Sallie Mae 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.through the same marketing channels and by the same sales force as FFELP Loans. We also originated Private

Education Loans at DSLP schools. While we continue to actively maintain our presence in school marketing

channels, changes in the student loan industry, school practices and the marketing of consumer lending

products in general require us to continue to develop and evolve our marketing efforts through various other

direct and indirect marketing channels, such as direct mailings, internet channels and marketing alliances with

various banks and financial institutions. As a result of the credit market dislocation of 2008 and 2009, a large

number of lenders have exited the Private Education Loan business and only a few of the country’s largest

banks and specialty finance companies continue to originate the product in any significant volumes.

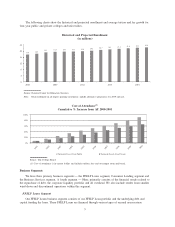

Growth in the Student Loan Industry

Growth in our “Core Earnings” basis student loan portfolio and our servicing and collections businesses

is driven by the growth in the overall market for student loans, as well as by market share gains. Rising

enrollment and college costs and increases in borrowing limits have caused the federal student loan market to

grow at a 10-year annual growth rate of 8.6 percent.

According to the College Board, tuition and fees at four-year public institutions and four-year private

institutions have increased at a compound annual growth rate of 11.4 percent and 7.1 percent, respectively,

since AY 2000-2001, well in excess of the 2.3 percent compound annual growth rate of the consumer price

index. The first federal loan limit increases since 1992 were implemented July 1, 2007. In response to the

credit crisis, Congress significantly increased loan limits again on July 1, 2008. Borrowers using DSLP are

expected to increase 4 percent per year over the next three years. If the cost of education continues to increase

at a pace that exceeds income and savings growth, we expect more students to borrow from private loan

programs.

The National Center for Education Statistics predicts that college-enrollment will increase 14 percent

from 2010 to 2019. Demand for education credit is expected to increase with enrollment over the next decade.

Federal Direct Student Loan Programs

Students and their families can borrow money directly from the federal government to pay for a college

education under the DSLP. The loans can be used to cover the cost of tuition, room and board. A dependent

undergraduate student can borrow up to $5,500 as a freshman and $7,500 as a senior. An independent

undergraduate student can borrow $9,500 as a freshman and up to $12,500 as a senior. A graduate student can

borrow up to the full cost of attendance. Students apply directly to the federal government for a Direct Loan

and the funds are dispersed directly to the school he or she is attending. The DSLP is serviced by four private

sector institutions, including Sallie Mae. Defaulted Direct Loans are collected by 22 private sector companies,

including Sallie Mae.

4