Sallie Mae 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

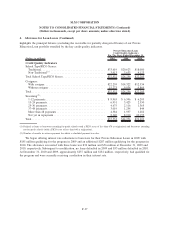

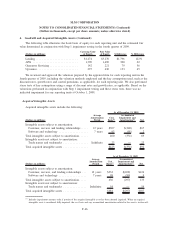

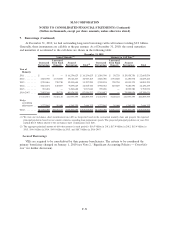

6. Goodwill and Acquired Intangible Assets (Continued)

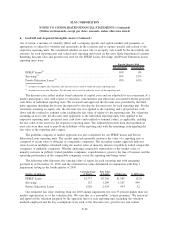

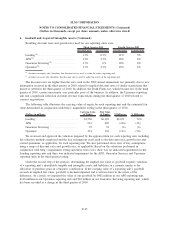

The following table illustrates the book basis of equity for each reporting unit and the estimated fair

value determined in conjunction with Step 1 impairment testing in the fourth quarter of 2009.

(Dollars in millions)

Carrying Value

of Equity

Fair Value

of Equity $ Difference % Difference

Lending ........................... $1,474 $3,270 $1,796 122%

APG ............................. 1,390 1,690 300 22

Guarantor Servicing .................. 142 221 79 56

Upromise .......................... 297 430 133 45

We reviewed and approved the valuation prepared by the appraisal firm for each reporting unit in the

fourth quarter of 2009, including the valuation methods employed and the key assumptions used, such as the

discount rates, growth rates and control premiums, as applicable, for each reporting unit. We also performed

stress tests of key assumptions using a range of discount rates and growth rates, as applicable. Based on the

valuations performed in conjunction with Step 1 impairment testing and these stress tests, there was no

indicated impairment for any reporting units at October 1, 2009,

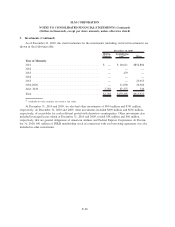

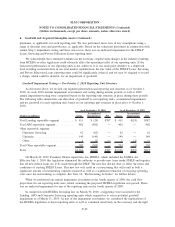

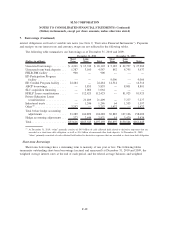

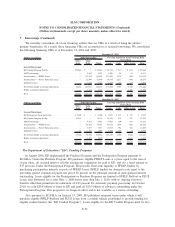

Acquired Intangible Assets

Acquired intangible assets include the following:

(Dollars in millions)

Average

Amortization

Period

Cost

Basis

(1)

Accumulated

Impairment and

Amortization

(1)

Net

As of December 31, 2010

Intangible assets subject to amortization:

Customer, services and lending relationships ..... 12years $307 $(240) $67

Software and technology ................... 7years 93 (91) 2

Total intangible assets subject to amortization...... 400 (331) 69

Intangible assets not subject to amortization:

Trade names and trademarks ................ Indefinite 23 — 23

Total acquired intangible assets ................ $423 $(331) $92

(Dollars in millions)

Average

Amortization

Period

Cost

Basis

(1)

Accumulated

Impairment and

Amortization

(1)

Net

As of December 31, 2009

Intangible assets subject to amortization:

Customer, services, and lending relationships . . . 12 years $332 $(208) $124

Software and technology .................. 7years 98 (89) 9

Total intangible assets subject to amortization ..... 430 (297) 133

Intangible assets not subject to amortization:

Trade names and trademarks ............... Indefinite 54 — 54

Total acquired intangible assets ............... $484 $(297) $187

(1)

Includes impairment amounts only if portion of the acquired intangible asset has been deemed impaired. When an acquired

intangible asset is considered fully impaired, the cost basis and any accumulated amortization related to the asset is written off.

F-46

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)