Sallie Mae 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

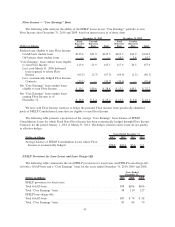

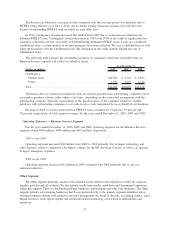

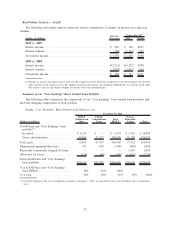

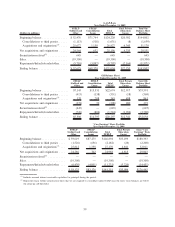

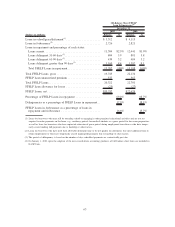

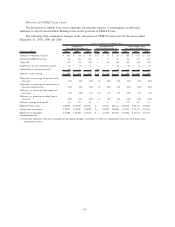

Rate/Volume Analysis — GAAP

The following rate/volume analysis shows the relative contribution of changes in interest rates and asset

volumes.

(Dollars in millions)

Increase

(Decrease) Rate Volume

Change Due To

(1)

2010 vs. 2009

Interest income ........................................ $ 996 $ 149 $847

Interest expense........................................ (760) (1,194) 434

Net interest income ..................................... $1,756 $ 1,416 $340

2009 vs. 2008

Interest income ........................................ $(2,512) $(3,252) $740

Interest expense........................................ (2,870) (3,435) 565

Net interest income ..................................... $ 358 $ 197 $161

(1) Changes in income and expense due to both rate and volume have been allocated in proportion to the relationship of the absolute

dollar amounts of the change in each. The changes in income and expense are calculated independently for each line in the table.

The totals for the rate and volume columns are not the sum of the individual lines.

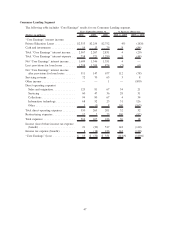

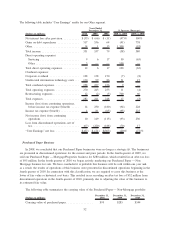

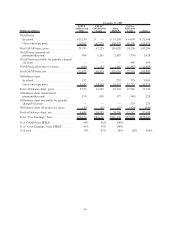

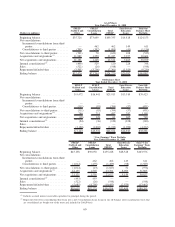

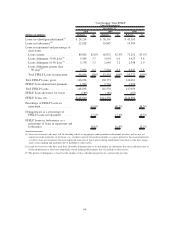

Summary of our “Core Earnings” Basis Student Loan Portfolio

The following tables summarize the components of our “Core Earnings” basis student loan portfolios and

show the changing composition of each portfolio.

Ending “Core Earnings” Basis Student Loan Balances, net

(Dollars in millions)

FFELP

Stafford and

Other

FFELP

Consolidation

Loans

Total

FFELP

Private

Education

Loans Total

December 31, 2010

GAAP-basis and “Core Earnings” basis

portfolio

(1)

:

In-school ......................... $ 6,333 $ — $ 6,333 $ 3,752 $ 10,085

Grace and repayment ................ 49,068 91,537 140,605 33,780 174,385

Total, gross ......................... 55,401 91,537 146,938 37,532 184,470

Unamortized premium/(discount) ......... 971 929 1,900 (894) 1,006

Receivable for partially charged-off loans . . . — — — 1,039 1,039

Allowance for losses .................. (120) (69) (189) (2,021) (2,210)

Total GAAP-basis and “Core Earnings”

basis portfolio ..................... $56,252 $92,397 $148,649 $35,656 $184,305

% of GAAP-basis and “Core Earnings”

basis FFELP ...................... 38% 62% 100%

% of total .......................... 31% 50% 81% 19% 100%

(1) Upon the adoption of the new consolidation accounting on January 1, 2010, we consolidated all of our off-balance sheet securitization

trusts.

55