Sallie Mae 2010 Annual Report Download - page 157

Download and view the complete annual report

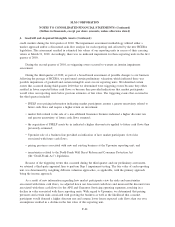

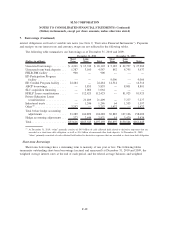

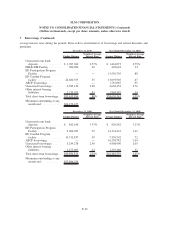

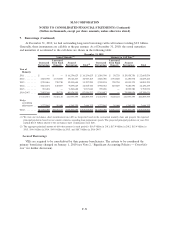

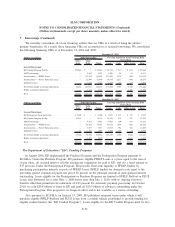

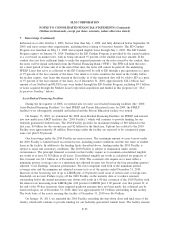

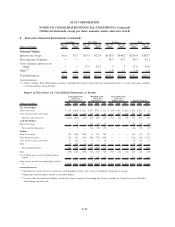

Please find page 157 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

is now $7.5 billion, reflecting an increase of $2.5 billion over the previously scheduled facility reduction. The

scheduled maturity date of the facility is January 10, 2014. We paid an extension fee of $2 million. The usage

fee for the 2010 Facility remains unchanged at 0.50 percent over the applicable funding rate. The amended

facility features two contractual reductions over the term. The first reduction is on January 13, 2012, to

$5.0 billion. The second reduction is on January 11, 2013, to $2.5 billion. If we fail to reduce the facility at

either trigger point, the usage fee increases to a maximum of 2.00 percent over the applicable funding rate. If

liquidity agreements are not renewed on the trigger dates, the usage fee increases to 1.00 percent over the

applicable funding rate on January 13, 2012 and 1.50 percent over the applicable funding rate on January 11,

2013. All other terms are consistent with the original 2010 Facility described above.

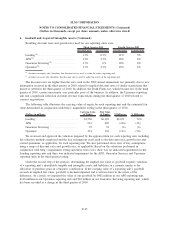

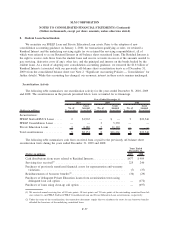

SLC Acquisition Financing

On December 31, 2010, we closed on our agreement to purchase an interest in $26.1 billion of securitized

federal student loans and related assets from the Student Loan Corporation (“SLC”), a subsidiary of Citibank,

N.A. The purchase price was approximately $1.1 billion. The transaction was funded by a 5-year term loan

provided by Citibank in an amount equal to the purchase price. The loan is secured by the purchased assets

and guaranteed by us. The loan bears interest at a rate of LIBOR plus 4.50 percent, and is subject to

scheduled quarterly principal payments of the lesser of (i) 2.5 percent of the original principal amount of the

term loan or (ii) the residual cash flow derived from the assets securing the loan. Residual cash flow in excess

of that needed to make quarterly principal payments is restricted but we are permitted, at our option, to prepay

the obligation, in whole or in part, at any time without penalty.

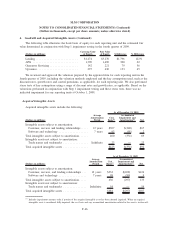

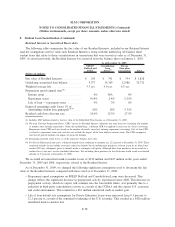

Securitizations

In early 2009, the Federal Reserve Bank of New York initiated a program, The Term Asset-Backed

Securities Loan Facility (“TALF”), to facilitate renewed issuance of eligible consumer and small business

ABS with a term of up to five years. For student loan collateral, TALF expired on March 31, 2010. During the

program, we completed five transactions totaling $7.5 billion which were TALF eligible.

In 2009, we completed four FFELP long-term ABS transactions totaling $5.9 billion. The FFELP

transactions were composed primarily of FFELP Consolidation Loans which were not eligible for the ED

Conduit Program or the TALF. During 2009, we completed $7.5 billion of Private Education Loan term ABS

transactions, all of which were private placement transactions and some were TALF eligible. On January 6,

2009, we closed a $1.5 billion 12.5 year ABS based facility (“Total Return Swap Facility”).

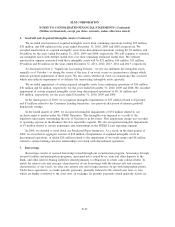

In March, 2010, we issued a $1.6 billion Private Education Loan term ABS transaction which was

TALF-eligible. The issuance included one $149 million tranche bearing a coupon of Prime minus 0.05 percent

and a second $1.401 billion tranche bearing a coupon of 1-month LIBOR plus 3.25 percent.

In April, 2010, we issued a $1.2 billion FFELP long-term ABS transaction. The issuance included

$1.2 billion A Notes bearing a coupon of 1-month LIBOR plus 0.40 percent and $37 million B Notes bearing

a coupon of 1-month LIBOR plus 0.90 percent. The B Notes were purchased by us in their entirety on the

settlement date. This transaction was composed primarily of FFELP Stafford and PLUS loans.

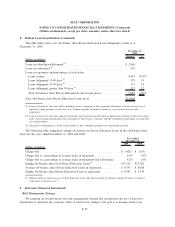

In July 2010, we redeemed our $1.5 billion SLM Private Education Loan Trust 2009-A ABS issue and

closed new offerings of our $869 million SLM 2010-B and $1.7 billion SLM 2010-C Private Education Loan

Trust ABS issues. Approximately $875 million of the 2010-B and 2010-C bonds were issued at a weighted

average coupon of 1-month LIBOR plus 2.23 percent; the remaining $1.7 billion of bonds were financed

under our Total Return Swap Facility. We raised approximately $1.0 billion of net additional cash on these

concurrent transactions.

F-54

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)