Sallie Mae 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

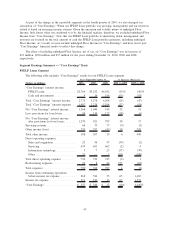

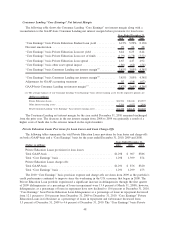

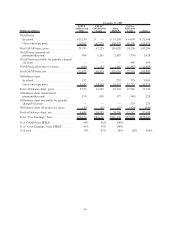

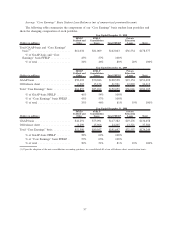

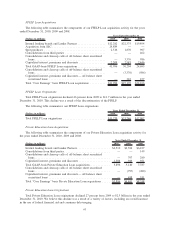

The following table includes “Core Earnings” results for our Other segment.

(Dollars in millions) 2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended

December 31, % Increase (Decrease)

Net interest loss after provision........... $(35) $ (66) $ (11) (47)% 500%

Gains on debt repurchases .............. 317 536 64 (41) 738

Other .............................. 14 1 15 1,300 (93)

Total income . . ...................... 331 537 79 (38) 580

Direct operating expenses:

Servicing . . . ...................... 9 6 17 50 (65)

Other ............................ 3 — — 100 —

Total direct operating expenses ........... 12 6 17 100 (65)

Overhead expenses:

Corporate overhead ................... 128 138 150 (7) (8)

Unallocated information technology costs . . . 130 99 86 31 15

Total overhead expenses ................ 258 237 236 9 —

Total operating expenses................ 270 243 253 11 (4)

Restructuring expenses ................. 12 (2) (5) 700 60

Total expenses . ...................... 282 241 248 17 (3)

Income (loss) from continuing operations,

before income tax expense (benefit) ..... 14 230 (180) (94) 228

Income tax expense (benefit) ............ 4 81 (65) (95) 225

Net income (loss) from continuing

operations. . . ...................... 10 149 (115) (93) 230

Loss from discontinued operations, net of

tax.............................. (67) (220) (188) (70) 17

“Core Earnings” net loss ............... $(57) $ (71) $(303) (20)% (77)%

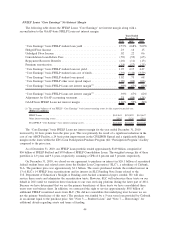

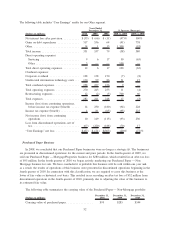

Purchased Paper Business

In 2008, we concluded that our Purchased Paper businesses were no longer a strategic fit. The businesses

are presented in discontinued operations for the current and prior periods. In the fourth quarter of 2009, we

sold our Purchased Paper — Mortgage/Properties business for $280 million, which resulted in an after-tax loss

of $95 million. In the fourth quarter of 2010 we began actively marketing our Purchased Paper — Non

Mortgage business for sale. We have concluded it is probable this business will be sold within one year and,

as a result, the results of operations of this business were presented in discontinued operations beginning in the

fourth quarter of 2010. In connection with this classification, we are required to carry this business at the

lower of fair value or historical cost basis. This resulted in us recording an after-tax loss of $52 million from

discontinued operations in the fourth quarter of 2010, primarily due to adjusting the value of this business to

its estimated fair value.

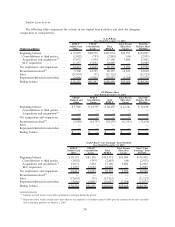

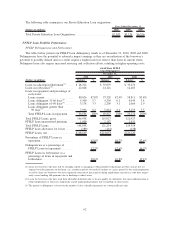

The following table summarizes the carrying value of the Purchased Paper — Non-Mortgage portfolio:

(Dollars in millions)

December 31,

2010

December 31,

2009

December 31,

2008

Carrying value of purchased paper ................. $95 $285 $544

52