Sallie Mae 2010 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Higher Education Reconciliation Act of 2005 reauthorized the loan programs of the HEA. Major

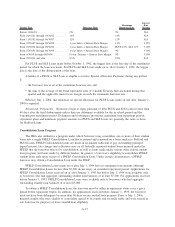

provisions, which became effective July 1, 2006 (unless stated otherwise), include:

• Change to a fixed 6.8 percent interest rate for Stafford Loans.

• Increases the scheduled change to a fixed PLUS interest rate from 7.9 percent to 8.5 percent in the

FFELP.

• Permanently modifies the minimum special allowance calculation for loans made with proceeds of tax-

exempt obligations.

• Requires submission of Floor Income to the government on loans made on or after April 1, 2006.

• Repeals limitations on special allowance for PLUS Loans made on and after January 1, 2000.

• Increases first and second year Stafford loan limits from $2,625 and $3,500 to $3,500 and $4,500

respectively (effective July 1, 2007).

• Increases graduate and professional student unsubsidized Stafford Loan limits from $10,000 to $12,000

(effective July 1, 2007).

• Authorizes graduate and professional students to borrow PLUS Loans.

• Reduces insurance from 98 percent to 97 percent for new loans beginning July 1, 2006.

• Phases out the Stafford Loan origination fee by 2010.

• Reduces insurance for Exceptional Performers from 100 percent to 99 percent.

• Repeals in-school consolidation, spousal consolidation, reconsolidation, and aligns loan consolidation

terms in the FFELP and DSLP.

• Mandates the deposit of a one percent federal default fee into a guaranty agency’s Federal Fund, which

may be deducted from loan proceeds.

• Repeals the guaranty agency Account Maintenance Fee cap (effective FY 2007).

• Reduces Guarantor retention of collection fees on defaulted FFELP Consolidation Loans from

18.5 percent to 10 percent (effective October 1, 2006).

• Provides a discharge for loans that are falsely certified as a result of identity theft.

• Provides 100 percent insurance on ineligible loans due to false or erroneous information on loans made

on or after July 1, 2006.

• Allows for a 3-year military deferment for a borrower’s loans made on or after July 1, 2001.

• Reduces the monthly payment remittance needed to rehabilitate defaulted loans from 12 to 9.

• Increases from 10 percent to 15 percent the amount of disposable pay a guaranty agency may garnish

without borrower consent.

• Streamlines mandatory forbearances to accommodate verbal requests.

The changes made by THEEA include:

• Restrictions on the use of eligible lender trustees by schools that make FFELP Loans;

• New discharge provisions for Title IV loans for the survivors of eligible public servants and certain

other eligible victims of the terrorist attacks on the United States on September 11, 2001; and

• A technical modification to the HEA provision governing account maintenance fees that are paid to

guaranty agencies in the FFELP.

A-3