Sallie Mae 2010 Annual Report Download - page 203

Download and view the complete annual report

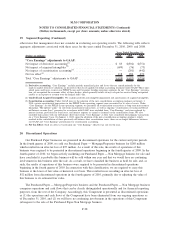

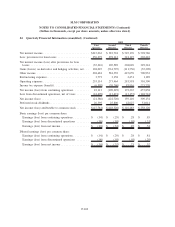

Please find page 203 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21. Concentrations of Risk — (Continued)

Concentration Risk in the Revenues Associated with FFELP Loans

Effective July 1, 2010, the HCERA legislation required that all new federal loans are to be made through

the DSLP and eliminated the FFELP through which we currently generate the majority of our net income. The

new law did not alter or affect the terms and conditions of existing FFELP Loans. We will no longer originate

FFELP Loans and therefore will no longer earn revenue on newly originated FFELP Loan volume after 2010.

In 2010 we earned revenue of $321 million related to selling FFELP Loans to ED as part of the Loan

Purchase Commitment Program and also earned $110 million in net interest income on the loans before

selling them to ED. The net interest margin we earn on our FFELP Loans portfolio, which totaled $1.9 billion

in 2010, will decline over time as the portfolio amortizes.

In addition, the legislation eliminates the need for the Guarantors and the services we provide to the

sector. We earned an origination fee when we processed a loan guarantee for a Guarantor client and a

maintenance fee for the life of the loan for servicing the Guarantor’s portfolio of loans. We are no longer

originating FFELP Loans; therefore we will no longer earn the origination fee paid by the Guarantor. The

portfolio that generates the maintenance fee is now in runoff, and the maintenance fees we earn will decline

ratably with the portfolio. In 2010, we earned guarantor origination fees of $34 million and maintenance fees

of $56 million.

Our student loan contingent collection business is also affected by HCERA. We currently have 12

Guarantors as clients. We earn revenue from Guarantors for collecting defaulted loans as well as for managing

their portfolios of defaulted loans. In 2010, collection revenue from Guarantor clients totaled $245 million.

We anticipate that revenue from Guarantors will be relatively stable through 2012 and then begin to steadily

decline as the portfolio of defaulted loans we manage is resolved and amortizes.

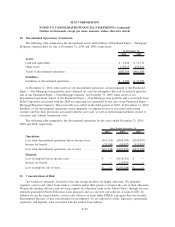

Concentration Risk in the Servicing of Direct Loans

The DSLP is serviced by four private sector institutions, including Sallie Mae. Defaulted Direct Loans

are collected by 22 private sector companies, including Sallie Mae. Because of the concentration of our

business in servicing and collecting on Direct Loans, we are exposed to risks associated with ED reducing the

amount of new loan servicing and collections allocated to us or the termination of our servicing or collections

contracts.

Concentration Risk in the Revenues Associated with Private Education Loans

We are the leader in the origination of Private Education Loans. As such, we are exposed to the risk that

students and their families have greater access to FFELP Loans or grants for education which, in turn, would

reduce our opportunity to originate and service Private Education Loans. Students and their families use

multiple sources of funding to pay for their college education, including savings, current income, grants,

scholarships, and federally guaranteed and Private Education Loans. Due to an increase in federal loan limits

that took effect in 2007 and 2008, we have seen a substantial increase in borrowing from federal loan

programs in recent years. In addition to the risk associated with reduced Private Education Loan volumes, we

are exposed to credit risk from economic conditions, particularly as they relate to the ability of recent

graduates to find jobs in their fields of study, thereby increasing our risk of loss.

F-100

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)