Sallie Mae 2010 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19. Segment Reporting (Continued)

Operating expenses for this segment include the cost incurred to perform the services described above.

We expect that FFELP servicing revenue and Guarantor servicing and contingency revenue will decline over

time as the FFELP Loan portfolios amortize. We expect that revenues under the ED collections contract will

increase as the Direct Lending program expands. Between 2004 and 2008, less than 25 percent of loans were

originated under the Direct Lending program. Effective July 1, 2010, all government guaranteed student loans are

originated through the Direct Lending program. This growth will create revenue opportunity under the ED

collections contract as the volume of defaults of Direct Loans surges in the coming years.

FFELP and Guarantor servicing is a runoff business and therefore we face very little competition. In the

second quarter of 2009, ED named Sallie Mae as one of four servicers awarded a servicing contract (the “ED

Servicing Contract”) to service all federal loans owned by ED. The contract will span five years with one,

five-year renewal at the option of ED. We compete for Direct Loan servicing volume from ED with the three

other servicing companies with whom we share the contract. The contract has four years remaining. Account

allocations are awarded annually based on each company’s performance on five different metrics: defaulted

borrower count, defaulted borrower dollar amount, a survey of borrowers, a survey of schools and a survey of

federal personnel. We are focused on improving our performance as measured by these metrics to increase our

market share and allocation of accounts under the ED Servicing Contract.

The Bank is also a key component of our Campus Payment Solutions and college savings products. We

utilize the Bank to warehouse funds from our Campus Payment Solutions and refund services business. In

addition, the Upromise rewards earned by members are held at the Bank.

At December 31, 2010 and 2009, the Business Services segment had total assets of $930 million and

$1.8 billion, respectively.

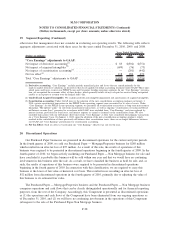

Other Segment

The Other segment primarily consists of the financial results related to the repurchase of debt, the

corporate liquidity portfolio and all overhead. We also include results from smaller wind-down and discontin-

ued operations within this segment. These are the Purchased Paper businesses and mortgage and other loan

businesses. The Other segment includes our remaining businesses that do not pertain directly to the primary

segments identified above. Overhead expenses include costs related to executive management, the board of

directors, accounting, finance, legal, human resources, stock option expense and information technology costs

related to infrastructure and operations.

At December 31, 2010 and 2009, the Other segment had total assets of $2.8 billion and $6.1 billion,

respectively.

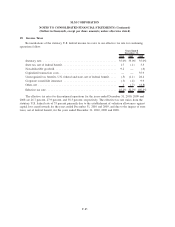

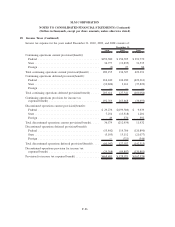

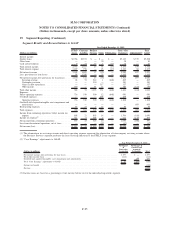

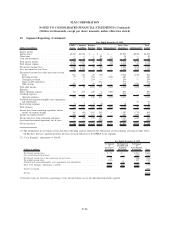

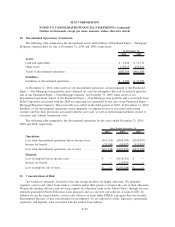

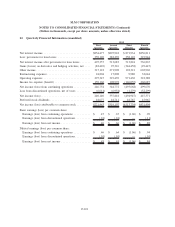

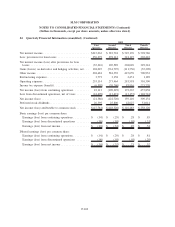

Measure of Profitability

The tables below include the condensed operating results for each of our reportable segments. Manage-

ment, including the chief operating decision makers, evaluates the Company on certain performance measures

that we refer to as “Core Earnings” performance measures for each operating segment. We use “Core

Earnings” to manage each business segment because “Core Earnings” reflect adjustments to GAAP financial

results for three items, discussed below, that create significant volatility mostly due to timing factors generally

beyond the control of management. Accordingly, we believe that “Core Earnings” provide management with a

useful basis from which to better evaluate results from ongoing operations against the business plan or against

results from prior periods. Consequently, we disclose this information as we believe it provides investors with

additional information regarding the operational and performance indicators that are most closely assessed by

F-93

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)