Sallie Mae 2010 Annual Report Download - page 80

Download and view the complete annual report

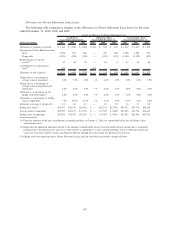

Please find page 80 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FFELP Loans. We have provided a guarantee to the FHLB-DM for the performance and payment of HICA’s

obligations.

Senior Unsecured Debt

We issue unsecured debt in a variety of maturities and currencies to achieve cost-efficient funding and to

maintain an appropriate maturity profile. While the cost and availability of unsecured funding may be

negatively affected by general market conditions or by matters specific to the financial services industry or

Sallie Mae, we seek to mitigate refinancing risk by actively managing the amount of our borrowings that we

anticipate will mature within any month, quarter or year. Substantially all of our senior and subordinated debt

obligations contain no provisions (other than a change in control would allow $4 billion of these obligations as

of December 31, 2010, to be put at 101 percent) that could trigger a requirement for an early repayment,

require additional collateral support, result in changes to terms, accelerate maturity, or create additional

financial obligations upon an adverse change in our credit ratings, financial ratios, earnings, cash flows or

stock price.

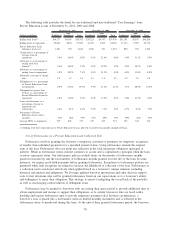

We issue unsecured debt when the pricing for the term of the debt is favorable relative to our other

funding options and our overall liquidity position. In 2010 we issued $1.5 billion of unsecured debt maturing

in 2020 and an all in cost of LIBOR plus 4.65 percent. On January 11, 2011, we announced and priced a

$2 billion five-year 6.25 percent fixed rate unsecured bond. The bond was issued to yield 6.50 percent before

underwriting fees. The rate on the bond was swapped from a fixed rate to a floating rate equal to an all-in cost

of one-month LIBOR plus 4.46 percent. The proceeds of this bond will be used for general corporate

purposes.

We also repurchase our outstanding unsecured debt in both open-market repurchases and public tender

offers. Repurchasing debt helps us better manage our short-term and long-term funding needs. In 2010 we

repurchased $4.9 billion face amount of our senior unsecured notes in the aggregate, with maturity dates

ranging from 2010 to 2014, which resulted in a total gain of $317 million.

Counterparty Exposure

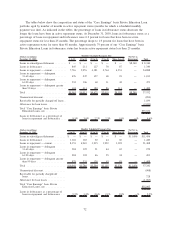

Counterparty exposure related to financial instruments arises from the risk that a lending, investment or

derivative counterparty will not be able to meet its obligations to us. Risks associated with our lending

portfolio are discussed in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results

of Operations — Financial Condition — FFELP Loan Portfolio Performance” and “— Consumer Lending

Portfolio Performance.”

Our investment portfolio is composed of very short-term securities issued by highly rated issuers limiting

our counterparty exposure. Additionally, our investing activity is governed by Board approved limits on the

amount that is allowed to be invested with any one issuer based on the credit rating of the issuer, further

minimizing our counterparty exposure. Counterparty credit risk is considered when valuing investments and

considering impairment.

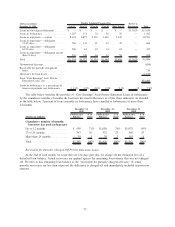

Related to derivative transactions, protection against counterparty risk is generally provided by Interna-

tional Swaps and Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”). CSAs require a

counterparty to post collateral if a potential default would expose the other party to a loss. All derivative

contracts entered into by SLM Corporation and the Bank are covered under such agreements and require

collateral to be exchanged based on the net fair value of derivatives with each counterparty. Our securitization

trusts require collateral in all cases if the counterparty’s credit rating is withdrawn or downgraded below a

certain level. Additionally, securitizations involving foreign currency notes issued after November 2005 also

require the counterparty to post collateral to the trust based on the fair value of the derivative, regardless of

credit rating. The trusts are not required to post collateral to the counterparties. In all cases, our exposure is

limited to the value of the derivative contracts in a gain position net of any collateral we are holding. We

consider counterparties’ credit risk when determining the fair value of derivative positions on our exposure net

of collateral.

79