Sallie Mae 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

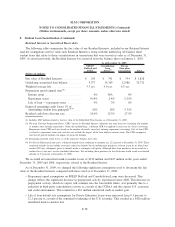

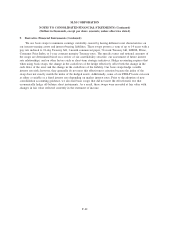

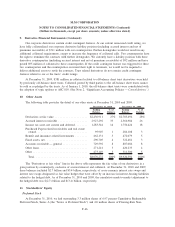

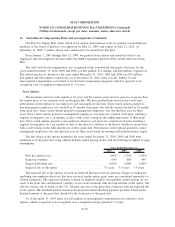

11. Stockholders’ Equity (Continued)

The following table summarizes our common share repurchases and issuances for the years ended

December 31, 2010, 2009 and 2008.

(Shares in millions) 2010 2009 2008

Years Ended December 31,

Common shares repurchased:

Benefit plans

(1)

........................................ 1.1 .3 1.0

Total shares repurchased ................................. 1.1 .3 1.0

Average purchase price per share ........................... $13.44 $20.29 $24.51

Common shares issued .................................... 43.0 17.8 1.9

Authority remaining at end of period for repurchases .............. 38.8 38.8 38.8

(1) Shares withheld from stock option exercises and vesting of restricted stock for employees’ tax withholding obligations and

shares tendered by employees to satisfy option exercise costs.

The closing price of our common stock on December 31, 2010 was $12.59.

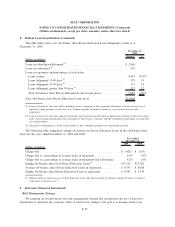

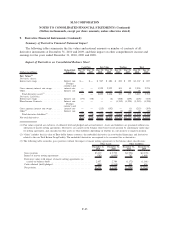

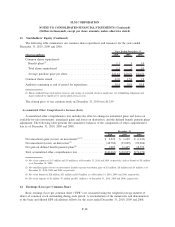

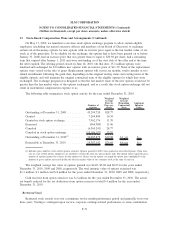

Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive loss includes the after-tax change in unrealized gains and losses on

available-for-sale investments, unrealized gains and losses on derivatives, and the defined benefit pension plans

adjustment. The following table presents the cumulative balances of the components of other comprehensive

loss as of December 31, 2010, 2009 and 2008.

2010 2009 2008

December 31,

Net unrealized gains (losses) on investments

(1)(2)

............ $ 2,222 $ 1,629 $ (1,243)

Net unrealized (losses) on derivatives

(3)

................... (48,789) (53,899) (93,986)

Net gain on defined benefit pension plans

(4)

................ 1,903 11,445 18,753

Total accumulated other comprehensive loss ................ $(44,664) $(40,825) $(76,476)

(1) Net of tax expense of $1.3 million and $.9 million as of December 31, 2010 and 2009, respectively, and tax benefit of $.8 million

as of December 31, 2008.

(2) Net unrealized gains (losses) on investments include currency translation gains of $.5 million, $.8 million and $.4 million as of

December 31, 2010, 2009 and 2008, respectively.

(3) Net of tax benefit of $28 million, $31 million and $53 million as of December 31, 2010, 2009 and 2008, respectively.

(4) Net of tax expense of $1 million, $7 million and $11 million as of December 31, 2010, 2009 and 2008, respectively.

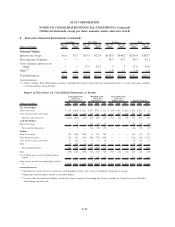

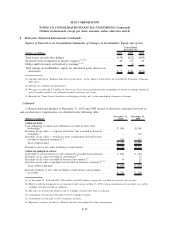

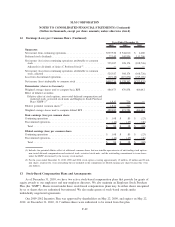

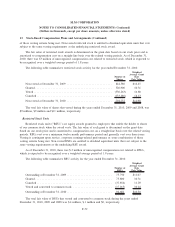

12. Earnings (Loss) per Common Share

Basic earnings (loss) per common share (“EPS”) are calculated using the weighted average number of

shares of common stock outstanding during each period. A reconciliation of the numerators and denominators

of the basic and diluted EPS calculations follows for the years ended December 31, 2010, 2009 and 2008.

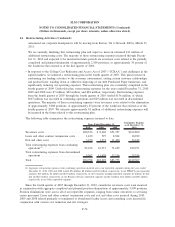

F-68

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)