Sallie Mae 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

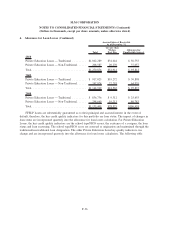

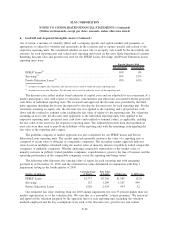

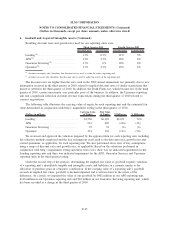

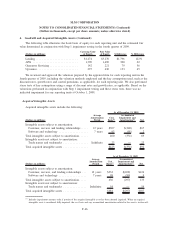

6. Goodwill and Acquired Intangible Assets (Continued)

premiums, as applicable, for each reporting unit. We also performed stress tests of key assumptions using a

range of discount rates and growth rates, as applicable. Based on the valuations performed in conjunction with

annual Step 1 impairment testing and these stress tests, there was no indicated impairment for the FFELP

Loans, Servicing and Private Education Loans reporting units.

We acknowledge that continued weakness in the economy coupled with changes in the industry resulting

from HCERA or other legislation could adversely affect the operating results of our reporting units. If the

forecasted performance of our reporting units is not achieved, or if our stock price declines to a depressed

level resulting in deterioration in our total market capitalization, the fair value of the FFELP Loans, Servicing

and Private Education Loans reporting units could be significantly reduced, and we may be required to record

a charge, which could be material, for an impairment of goodwill.

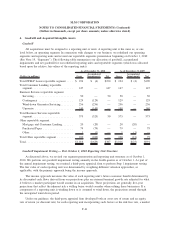

Goodwill Impairment Testing — Pre-October 1, 2010 Reporting Unit Structure

As discussed above, we revised our segment presentation and reporting unit structure as of October 1,

2010. As such, 2010 interim impairment assessments and testing during interim periods as well as 2009

annual impairment testing were completed based on the reporting unit structure in place during these periods.

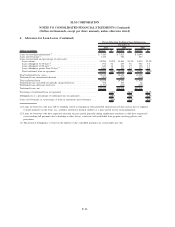

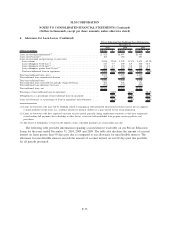

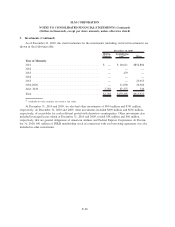

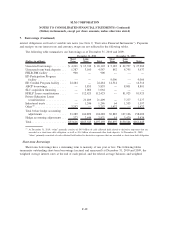

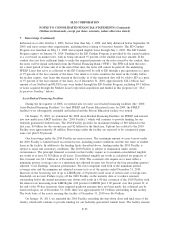

The following table summarizes our allocation of goodwill to our reporting units, accumulated impairments

and net goodwill for each reporting unit, based on our reporting unit structure in place prior to October 1,

2010.

(Dollars in millions) Gross

Accumulated

Impairments Net Gross

Accumulated

Impairments Net

As of September 30, 2010 As of December 31, 2009

Total Lending reportable segment ........ $ 411 $ (24) $387 $ 411 $(24) $387

Total APG reportable segment ........... 402 (402) — 402 — 402

Other reportable segment

Guarantor Servicing ................. 62 (62) — 62 — 62

Upromise . . . ..................... 140 (140) — 140 — 140

Other............................ 1 (1) — 1 (1) —

Total Other reportable segment .......... 203 (203) — 203 (1) 202

Total .............................. $1,016 $(629) $387 $1,016 $(25) $991

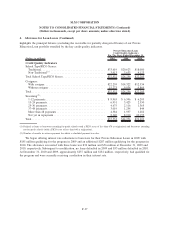

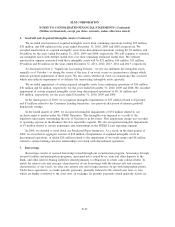

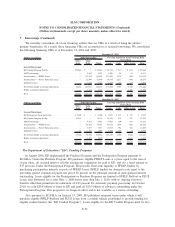

On March 30, 2010, President Obama signed into law HCERA, which included the SAFRA Act.

Effective July 1, 2010, this legislation eliminated the authority to provide new loans under FFELP and requires

that all new federal loans are to be made through the DSLP. The new law did not alter or affect the terms and

conditions of existing FFELP Loans. This new law will result in a restructuring that will result in both a

significant amount of restructuring expenses incurred as well as a significant reduction of on-going operating

costs once the restructuring is complete. See Note 14, “Restructuring Activities” for further details.

When we performed our annual impairment assessment in the fourth quarter of 2009, the cash flow

projections for our reporting units were valued assuming the proposed HCERA legislation was passed. There

was no indicated impairment for any of the reporting units in the fourth quarter of 2009.

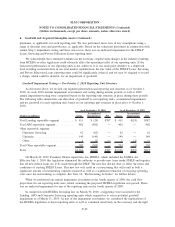

In connection with HCERA becoming law on March 30, 2010, a triggering event occurred for the

Lending, APG and Guarantor Servicing reporting units which required us to assess potential goodwill

impairment as of March 31, 2010. As part of the impairment assessment, we considered the implications of

the HCERA legislation to these reporting units as well as continued uncertainty in the economy and the tight

F-43

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)