Sallie Mae 2010 Annual Report Download - page 87

Download and view the complete annual report

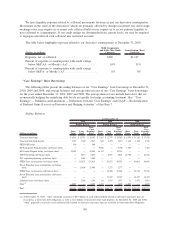

Please find page 87 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.linkage between the management performance process and individual compensation to encourage employees

to work toward corporate-wide compliance goals.

Our Risk Assessment Department monitors our various risk management and compliance efforts, identifies

areas that require increased focus and resources, and reports significant control issues to executive management and

the Audit Committee of our Board of Directors. At least annually, the Risk Assessment Department performs a risk

assessment to identify our top risks, to develop the internal audit plan. Risks are ratedonsignificanceand

likelihood of occurrence and communicated to our management team members who allocate appropriate attention

and resources. Results of the assessment, including survey results, identified risks and recommendations, are

reported to the Audit Committee of our Board of Directors.

Our Board of Directors and its various committees oversee our overall strategic direction and provide

direction to management as to its tolerance levels of various significant risks. Through its committees, our

Board of Directors regularly reviews our risk management practices.

Our Significant Risks

Significant risks may be grouped into the following categories: (1) funding and liquidity; (2) operations;

(3) political/reputation; (4) competition; (5) credit; and (6) regulatory and compliance. More specific

descriptions of the particular risks of each type we currently face are discussed in Item 1A “Risk Factors”.

Funding and Liquidity Risk Management

Funding and liquidity risk is the potential inability to fund liability maturities and deposit withdrawals,

fund asset growth and business operations, and meet contractual obligations at reasonable market rates. Our

primary liquidity objective is to ensure our ongoing ability to meet our funding needs for our businesses

throughout market cycles, including during periods of financial stress. Our two primary liquidity needs are

originating Private Education Loans and retiring secured and unsecured debt when it matures.

We define excess liquidity as readily available assets, limited to cash and high-quality liquid unencum-

bered securities, that we can use to meet our funding requirements as those obligations arise. Our primary

liquidity risk relates to our ability to raise replacement funding and raise that funding at a reasonable cost as

our secured and unsecured debt matures. In addition, we must continue to obtain funding at reasonable rates to

meet our other business obligations and to continue to grow our business. Key risks associated with our

liquidity relates to our ability to access the capital markets and access them at reasonable rates. This ability is

directly affected by our credit ratings. In addition, credit ratings may be important to customers or

counterparties when we compete in certain markets and when we seek to engage in certain transactions,

including over-the-counter derivatives. A negative change in our credit rating would have a negative effect on

our liquidity because it would raise the cost, diminish the availability of funding and potentially require

additional cash collateral or restrict cash currently held as collateral on existing borrowings or derivative

collateral arrangements.

Our funding and liquidity risk management activities are centralized within our Corporate Finance

Department, which is responsible for planning and executing our funding activities and strategies. We analyze

and monitor our liquidity risk, maintain excess liquidity and access diverse funding. Funding and liquidity risk

are overseen and recommendations approved via one or more management committees that manage market,

interest rate and balance sheet risk.

The Finance Committee of the Board of Directors is responsible for approving our Asset and Liability

Management Policy. The Finance Committee of the Board, and in some cases the full Board, monitor our

liquidity on an ongoing basis. Our liquidity risk management activities are centralized within the Corporate

Finance Department, which is responsible for planning and executing our funding activities and strategies.

Operations Risk Management

Operations risk arises from problems with service or product delivery or from nonconformance with

internal policies and procedures. The Company is exposed to transaction risk when products, services or

86