Sallie Mae 2010 Annual Report Download - page 158

Download and view the complete annual report

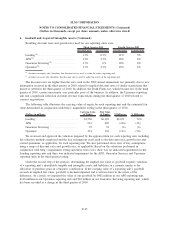

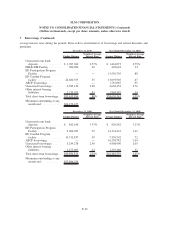

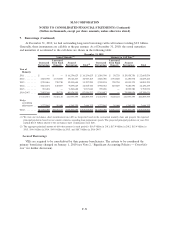

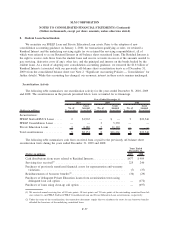

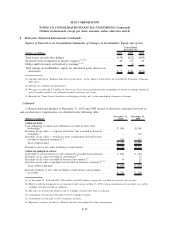

Please find page 158 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

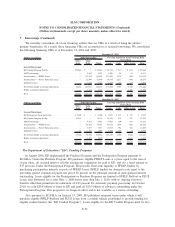

In August, 2010, we issued a $760 million FFELP ABS transaction. This issuance included $738 million

A Notes bearing a coupon of 1-month LIBOR plus 0.50 percent and $22 million B Notes bearing a coupon of

1-month LIBOR plus 0.90 percent. We purchased the B Notes in their entirety on the settlement date. This

transaction was composed primarily of FFELP Stafford and PLUS loans.

We have $5.3 billion Private Education Loan securitization bonds outstanding at December 31, 2010,

where we have the ability to call the bonds at a discount to par between 2011 and 2014. We have concluded

that it is probable we will call these bonds at the call date at the respective discount. Probability is based on

our assessment of whether these bonds can be refinanced at the call date at or lower than a breakeven cost of

funds based on the call discount. As a result, we are accreting this call discount as a reduction to interest

expense through the call date. If it becomes less than probable that we will call these bonds at a future date, it

will result in our reversing this prior accretion as a cumulative catch-up adjustment. We have accreted

approximately $172 million, cumulatively, and $112 million in the year ended December 31, 2010 as a

reduction of interest expense.

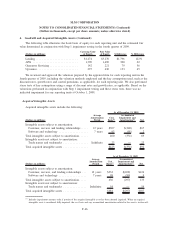

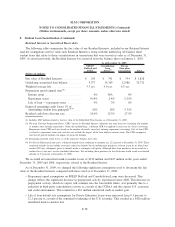

Auction Rate Securities

At December 31, 2010, we had $3.3 billion of taxable and $0.9 billion of tax-exempt auction rate

securities outstanding in securitizations and indentured trusts, respectively. Since February 2008, problems in

the auction rate securities market as a whole led to failures of the auctions pursuant to which certain of our

auction rate securities’ interest rates are set. As a result, $3.4 billion of our auction rate securities as of

December 31, 2010 bore interest at the maximum rate allowable under their terms. The maximum allowable

interest rate on our taxable auction rate securities is generally LIBOR plus 1.50 percent to 3.50 percent,

dependant on the security’s credit rating. The maximum allowable interest rate on many of our tax-exempt

auction rate securities is a formula driven rate, which produced various maximum rates up to 0.84 percent

during the fourth quarter of 2010. As of December 31, 2010, $0.8 billion of auction rate securities with shorter

weighted average terms to maturity have had successful auctions, resulting in an average rate of 1.67 percent.

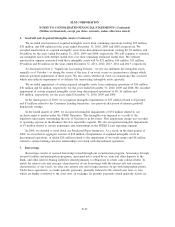

Reset Rate Notes

Certain tranches of our term ABS are reset rate notes. Reset rate notes are subject to periodic

remarketing, at which time the interest rates on the notes are reset. We also have the option to repurchase a

reset rate note upon a failed remarketing and hold it as an investment until such time it can be remarketed. In

the event a reset rate note cannot be remarketed on the remarketing date, and is not repurchased, the interest

rate generally steps up to and remains at LIBOR plus 0.75 percent until such time as the bonds are

successfully remarketed or repurchased. Our repurchase of a reset rate note requires additional funding, the

availability and pricing of which may be less favorable to us than it was at the time the reset rate note was

originally issued. Unlike the repurchase of a reset rate note, the occurrence of a failed remarketing does not

require additional funding. As a result of the ongoing dislocation in the capital markets, at December 31,

2010, $4.3 billion of our reset rate notes bore interest at, or were swapped to LIBOR plus 0.75 percent due to

a failed remarketing. Until capital markets conditions improve, it is possible these and additional reset rate

notes will experience failed remarketings. As of December 31, 2010, we had $2.0 billion and $0.8 billion of

reset rate notes due to be newly remarketed in 2011 and 2012, respectively, and an additional $5.7 billion to

be newly remarked thereafter.

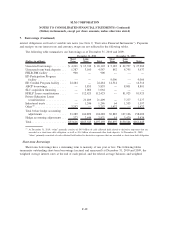

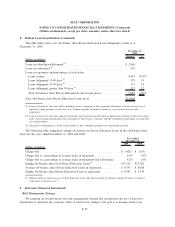

Indentured Trusts

We have secured assets and outstanding bonds in indentured trusts resulting from the acquisition of

various student loan providers in prior periods. The indentures were created and bonds issued to finance the

F-55

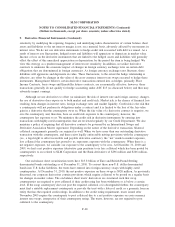

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)