Sallie Mae 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

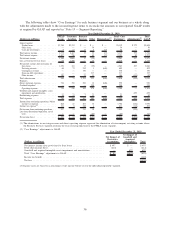

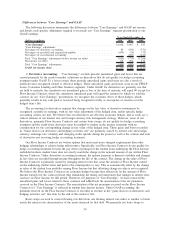

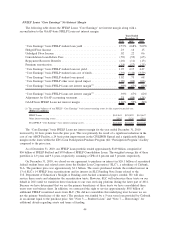

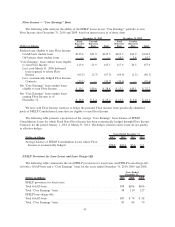

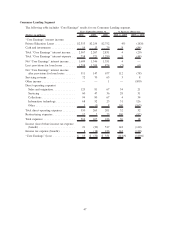

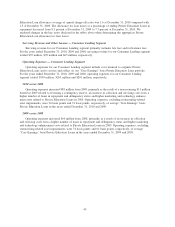

As part of the change in the reportable segments in the fourth quarter of 2010, we also changed our

calculation of “Core Earnings.” When our FFELP Loan portfolio was growing, management and our investors

valued it based on recurring income streams. Given the uncertain and volatile nature of unhedged Floor

Income, little future value was attributed to it by the financial markets; therefore, we excluded unhedged Floor

Income from “Core Earnings.” Now that our FFELP Loan portfolio is amortizing down, management and

investors are focused on the total amount of cash the FFELP Loan portfolio generates, including unhedged

Floor Income. As a result, we now include unhedged Floor Income in “Core Earnings” and have recast past

“Core Earnings” financial results to reflect this change.

The effect of including unhedged Floor Income, net of tax, on “Core Earnings” was an increase of

$21 million, $210 million and $57 million for the years ending December 31, 2010, 2009 and 2008,

respectively.

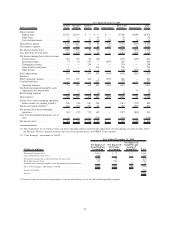

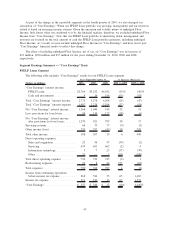

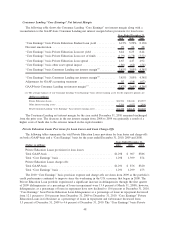

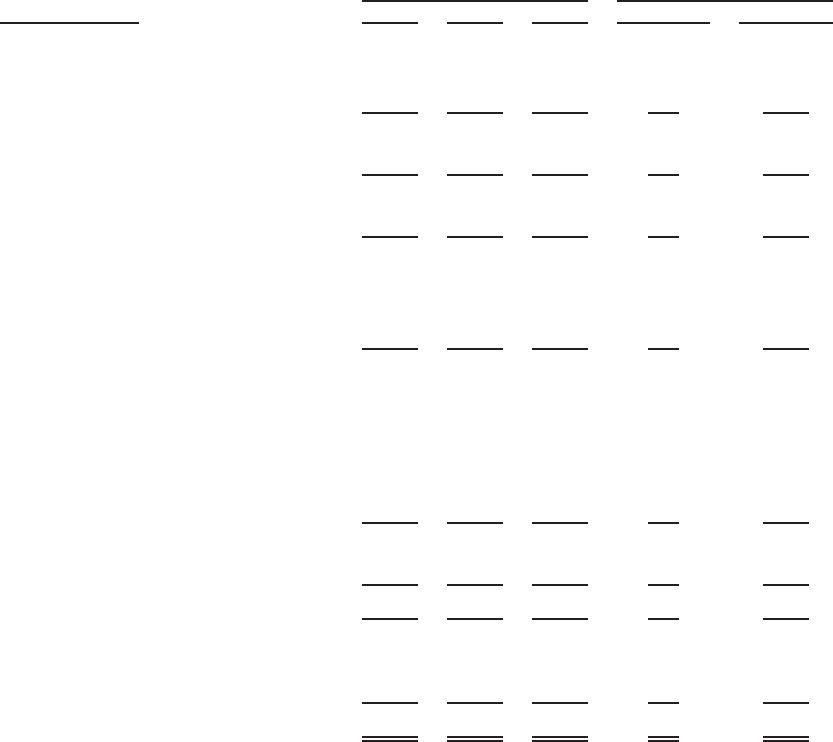

Segment Earnings Summary — “Core Earnings” Basis

FFELP Loans Segment

The following table includes “Core Earnings” results for our FFELP Loans segment.

(Dollars in millions) 2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended December 31, % Increase (Decrease)

“Core Earnings” interest income:

FFELP Loans ................... $2,766 $3,252 $6,052 (15)% (46)%

Cash and investments ............. 9 26 156 (65) (83)

Total “Core Earnings” interest income . . . 2,775 3,278 6,208 (15) (47)

Total “Core Earnings” interest expense . . 1,407 2,238 5,294 (37) (58)

Net “Core Earnings” interest income .... 1,368 1,040 914 32 14

Less: provisions for loan losses . ....... 98 119 127 (18) (6)

Net “Core Earnings” interest income

after provisions for loan losses ...... 1,270 921 787 38 17

Servicing revenue .................. 68 75 77 (9) (3)

Other income (loss) ................ 320 292 (42) 10 795

Total other income ................. 388 367 35 6 949

Direct operating expenses:

Sales and origination.............. 23 56 57 (59) (2)

Servicing ...................... 679 691 662 (2) 4

Information technology ............ 3 7 23 (57) (70)

Other ......................... 31 — 3 100 (100)

Total direct operating expense . . ....... 736 754 745 (2) 1

Restructuring expenses .............. 54 8 42 575 (81)

Total expenses .................... 790 762 787 4 (3)

Income from continuing operations,

before income tax expense . . ....... 868 526 35 65 1,403

Income tax expense ................ 311 186 13 67 1,331

“Core Earnings” ................... $ 557 $ 340 $ 22 64% 1,445%

43