Sallie Mae 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

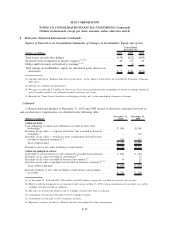

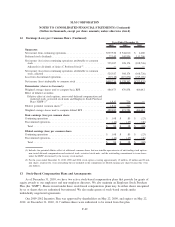

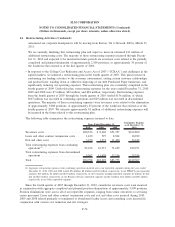

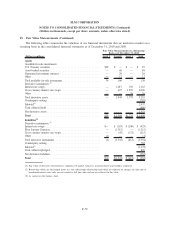

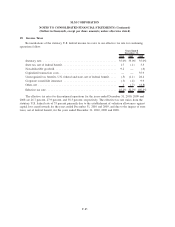

14. Restructuring Activities (Continued)

The following table summarizes the restructuring liability balance, which is included in other liabilities in

the accompanying consolidated balance sheet.

Severance

Costs

Lease and

Other

Contract

Termination

Costs

Exit and

Other Costs Total

Balance at December 31, 2008 ............. $15,124 $ 2,798 $ 60 $ 17,982

Net accruals from continuing operations ....... 8,402 597 1,572 10,571

Net accruals from discontinued operations ...... 9,356 2,193 109 11,658

Cash paid . . . ........................... (23,687) (1,807) (1,741) (27,235)

Balance at December 31, 2009 ............. $ 9,195 $ 3,781 $ — $ 12,976

Net accruals from continuing operations ....... 80,536 1,430 3,270 85,236

Net accruals from discontinued operations ...... 3,108 2,384 70 5,562

Cash paid . . . ........................... (45,235) (3,440) (1,678) (50,353)

Balance at December 31, 2010 ............. $47,604 $ 4,155 $ 1,662 $ 53,421

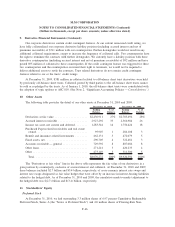

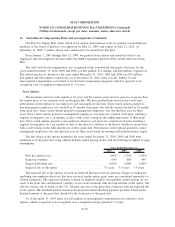

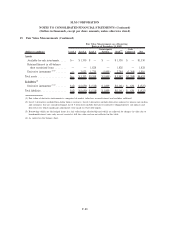

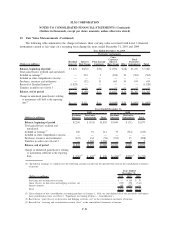

15. Fair Value Measurements

We use estimates of fair value in applying various accounting standards for our financial statements.

We categorize our fair value estimates based on a hierarchical framework associated with three levels of

price transparency utilized in measuring financial instruments at fair value. For additional information

regarding our policies for determining fair value and the hierarchical framework see Note 2, “Significant

Accounting Policies — Fair Value Measurement.”

During the year ended December 31, 2010, there were no significant transfers of financial instruments

between levels.

Student Loans

Our FFELP Loans and Private Education Loans are accounted for at cost or at the lower of cost or

market if the loan is held-for-sale. FFELP Loans classified as held-for-sale are those which we have the ability

and intent to sell under various ED loan purchase programs. In these instances, the FFELP Loans are valued

using the committed sales price under the programs. For all other FFELP Loans and Private Education Loans,

fair values were determined by modeling loan cash flows using stated terms of the assets and internally-

developed assumptions to determine aggregate portfolio yield, net present value and average life. The

significant assumptions used to project cash flows are prepayment speeds, default rates, cost of funds, required

return on equity, and expected Repayment Borrower Benefits to be earned. In addition, the Floor Income

component of our FFELP Loan portfolio is valued with option models using both observable market inputs

and internally developed inputs. A number of significant inputs into the models are internally derived and not

observable to market participants. Certain model assumptions were calibrated based upon pricing information

related to our acquisition of the Student Loan Corporation FFELP trusts on December 31, 2010.

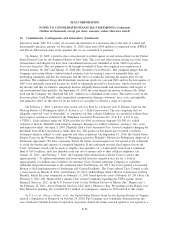

Other Loans

Facilities financings, and mortgage and consumer loans held for investment are accounted for at cost with

fair values being disclosed. Fair value was determined primarily by looking to the value of the underlying

F-75

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)