Sallie Mae 2010 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

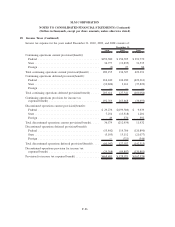

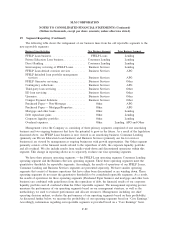

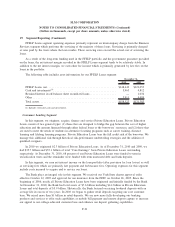

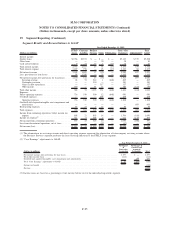

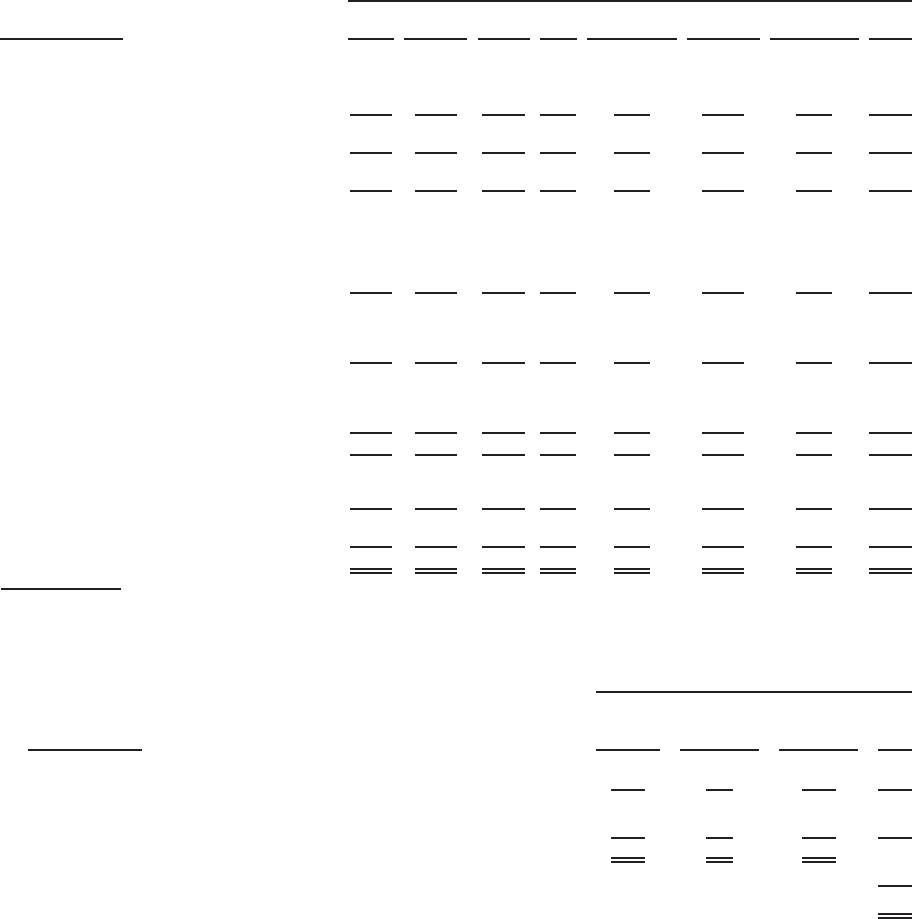

19. Segment Reporting (Continued)

(Dollars in millions)

FFELP

Loans

Consumer

Lending

Business

Services Other Eliminations

(1)

Total “Core

Earnings” Adjustments

(2)

Total

GAAP

Year Ended December 31, 2009

Interest income:

Student loans .......................... $3,252 $2,254 $ — $ — $ — $5,506 $(830) $4,676

Other loans ........................... — — — 56 — 56 — 56

Cash and investments ..................... 26 13 20 (10) (20) 29 (3) 26

Total interest income ..................... 3,278 2,267 20 46 (20) 5,591 (833) 4,758

Total interest expense ..................... 2,238 721 — 66 (20) 3,005 30 3,035

Net interest income (loss) .................. 1,040 1,546 20 (20) — 2,586 (863) 1,723

Less: provisions for loan losses ............... 119 1,399 — 46 — 1,564 (445) 1,119

Net interest income (loss) after provisions for loan

losses ............................. 921 147 20 (66) — 1,022 (418) 604

Servicing revenue ...................... 75 70 954 — (659) 440 — 440

Contingency revenue .................... — — 294 — — 294 — 294

Gains on debt repurchases ................ — — — 536 — 536 — 536

Other income ........................ 292 — 55 1 — 348 (285) 63

Total other income ....................... 367 70 1,303 537 (659) 1,618 (285) 1,333

Expenses:

Direct operating expenses .................. 754 265 440 6 (659) 806 — 806

Overhead expenses....................... — — — 237 — 237 — 237

Operating expenses ..................... 754 265 440 243 (659) 1,043 — 1,043

Goodwill and acquired intangible assets impairment

and amortization ...................... — — — — — — 76 76

Restructuring expenses .................... 8 2 2 (2) — 10 — 10

Total expenses ......................... 762 267 442 241 (659) 1,053 76 1,129

Income (loss) from continuing operations, before

income tax expense benefit ................ 526 (50) 881 230 — 1,587 (779) 808

Income tax expense benefit

(3)

................ 186 (18) 311 81 — 560 (296) 264

Net income (loss) from continuing operations ...... 340 (32) 570 149 — 1,027 (483) 544

Loss from discontinued operations, net of taxes ..... — — — (220) — (220) — (220)

Net income (loss) ....................... $ 340 $ (32) $ 570 $ (71) $ — $ 807 $(483) $ 324

(1) The eliminations in servicing revenue and direct operating expense represent the elimination of intercompany servicing revenue where

the Business Services segment performs the loan servicing function for the FFELP Loans segment.

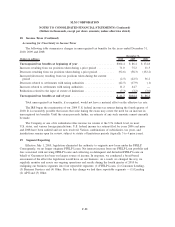

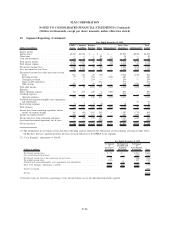

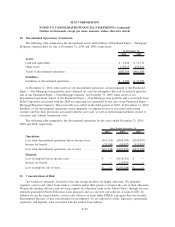

(2) “Core Earnings” adjustments to GAAP:

(Dollars in millions)

Net Impact

of

Derivative

Accounting

Net Impact of

Goodwill and

Acquired

Intangibles

Net Impact

of

Securitization

Accounting Total

Year Ended December 31, 2009

Net interest income (loss) . . . ........................................ $ 78 $— $(941) $(863)

Less: provisions for loan losses ....................................... — — (445) (445)

Net interest income (loss) after provisions for loan losses . . . ..................... 78 — (496) (418)

Total other income (loss) . . . ........................................ (580) — 295 (285)

Goodwill and acquired intangible assets impairment and amortization ................ — 76 — 76

Total “Core Earnings” adjustments to GAAP . .............................. $(502) $(76) $(201) (779)

Income tax benefit . . . ............................................ (296)

Net loss ..................................................... $(483)

(3) Income taxes are based on a percentage of net income before tax for the individual reportable segment.

F-96

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)