Sallie Mae 2010 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

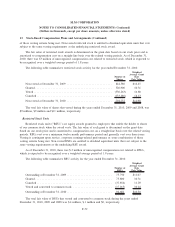

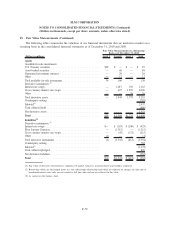

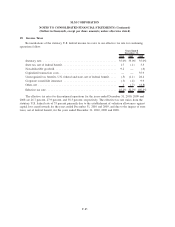

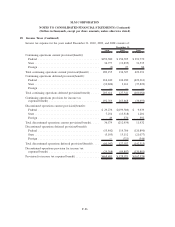

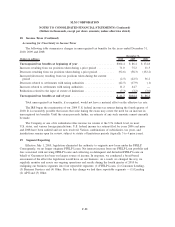

15. Fair Value Measurements (Continued)

The following table summarizes the fair values of our financial assets and liabilities, including derivative

financial instruments, as of December 31, 2010 and 2009.

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

December 31, 2010 December 31, 2009

Earning assets

FFELP Loans ................. $147,163 $148,649 $(1,486) $119,747 $121,053 $(1,306)

Private Education Loans ......... 30,949 35,656 (4,707) 20,278 22,753 (2,475)

Other loans .................. 88 270 (182) 219 420 (201)

Cash and investments . .......... 11,553 11,553 — 13,253 13,253 —

Total earning assets . . .......... 189,753 196,128 (6,375) 153,497 157,479 (3,982)

Interest-bearing liabilities

Short-term borrowings .......... 33,604 33,616 12 30,988 30,897 (91)

Long-term borrowings .......... 154,355 163,544 9,189 123,049 130,546 7,497

Total interest-bearing liabilities .... 187,959 197,160 9,201 154,037 161,443 7,406

Derivative financial instruments

Floor Income/Cap contracts ...... (1,315) (1,315) — (1,234) (1,234) —

Interest rate swaps . . . .......... 744 744 — 94 94 —

Cross currency interest rate swaps . . 1,811 1,811 — 2,783 2,783 —

Other ....................... 25 25 — (20) (20) —

Other

Residual interest in securitized

assets ..................... — 1,828 1,828 —

Excess of net asset fair value over

carrying value .............. $2,826 $ 3,424

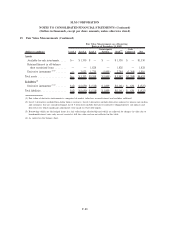

16. Commitments, Contingencies and Guarantees

We offer a line of credit to certain financial institutions and other institutions in the higher education

community for the purpose of originating student loans. In connection with these agreements, we also enter

into a participation agreement with the institution to participate in the loans as they are originated. In the

event that a line of credit is drawn upon, the loan is collateralized by underlying student loans and is usually

participated in on the same day. The contractual amount of these financial instruments represents the

maximum possible credit risk should the counterparty draw down the commitment, we do not participate in

the loan and the counterparty subsequently fails to perform according to the terms of its contract with us. At

December 31, 2010 and 2009, the contractual amount of these financial obligations was $50 million and

$850 million, respectively. There were no outstanding draws at December 31, 2010.

In addition, we maintain forward contracts to purchase loans from our lending partners at contractual

prices. These contracts typically have a maximum amount we are committed to buy, but lack a fixed or

determinable amount as it ultimately is based on the lending partner’s origination activity. FFELP forward

purchase contracts typically contain language relieving us of most of our responsibilities under the contract

due to, among other things, changes in student loan legislation. These commitments are not accounted for as

F-82

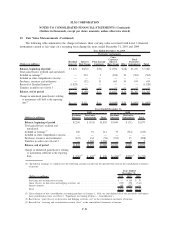

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)