Sallie Mae 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

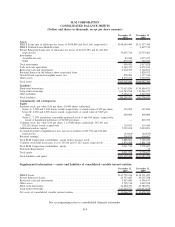

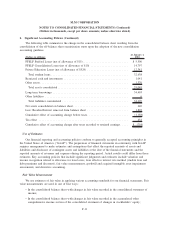

2. Significant Accounting Policies (Continued)

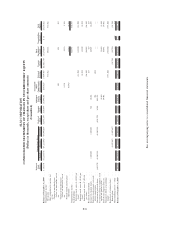

The following table summarizes the change in the consolidated balance sheet resulting from the

consolidation of the off-balance sheet securitization trusts upon the adoption of the new consolidation

accounting guidance.

(Dollars in millions)

At January 1,

2010

FFELP Stafford Loans (net of allowance of $15) ............................. $ 5,500

FFELP Consolidation Loans (net of allowance of $10) . . ...................... 14,797

Private Education Loans (net of allowance of $524) .......................... 12,341

Total student loans ................................................. 32,638

Restricted cash and investments ......................................... 1,041

Other assets ........................................................ 1,370

Total assets consolidated ............................................. 35,049

Long-term borrowings ................................................ 34,403

Other liabilities ..................................................... 6

Total liabilities consolidated .......................................... 34,409

Net assets consolidated on balance sheet ................................... 640

Less: Residual Interest removed from balance sheet .......................... 1,828

Cumulative effect of accounting change before taxes .......................... (1,188)

Tax effect ......................................................... 434

Cumulative effect of accounting change after taxes recorded to retained earnings ..... $ (754)

Use of Estimates

Our financial reporting and accounting policies conform to generally accepted accounting principles in

the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP

requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates. Key accounting policies that include significant judgments and estimates include valuation and

income recognition related to allowance for loan losses, loan effective interest rate method (student loan and

debt premiums and discounts), fair value measurements, goodwill and acquired intangible asset impairment

assessments, and derivative accounting.

Fair Value Measurement

We use estimates of fair value in applying various accounting standards for our financial statements. Fair

value measurements are used in one of four ways:

• In the consolidated balance sheet with changes in fair value recorded in the consolidated statement of

income;

• In the consolidated balance sheet with changes in fair value recorded in the accumulated other

comprehensive income section of the consolidated statement of changes in stockholders’ equity;

F-11

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)