Sallie Mae 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

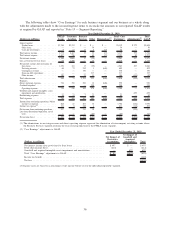

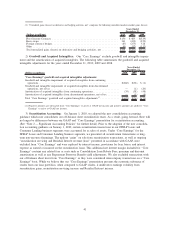

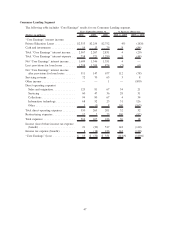

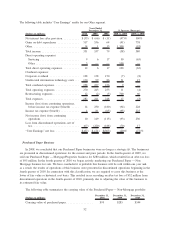

The following table summarizes “Core Earnings” securitization adjustments for the FFELP Loans and

Consumer Lending business segments for the years ended December 31, 2009 and 2008.

(Dollars in millions) 2009 2008

Years Ended

December 31,

“Core Earnings” securitization adjustments:

Net interest income on securitized loans, before provisions for loan losses and before

intercompany transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(942) $(872)

Provisions for loan losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 445 309

Net interest income on securitized loans, after provisions for loan losses, before intercompany

transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (497) (563)

Intercompany transactions with off-balance sheet trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 (141)

Net interest income on securitized loans, after provisions for loan losses . . . . . . . . . . . . . . . . . (496) (704)

Securitization servicing and Residual Interest revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 295 262

Total “Core Earnings” securitization adjustments

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(201) $(442)

(1) Negative amounts are subtracted from “Core Earnings” to arrive at GAAP net income and positive amounts are added to “Core

Earnings” to arrive at GAAP net income.

“Intercompany transactions with off-balance sheet trusts” in the above table relate primarily to losses that

result from the repurchase of delinquent loans from our off-balance sheet securitization trusts. When Private

Education Loans in our securitization trusts settling before September 30, 2005 became 180 days delinquent,

we previously exercised our contingent call option to repurchase these loans at par value out of the trust and

recorded a loss for the difference in the par value paid and the fair market value of the loan at the time of

purchase. We do not hold the contingent call option for any trusts settled after September 30, 2005. In October

2008, we decided to no longer exercise our contingent call option.

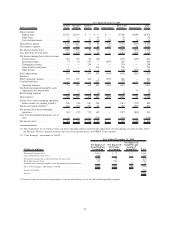

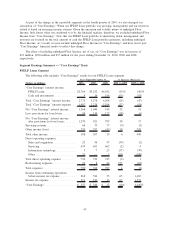

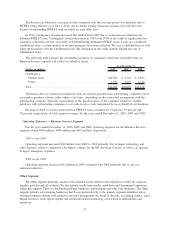

Business Segments

As a result of the change in segment reporting that occurred in the fourth quarter 2010, past periods have

been recast for comparison purposes. In connection with changing the reportable segments the following lists

other significant changes we made related to the new segment presentation:

• The operating expenses reported for each segment are directly attributable to the generation of revenues

by that segment. We have included corporate overhead and certain information technology costs

(together referred to as “Overhead”) in our Other segment rather than allocate those expenses by

segment.

• The creation of the FFELP Loans and Business Services segments has resulted in our accounting for

the significant servicing revenue we earn on FFELP Loans we own in the Business Services segment.

This bifurcates the FFELP interest income between the FFELP Loans and Business Services segment,

with an intercompany servicing fee charge from the Business Services segment. The intercompany

amounts are the contractual rates for encumbered loans within a financing facility or a similar market

rate if the loan is not in a financing facility and accordingly exceed our costs.

• In our GAAP-basis financial presentation we allocated existing goodwill to the new reporting units

within the reportable segments based upon relative fair value. During the fourth quarter 2010, we also

evaluated our goodwill for impairment using both the old reporting and new reporting unit framework

and there was no impairment under either analysis.

• Similar to prior periods, capital is assigned to each segment based on internally determined

risk-adjusted weightings for the assets in each segment. These weightings have been updated and differ

depending on the relative risk of each asset type and represent management’s view of the level of

capital needed to support different assets. Unsecured debt is allocated based on the remaining funding

needed for each segment after direct funding and the capital allocation has been considered.

42