Sallie Mae 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have been collecting defaulted student loans on behalf of ED since 1997. The contract is merit based

and accounts are awarded on collection performance. We have consistently ranked number one or two among

the ED collectors. In anticipation of a surge in volume as more loans switch to DSLP, ED added five new

collection companies bringing the total to 22. This led to a decline in account placements, which we believe is

temporary. We expect that as the DSLP grows, increased revenue under the ED contract will partially offset

the decline in revenue from our Guarantor clients.

As a result of HCERA, our FFELP Loans segment is now a runoff business. Our Consumer Lending and

components of Business Services segments are ongoing businesses with growth opportunities. We are currently

restructuring our operations to reflect the impact of the legislation which has resulted in significant

restructuring expenses. In 2010 most of our $85 million of restructuring expenses related to HCERA.

Student Lending Market

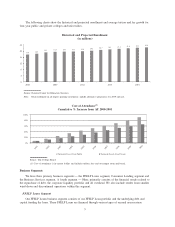

Students and their families use multiple sources of funding to pay for their college education, including

savings, current income, grants, scholarships, and federally guaranteed and private education loans. Due to an

increase in federal loan limits that took effect in 2007 and 2008, we have seen a substantial increase in

borrowing from federal loan programs in recent years. In the Academic Year (“AY”) that ended on June 30,

2010, according to the College Board, borrowing from federal loan programs increased 14 percent from the

prior year to $96.8 billion and has a five-year compound annual growth rate of 9.9 percent. Borrowing from

Private Education Loan programs decreased 24 percent to $7.7 billion and is down significantly from the peak

of $21.8 billion in the AY 2007-2008. The College Board also reported that federal grants increased 64 percent

to $41.2 billion from $25.2 billion in the most recent year. We believe the drop in borrowing from private loan

programs was caused by an increase in federal loans and consumer deleveraging.

Federal Family Education Loan Program (“FFELP”)

Prior to its elimination on July 1, 2010 by HCERA, the FFELP was the source of the vast majority of federal

loans to students. (For a full description of FFELP, see Appendix A “Federal Family Education Loan Program.”)

As of September 30, 2010, there were $759 billion in federal student loans outstanding, $529 billion of which

were originated under the FFELP. Private entities held $390 billion of FFELP Loans as of September 30, 2010,

with the remaining amount held by ED. We were the largest originator of loans under the FFELP and had

$148.6 billion of loans outstanding at December 31, 2010. See Item 7 “Management’s Discussion and Analysis of

Financial Condition and Results of Operations — Segment Earnings Summary — ‘Core Earnings’ Basis — FFELP

Loans Segment” for a full discussion of our FFELP business and related loan portfolio.

The Higher Education Act (the “HEA”) regulates every aspect of the FFELP, including communications

with borrowers and default aversion requirements. Failure to service a FFELP Loan properly jeopardizes the

guarantee on the loan. This guarantee generally covers 98 or 97 percent of the student loan’s principal and

accrued interest for loans disbursed before and after July 1, 2006, respectively. In the case of death, disability

or bankruptcy of the borrower, the guarantee covers 100 percent of the loan’s principal and accrued interest.

The guarantees on our existing loans were not affected by HCERA.

FFELP Loans are guaranteed by state agencies or not-for-profit companies designated as Guarantors, with

ED providing reinsurance to the Guarantors. Guarantors are responsible for performing certain functions

necessary to ensure the program’s soundness and accountability. Generally, the Guarantor is responsible for

ensuring that loans are serviced in compliance with the requirements of the HEA. When a borrower defaults,

we submit a claim to the Guarantor who provides reimbursements of principal and accrued interest subject to

Risk Sharing. (See Appendix A “Federal Family Education Loan Program” for a description of the role of

Guarantors.)

Private Education Loan Products

We offer Private Education Loan products to bridge the gap between family resources, federal loans,

grants, student aid, scholarships, and the cost of a college education. Historically, the majority of our Private

Education Loans were made in conjunction with a FFELP Stafford Loan and were marketed to schools

3