Sallie Mae 2010 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

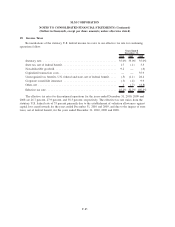

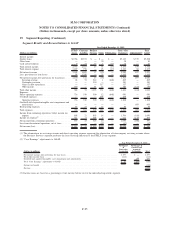

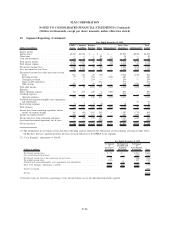

19. Segment Reporting (Continued)

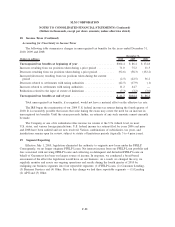

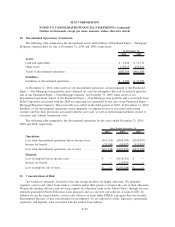

The following table includes asset information for our Consumer Lending segment.

2010 2009

December 31,

Private Education Loans, net ...................................... $35,656 $22,753

Cash and investments

(1)

......................................... 3,372 3,459

Retained Interest in off-balance sheet securitized loans .................. — 794

Other ....................................................... 4,004 3,729

Total assets .................................................. $43,032 $30,735

(1) Includes restricted cash and investments.

The significant increase in assets is primarily the result of the new consolidation accounting guidance

which required us to consolidate off-balance sheet trust assets onto the balance sheet.

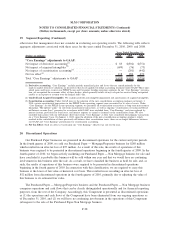

Business Services Segment

The Business Services segment generates its revenue from servicing our FFELP Loan portfolio as well as

servicing FFELP and other loans for other financial institutions, guarantors and ED. The segment also

performs default aversion work and contingency collections on behalf of Guarantors and ED, Campus Payment

Solutions, account asset servicing and transaction processing activities. We are the largest servicer of student

loans, the largest collector of defaulted student loans, the largest administrator of 529 college-savings plans

and saving for college loyalty programs, and we have a growing Campus Payment Solutions platform.

The segment generates revenue from servicing FFELP Loans owned and managed by us. These revenues

are intercompany charges to the FFELP Loans segment and are primarily charged at rates paid by the trusts

where the loans reside. These fees are contractually designated as the first payment from the trust cash flows.

These fees are high quality in terms of both their priority and predictability and exceed the actual cost of

servicing the loans. Revenue is also generated by servicing third-party loans for other financial institutions and

ED.

We generate revenue by servicing FFELP Loans for Guarantors. We earn an account maintenance fee on

a portfolio of $99 billion of FFELP Loans for 9 Guarantors. We provide a full complement of default aversion

and default collection services on a contingency or pay for performance basis to 13 Guarantors, campus-based

programs and ED. We have performed default collection work for over ten years and have consistently been a

top performer.

Our Upromise Investments subsidiary generates revenue by providing program management services for

529 college-savings plans with assets of $34.5 billion in 32 college savings plans in 16 states. We also

generate revenue in the form of transaction fees generated by our consumer savings network, through which

members have earned $600 million in rewards by purchasing products at hundreds of online retailers, booking

travel, purchasing a home, dining out, buying gas and groceries, by using the Upromise World Master Card

and completing qualified transactions. We earn a fee for providing the marketing and administrative services

we provide to companies that participate in the Upromise savings network.

Finally, our Campus Payment Solutions business offers a suite of solutions designed to help campus

business offices increase their services to students and families. The product suite includes electronic billing,

collection, payment and refund services plus full tuition payment plan administration. In 2010, we generated

servicing revenue from over 1,100 schools.

F-92

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)