Sallie Mae 2010 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

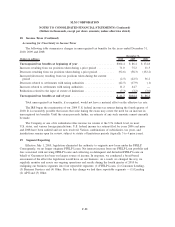

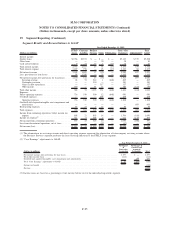

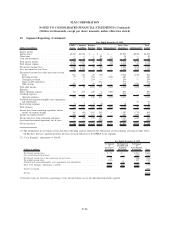

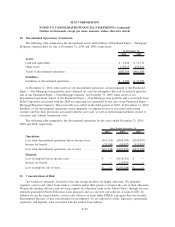

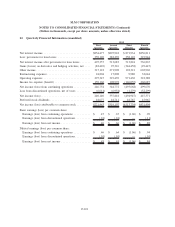

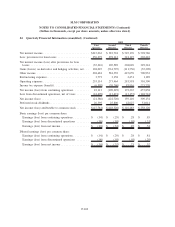

19. Segment Reporting (Continued)

other items that management does not consider in evaluating our operating results. The following table reflects

aggregate adjustments associated with these areas for the years ended December 31, 2010, 2009, and 2008.

(Dollars in millions) 2010 2009 2008

Years Ended December 31,

“Core Earnings” adjustments to GAAP:

Net impact of derivative accounting

(1)

........................... $ 83 $(502) $(751)

Net impact of acquired intangibles

(2)

............................ (699) (76) (73)

Net impact of securitization accounting

(3)

......................... — (201) (442)

Net tax effect

(4)

............................................ 118 296 470

Total “Core Earnings” adjustments to GAAP ...................... $(498) $(483) $(796)

(1) Derivative accounting: “Core Earnings” exclude periodic unrealized gains and losses that are caused primarily by the

mark-to-market derivative valuations on derivatives that do not qualify for hedge accounting treatment under GAAP. These unre-

alized gains and losses occur in our FFELP Loans and Consumer Lending operating segments. In our “Core Earnings” presenta-

tion, we recognized the economic effect of these hedges, which generally results in any cash paid or received being recognized

ratably as an expense or revenue over the hedged item’s life.

(2) Goodwill and Acquired Intangibles: We exclude goodwill and intangible impairment and amortization of acquired intangibles.

(3) Securitization accounting: Under GAAP, prior to the adoption of the new consolidation accounting guidance on January 1,

2010, certain securitization transactions in our FFELP Loans operating segment were accounted for as sales of assets. Under

“Core Earnings” for the FFELP Loans operating segment, we presented all securitization transactions as long-term non-recourse

financings. The upfront “gains” on sale from securitization transactions, as well as ongoing “securitization servicing and Resid-

ual Interest revenue (loss)” presented in accordance with GAAP, were excluded from “Core Earnings” and were replaced by

interest income, provisions for loan losses, and interest expense as earned or incurred on the securitization loans. We also

excluded transactions with our off-balance sheet trusts from “Core Earnings” as they were considered intercompany transactions

on a “Core Earnings” basis. On January 1, 2010, upon the adoption of the new consolidation accounting guidance, which

resulted in the consolidation of these previously off-balance sheet securitization trusts, there are no longer differences between

our GAAP and “Core Earnings” presentation for securitization accounting.

(4) Net Tax Effect: Such tax effect is based upon our “Core Earnings” effective tax rate for the year.

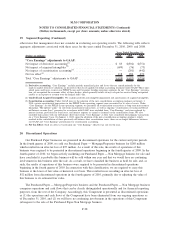

20. Discontinued Operations

Our Purchased Paper businesses are presented in discontinued operations for the current and prior periods.

In the fourth quarter of 2009, we sold our Purchased Paper — Mortgage/Properties business for $280 million

which resulted in an after-tax loss of $95 million. As a result of this sale, the results of operations of this

business were required to be presented in discontinued operations beginning in the fourth quarter of 2009. In the

fourth quarter of 2010, we began actively marketing our Purchased Paper — Non Mortgage business for sale and

have concluded it is probable this business will be sold within one year and that we would have no continuing

involvement in this business after the sale. As a result, we have classified the business as held for sale, and, as

such, the results of operations of this business were required to be presented in discontinued operations

beginning in the fourth quarter of 2010. In connection with this classification, we are required to carry this

business at the lower of fair value or historical cost basis. This resulted in us recording an after-tax loss of

$52 million from discontinued operations in the fourth quarter of 2010, primarily due to adjusting the value of

this business to its estimated fair value.

The Purchased Paper — Mortgage/Properties business and the Purchased Paper — Non Mortgage business

comprises operations and cash flows that can be clearly distinguished operationally and for financial reporting

purposes, from the rest of the Company. Accordingly, this Component is presented as discontinued operations

as (1) the operations and cash flows of the Component have been eliminated from our ongoing operations as

of December 31, 2010, and (2) we will have no continuing involvement in the operations of this Component

subsequent to the sale of the Purchased Paper-Non Mortgage business.

F-98

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)