Sallie Mae 2010 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

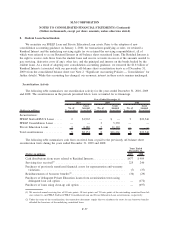

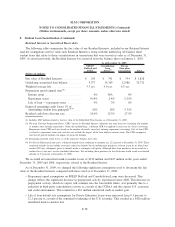

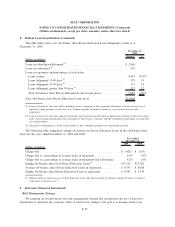

8. Student Loan Securitization

We securitize our FFELP Loan and Private Education Loan assets. Prior to the adoption of new

consolidation accounting guidance on January 1, 2010, for transactions qualifying as sales, we retained a

Residual Interest and the underlying servicing rights (as we retained the servicing responsibilities), all of

which were referred to as our Retained Interest in off-balance sheet securitized loans. The Residual Interest is

the right to receive cash flows from the student loans and reserve accounts in excess of the amounts needed to

pay servicing, derivative costs (if any), other fees, and the principal and interest on the bonds backed by the

student loans. As a result of adopting new consolidation accounting guidance, we removed the $1.8 billion of

Residual Interests (associated with our previously off-balance sheet securitization trusts as of December 31,

2009) from the consolidated balance sheet (see Note 2, “Significant Accounting Policies — Consolidation” for

further details). While this accounting has changed, our economic interest in these assets remains unchanged.

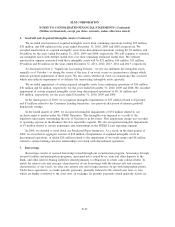

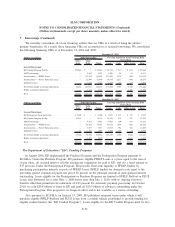

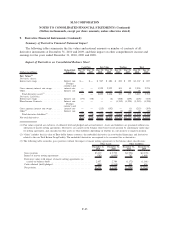

Securitization Activity

The following table summarizes our securitization activity for the years ended December 31, 2010, 2009

and 2008. The securitizations in the periods presented below were accounted for as financings.

(Dollars in millions)

No. of

Transactions

Loan

Amount

Securitized

No. of

Transactions

Loan

Amount

Securitized

No. of

Transactions

Loan

Amount

Securitized

2010 2009 2008

Years Ended December 31,

Securitizations:

FFELP Stafford/PLUS Loans ..... 2 $1,965 — $ — 9 $18,546

FFELP Consolidation Loans ...... — — 3 5,339 — —

Private Education Loans ......... 3 6,186 5 11,122 — —

Total securitizations ............ 5 $8,151 8 $16,461 9 $18,546

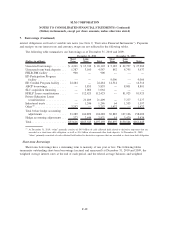

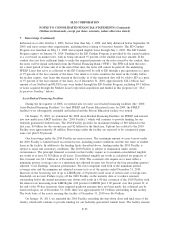

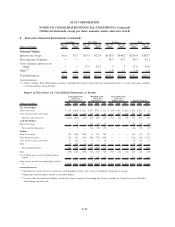

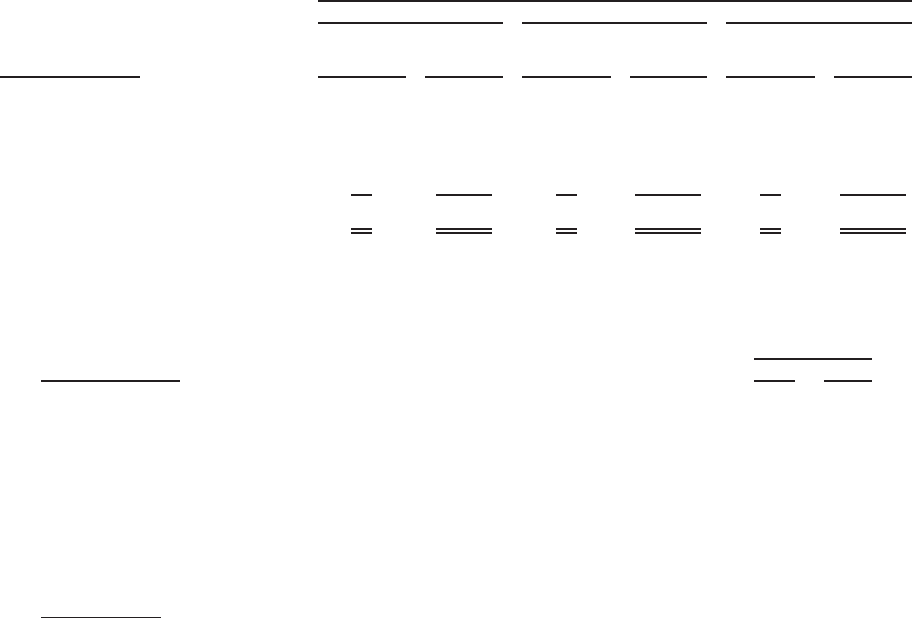

The following table summarizes cash flows received from or paid to the previously off-balance sheet

securitization trusts during the years ended December 31, 2009 and 2008.

(Dollars in millions) 2009 2008

Years Ended

December 31,

Cash distributions from trusts related to Residual Interests .................... $477 $909

Servicing fees received

(1)

............................................ 225 246

Purchases of previously transferred financial assets for representation and warranty

violations ...................................................... (7) (37)

Reimbursements of borrower benefits

(2)

.................................. (36) (29)

Purchases of delinquent Private Education Loans from securitization trusts using

delinquent loan call option ......................................... — (172)

Purchases of loans using clean-up call option ............................. — (697)

(1) We received annual servicing fees of 90 basis points, 50 basis points and 70 basis points of the outstanding securitized loan bal-

ance related to our FFELP Stafford, FFELP Consolidation Loan and Private Education Loan securitizations, respectively.

(2) Under the terms of the securitizations, the transaction documents require that we reimburse the trusts for any borrower benefits

afforded the borrowers of the underlying securitized loans.

F-57

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)