

The tables below present our FFELP Loan delinquency trends as of December 31, 2010, 2009 and 2008.

Delinquencies have the potential to adversely impact earnings as they are an indication of the borrower’s

potential to possibly default and as a result require a higher loan loss reserve than loans in current status.

Delinquent loans also require increased servicing and collection efforts, resulting in higher operating costs.

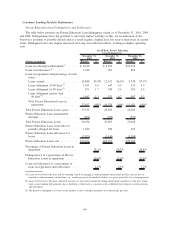

(Dollars in millions) Balance % Balance % Balance %

2010 2009 2008

December 31,

GAAP-Basis FFELP

Loan Delinquencies

Loans in-school/grace/deferment

(1)

.... $ 28,214 $ 35,079 $ 39,270

Loans in forbearance

(2)

............. 22,028 14,121 12,483

Loans in repayment and percentage of

each status:

Loans current .................. 80,026 82.8% 57,528 82.4% 58,811 83.8%

Loans delinquent 31-60 days

(3)

..... 5,500 5.7 4,250 6.1 4,044 5.8

Loans delinquent 61-90 days

(3)

..... 3,178 3.3 2,205 3.1 2,064 2.9

Loans delinquent greater than

90 days

(3)

................... 7,992 8.2 5,844 8.4 5,255 7.5

Total FFELP Loans in repayment . . . 96,696 100% 69,827 100% 70,174 100%

Total FFELP Loans, gross ........... 146,938 119,027 121,927

FFELP Loan unamortized premium .... 1,900 2,187 2,431

Total FFELP Loans. . . ............. 148,838 121,214 124,358

FFELP Loan allowance for losses ..... (189) (161) (138)

FFELP Loans, net................. $148,649 $121,053 $124,220

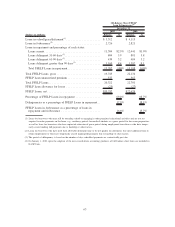

Percentage of FFELP Loans in

repayment ..................... 65.8% 58.7% 57.6%

Delinquencies as a percentage of

FFELP Loans in repayment ........ 17.2% 17.6% 16.2%

FFELP Loans in forbearance as a

percentage of loans in repayment and

forbearance .................... 18.6% 16.8% 15.1%

(1) Loans for borrowers who may still be attending school or engaging in other permitted educational activities and are not yet

required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation,

as well as loans for borrowers who have requested extension of grace period during employment transition or who have tempo-

rarily ceased making full payments due to hardship or other factors.

(2) Loans for borrowers who have used their allowable deferment time or do not qualify for deferment, that need additional time to

obtain employment or who have temporarily ceased making full payments due to hardship or other factors.

(3) The period of delinquency is based on the number of days scheduled payments are contractually past due.

62