Sallie Mae 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

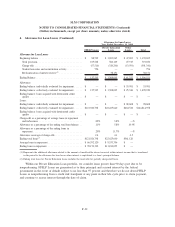

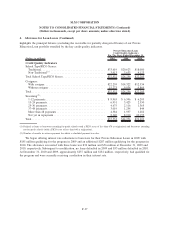

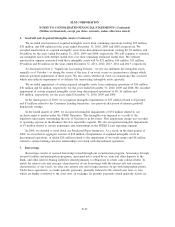

6. Goodwill and Acquired Intangible Assets

Goodwill

All acquisitions must be assigned to a reporting unit or units. A reporting unit is the same as, or one

level below, an operating segment. In connection with changes to our business, we redefined our operating

segments and reporting units and revised our reportable segments presentation beginning on October 1, 2010

(See Note 19, “Segments”). The following table summarizes our allocation of goodwill, accumulated

impairments and net goodwill for our redefined reporting units and reportable segments (which was allocated

based upon the relative fair values of the reporting units).

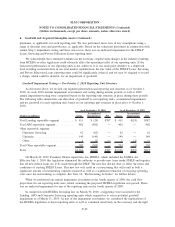

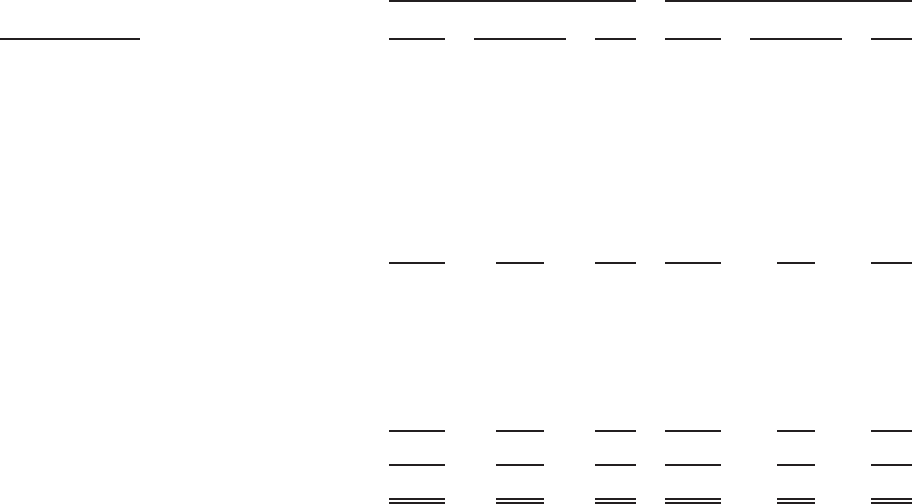

(Dollars in millions) Gross

Accumulated

Impairments Net Gross

Accumulated

Impairments Net

As of December 31, 2010 As of December 31, 2009

Total FFELP Loans reportable segment .... $ 194 $ (4) $190 $ 194 $ (4) $190

Total Consumer Lending reportable

segment.......................... 147 — 147 147 — 147

Business Services reportable segment

Servicing ......................... 50 — 50 50 — 50

Contingency . ..................... 129 (129) — 129 — 129

Wind-down Guarantor Servicing........ 256 (256) — 256 — 256

Upromise . . . ..................... 140 (140) — 140 — 140

Total Business Services reportable

segment.......................... 575 (525) 50 575 — 575

Other reportable segment

Mortgage and Consumer Lending ....... 20 (20) — 20 (20) —

Purchased Paper ................... 79 (79) — 79 — 79

Other............................ 1 (1) — 1 (1) —

Total Other reportable segment .......... 100 (100) — 100 (21) 79

Total .............................. $1,016 $(629) $387 $1,016 $(25) $991

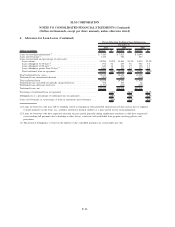

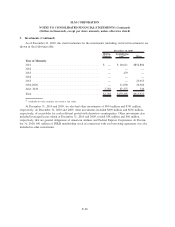

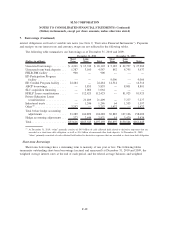

Goodwill Impairment Testing — Post October 1, 2010 Reporting Unit Structure

As discussed above, we revised our segment presentation and reporting unit structure as of October 1,

2010. We perform our goodwill impairment testing annually in the fourth quarter as of October 1. As part of

the annual impairment testing, we retained a third-party appraisal firm to perform Step 1 impairment testing.

The fair value of each reporting unit was determined by weighting different valuation approaches, as

applicable, with the primary approach being the income approach.

The income approach measures the value of each reporting unit’s future economic benefit determined by

its discounted cash flows derived from our projections plus an assumed terminal growth rate adjusted for what

it believes a market participant would assume in an acquisition. These projections are generally five-year

projections that reflect the inherent risk a willing buyer would consider when valuing these businesses. If a

component of a reporting unit is winding down or is assumed to wind down, the projections extend through

the anticipated wind down period.

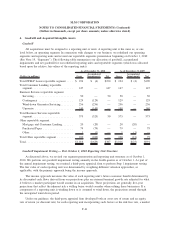

Under our guidance, the third-party appraisal firm developed both an asset rate of return and an equity

rate of return (or discount rate) for each reporting unit incorporating such factors as the risk free rate, a market

F-41

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)