Sallie Mae 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

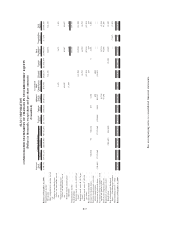

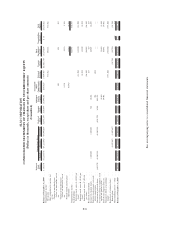

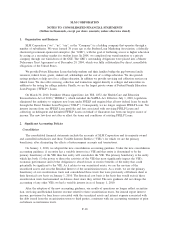

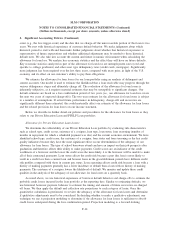

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Dollars in thousands, except share and per share amounts)

(Unaudited)

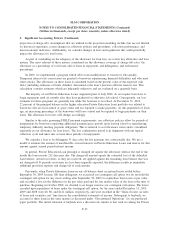

Preferred

Stock

Shares Issued Treasury Outstanding

Preferred

Stock

Common

Stock

Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Treasury

Stock

Total

Stockholders’

Equity

Noncontrolling

Interest

Total

Equity

Common Stock Shares

Balance at December 31, 2009 .... 8,110,370 552,219,576 (67,221,942) 484,997,634 $1,375,370 $110,444 $5,090,891 $(40,825) $ 604,467 $(1,861,738) $5,278,609 $ 13 $5,278,622

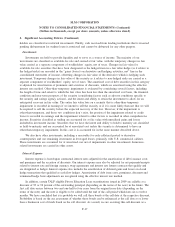

Comprehensive income:

Net income . ............. 530,382 530,382 530,382

Other comprehensive income, net

of tax:

Change in unrealized gains

(losses) on investments, net of

tax................. 593 593 593

Change in unrealized gains

(losses) on derivatives, net of

tax................. 5,110 5,110 5,110

Defined benefit pension plans

adjustment ............ (9,542) (9,542) (9,542)

Comprehensive income ......... 526,543 526,543

Cash dividends:

Preferred stock, series A ($3.49 per

share) . . . ............. (11,500) (11,500) (11,500)

Preferred stock, series B ($1.05 per

share) . . . ............. (4,208) (4,208) (4,208)

Preferred stock, series C ($72.50

per share) . ............. (56,141) (56,141) (56,141)

Restricted stock dividend . . . . .... (11) (11) (11)

Issuance of common shares . . .... 1,803,683 1,803,683 361 16,184 16,545 16,545

Preferred stock issuance costs and

related amortization ......... 294 (294) — —

Conversion of preferred shares. .... (810,370) 41,240,215 41,240,215 (810,370) 8,248 802,122 — —

Tax benefit related to employee stock

option and purchase plans . . .... (9,145) (9,145) (9,145)

Stock-based compensation cost .... 39,492 39,492 39,492

Cumulative effect of accounting

change . . . . ............. (753,856) (753,856) (753,856)

Repurchase of common shares:

Benefit plans ............. (1,097,647) (1,097,647) (14,750) (14,750) (14,750)

Noncontrolling interest — other .... — (13) (13)

Balance at December 31, 2010 .... 7,300,000 595,263,474 (68,319,589) 526,943,885 $ 565,000 $119,053 $5,939,838 $(44,664) $ 308,839 $(1,876,488) $5,011,578 $ — $5,011,578

See accompanying notes to consolidated financial statements.

F-8