Sallie Mae 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.“Risk Factors — Regulatory and Compliance.” In 2010, we were anticipating the introduction of the Troubled

Asset Relief Program (“TARP”) tax, which had the potential to significantly reduce our net income. The

President’s Fiscal 2012 Budget resubmits such a tax for Congress’ consideration. The passage of sweeping

changes to the legal and regulatory environments in which we operate, including increases in taxation or fees

charged on our business, have the potential to materially and adversely impact our business, financial condition

and results of operations.

Our ability to continue to grow our businesses related to contracting with state and federal governments

is partly reliant on our ability to remain compliant with the laws and regulations applicable to those

contracts.

We are subject to a variety of laws and regulations related to our government contracting businesses,

including our contracts with ED. In addition, these government contracts are subject to termination rights,

audits and investigations. If we were found in noncompliance with the contract provisions or applicable laws

or regulations, or the government exercised its termination or other rights for that or other reasons, our

reputation could be negatively affected, and our ability to compete for new contracts could be diminished. If

this were to occur, the future prospects, revenues and results of operations of this portion of our business could

be negatively affected.

Competition.

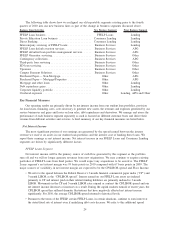

We operate in a competitive environment, and our product offerings are primarily concentrated in loan

and savings products for higher education.

We compete in the private credit lending business with banks and other consumer lending institutions,

many with strong consumer brand name recognition. We compete based on our products, origination capability

and customer service. To the extent our competitors compete aggressively or more effectively, we could lose

market share to them or subject our existing loans to refinancing risk. In addition, there is a risk that any new

education or loan products that we introduce will not be accepted in the marketplace. Our product offerings

may not prove to be profitable and may fail to offset the loss of business in the education credit market.

We are a leading provider of saving- and paying-for-college products and programs. This concentration

gives us a competitive advantage in the marketplace. This concentration also creates risks in our business,

particularly in light of our concentration as a private credit lender and servicer for the FFELP and DSLP. If

population demographics result in a decrease in college-age individuals, if demand for higher education

decreases, if the cost of attendance of higher education decreases, if public resistance to higher education costs

increases, or if the demand for higher education loans decreases, our private credit lending business could be

negatively affected. In addition, the federal government, through the DSLP, poses significant competition to

our private credit loan products. If loan limits under the DSLP increase, as they did in late 2007 and 2008,

DSLP loans could be more widely available to students and parents and DSLP loan limits could increase,

resulting in a decrease in the size of the private credit education loan market and lessened demand for our

private credit education loan products.

Credit and Counterparty.

Unexpected and sharp changes in the overall economic environment may negatively impact the

performance of our loan and credit portfolios.

Unexpected changes in the overall economic environment may result in the credit performance of our

loan portfolio being materially different from what we expect. Our earnings are critically dependent on the

evolving creditworthiness of our student loan customers. We maintain a reserve for credit losses based on

expected future charge-offs which considers many factors, including levels of past due loans and forbearances

and expected economic conditions. However, management’s determination of the appropriate reserve level may

under- or over-estimate future losses. If the credit quality of our customer base materially decreases, if a

market risk changes significantly, or if our reserves for credit losses are not adequate, our business, financial

condition and results of operations could suffer.

14