Sallie Mae 2010 Annual Report Download - page 170

Download and view the complete annual report

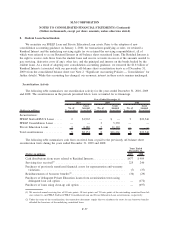

Please find page 170 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11. Stockholders’ Equity (Continued)

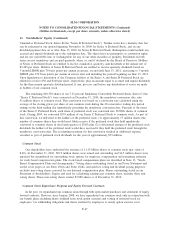

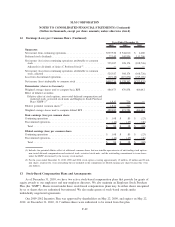

Cumulative Preferred Stock, Series B (the “Series B Preferred Stock”). Neither series has a maturity date but

can be redeemed at our option beginning November 16, 2009 for Series A Preferred Stock, and on any

dividend payment date on or after June 15, 2010 for Series B Preferred Stock. Redemption would include any

accrued and unpaid dividends up to the redemption date. The shares have no preemptive or conversion rights

and are not convertible into or exchangeable for any of our other securities or property. Dividends on both

series are not mandatory and are paid quarterly, when, as, and if declared by the Board of Directors. Holders

of Series A Preferred Stock are entitled to receive cumulative, quarterly cash dividends at the annual rate of

$3.485 per share. Holders of Series B Preferred Stock are entitled to receive quarterly dividends based on

3-month LIBOR plus 70 basis points per annum in arrears, on and until June 15, 2011, increasing to 3-month

LIBOR plus 170 basis points per annum in arrears after and including the period beginning on June 15, 2011.

Upon liquidation or dissolution of the Company, holders of the Series A and Series B Preferred Stock are

entitled to receive $50 and $100 per share, respectively, plus an amount equal to accrued and unpaid dividends

for the then current quarterly dividend period, if any, pro rata, and before any distribution of assets are made

to holders of our common stock.

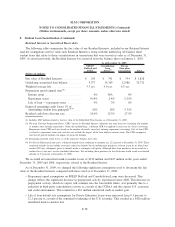

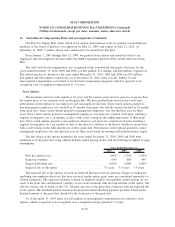

The remaining 810,370 shares of our 7.25 percent Mandatory Convertible Preferred Stock, Series C (the

“Series C Preferred Stock”) were converted on December 15, 2010, the mandatory conversion date, into

41 million shares of common stock. This conversion was based on a conversion rate calculated using the

average of the closing prices per share of our common stock during the 20 consecutive trading day period

ending on the third trading day immediately preceding the mandatory conversion date. Pursuant to the terms

of the Series C Preferred Stock, each share of preferred stock was converted into 50.8906 shares of common

stock. During 2009, we converted $339 million of our Series C Preferred Stock to common stock. As part of

this conversion, we delivered to the holders of the preferred stock: (1) approximately 17 million shares (the

number of common shares they would most likely receive if the preferred stock they held mandatorily

converted to common shares in the fourth quarter of 2010) plus (2) a discounted amount of the preferred stock

dividends the holders of the preferred stock would have received if they held the preferred stock through the

mandatory conversion date. The accounting treatment for this conversion resulted in additional expense

recorded as part of preferred stock dividends for the year of approximately $53 million.

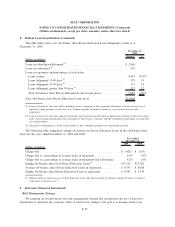

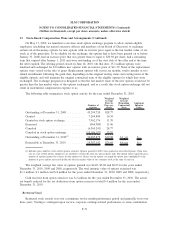

Common Stock

Our shareholders have authorized the issuance of 1.125 billion shares of common stock (par value of

$.20). At December 31, 2010, 526.9 million shares were issued and outstanding and 34.5 million shares were

unissued but encumbered for outstanding stock options for employee compensation and remaining authority

for stock-based compensation plans. The stock-based compensation plans are described in Note 13, “Stock-

Based Compensation Plans and Arrangements.” Voting shares outstanding stated in our Proxy Statement and

on the cover pages of our Form 10-Qs and Form 10-Ks, and used for voting and dividend paying purposes,

excludes non-voting shares reserved for our deferred compensation plan. Shares outstanding stated in our

Statement of Stockholders’ Equity and used for calculating earnings per common share, includes these non-

voting shares. These non-voting shares totaled 87,880 shares as of December 31, 2010.

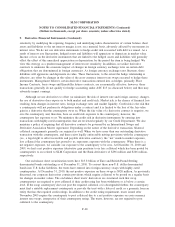

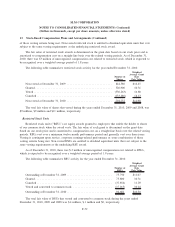

Common Stock Repurchase Program and Equity Forward Contracts

In the past, we repurchased our common stock through both open market purchases and settlement of equity

forward contracts. However, since January 2008, we have repurchased our common stock only in connection with

our benefit plans, including shares withheld from stock option exercises and vesting of restricted stock for

employees’ tax withholding obligations and shares tendered by employees to satisfy option exercise costs.

F-67

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)