Sallie Mae 2010 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

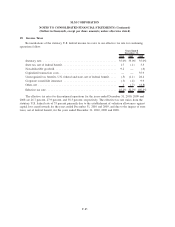

18. Income Taxes (Continued)

Accounting for Uncertainty in Income Taxes

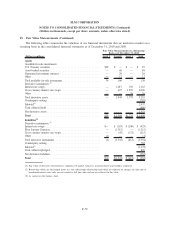

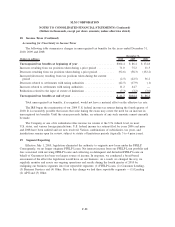

The following table summarizes changes in unrecognized tax benefits for the years ended December 31,

2010, 2009 and 2008:

(Dollars in millions) 2010 2009 2008

December 31,

Unrecognized tax benefits at beginning of year ....................... $104.4 $ 86.4 $ 174.8

Increases resulting from tax positions taken during a prior period ........... 71.0 75.2 11.3

Decreases resulting from tax positions taken during a prior period ........... (92.6) (58.3) (132.2)

Increases/(decreases) resulting from tax positions taken during the current

period ..................................................... (2.5) (22.5) 36.2

Decreases related to settlements with taxing authorities . . . ................ (42.5) (17.9) (.1)

Increases related to settlements with taxing authorities . . . ................ 11.2 44.7 —

Reductions related to the lapse of statute of limitations . . . ................ (7.3) (3.2) (3.6)

Unrecognized tax benefits at end of year ............................ $ 41.7 $104.4 $ 86.4

Total unrecognized tax benefits, if recognized, would not have a material effect on the effective tax rate.

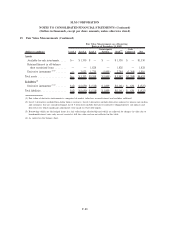

The IRS began the examination of our 2009 U.S. federal income tax returns during the fourth quarter of

2010. It is reasonably possible that issues that arise during the exam may create the need for an increase in

unrecognized tax benefits. Until the exam proceeds further, an estimate of any such amounts cannot currently

be made.

The Company or one of its subsidiaries files income tax returns at the U.S. federal level, in most

U.S. states, and various foreign jurisdictions. U.S. federal income tax returns filed for years 2006 and prior

and 2008 have been audited and are now resolved. Various combinations of subsidiaries, tax years, and

jurisdictions remain open for review, subject to statute of limitations periods (typically 3 to 4 prior years).

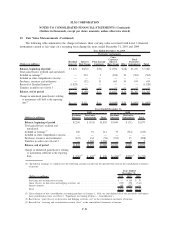

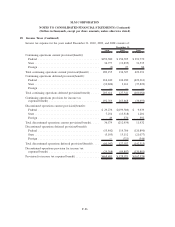

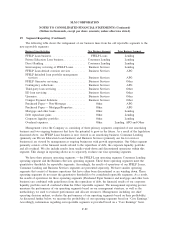

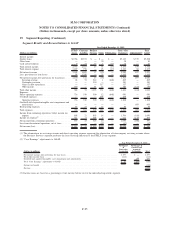

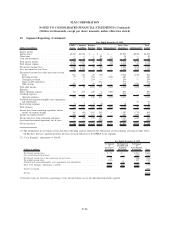

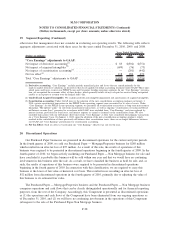

19. Segment Reporting

Effective July 1, 2010, legislation eliminated the authority to originate new loans under the FFELP.

Consequently, we no longer originate FFELP Loans. Net interest income from our FFELP Loan portfolio and

fees associated with servicing FFELP Loans and collecting on delinquent and defaulted FFELP Loans on

behalf of Guarantors has been our largest source of income. In response, we conducted a broad-based

assessment of the effect the legislation would have on our business. As a result, we changed the way we

regularly monitor and assess our ongoing operations and results during the fourth quarter of 2010 by

realigning our business segments into four reportable segments: (1) FFELP Loans, (2) Consumer Lending,

(3) Business Services and (4) Other. Prior to this change we had three reportable segments — (1) Lending

(2) APG and (3) Other.

F-88

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)