Sallie Mae 2010 Annual Report Download - page 129

Download and view the complete annual report

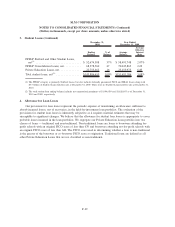

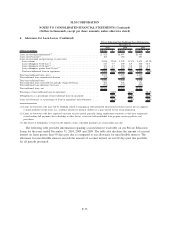

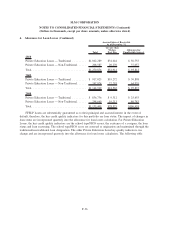

Please find page 129 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Student Loans (Continued)

repayment, or have modified repayment plans, while the borrower is in-school and during the grace period

immediately upon leaving school. The borrower may also be granted a deferment or forbearance for a period

of time based on need, during which time the borrower is not considered to be in repayment. Interest

continues to accrue on loans in the in-school, deferment and forbearance period. FFELP Loans obligate the

borrower to pay interest at a stated fixed rate or a variable rate reset annually (subject to a cap) on July 1 of

each year depending on when the loan was originated and the loan type. We earn interest at the greater of the

borrower’s rate or a floating rate based on the SAP formula, with the interest earned on the floating rate that

exceeds the interest earned from the borrower being paid directly by ED. In low or certain declining interest

rate environments when student loans are earning at the fixed borrower rate, and the interest on the funding

for the loans is variable and declining, we can earn additional spread income that we refer to as Floor Income.

For loans disbursed after April 1, 2006, FFELP Loans effectively only earn at the SAP rate, as the excess

interest earned when the borrower rate exceeds the SAP rate (Floor Income) is required to be paid to ED.

FFELP Loans are guaranteed as to their principal and accrued interest in the event of default subject to a

Risk Sharing level based on the date of loan disbursement. For loans disbursed after October 1, 1993 and

before July 1, 2006, we receive 98 percent reimbursement on all qualifying default claims. For loans disbursed

on or after July 1, 2006, we receive 97 percent reimbursement.

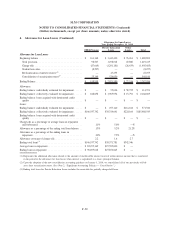

In December 2008, we sold approximately $494 million (principal and accrued interest) of FFELP Loans

to ED at a price of 97 percent of principal and unpaid interest pursuant to ED’s authority under ECASLA to

make such purchases, and recorded a loss on the sale. Additionally, in early January 2009, we sold an

additional $486 million (principal and accrued interest) in FFELP Loans to ED under this program. The loss

related to this sale in January was recognized in 2008 as the loans were classified as “held-for-sale”. The total

loss recognized on these two sales for the year ended December 31, 2008 was $53 million and was recorded

in “Losses on sales of loans and securities, net” in the consolidated statements of income.

In 2009, we sold to ED approximately $18.5 billion face amount of loans as part of the Purchase Program

(approximately $840 million face amount of this amount was sold in the third quarter of 2009, with the

remainder sold in the fourth quarter of 2009). Outstanding debt of $18.5 billion was paid down related to the

Participation Program pursuant to ECASLA in connection with these loan sales. These loan sales resulted in a

$284 million gain. The settlement of the fourth quarter sale of loans out of the Participation Program included

repaying the debt by delivering the related loans to ED in a non-cash transaction and receipt of cash from ED

for $484 million, representing the reimbursement of a one-percent payment made to ED plus a $75 fee per loan.

In 2010, we sold to ED approximately $20.4 billion face amount of loans as part of the Purchase

Program. These loan sales resulted in a $321 million gain. Outstanding debt of $20.3 billion has been paid

down related to the Participation Program in connection with these loan sales.

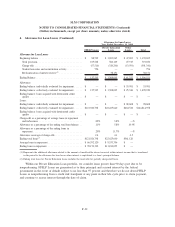

On December 31, 2010, we closed on our agreement to purchase an interest in $26.1 billion of securitized

federal student loans and related assets and $25.0 billion of liabilities from the Student Loan Corporation

(“SLC”), a subsidiary of Citibank, N.A. The purchase price was approximately $1.1 billion. The assets

purchased include the residual interest in 13 of SLC’s 14 FFELP loan securitizations and its interest in SLC

Funding Note Issuer related to the U.S. Department of Education’s Straight-A Funding asset-backed commer-

cial paper conduit. We will also service these assets and administer the securitization trusts. We expect to

convert all of the underlying loans to our servicing platform in 2011, with an interim subservicing agreement

for Citibank to service the loans while they are converted to our platform. Because we have determined that

we are the primary beneficiary of these trusts we have consolidated these trusts onto our balance sheet. In

addition, we contracted the right to service approximately $0.8 billion of additional FFELP securitized assets

from SLC. We did not consolidate this underlying trust because we are not the primary beneficiary of this

F-26

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)