Sallie Mae 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

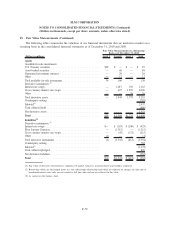

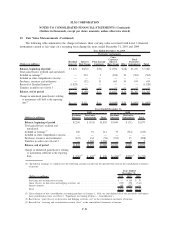

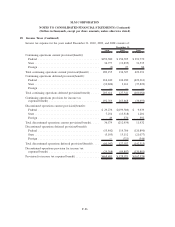

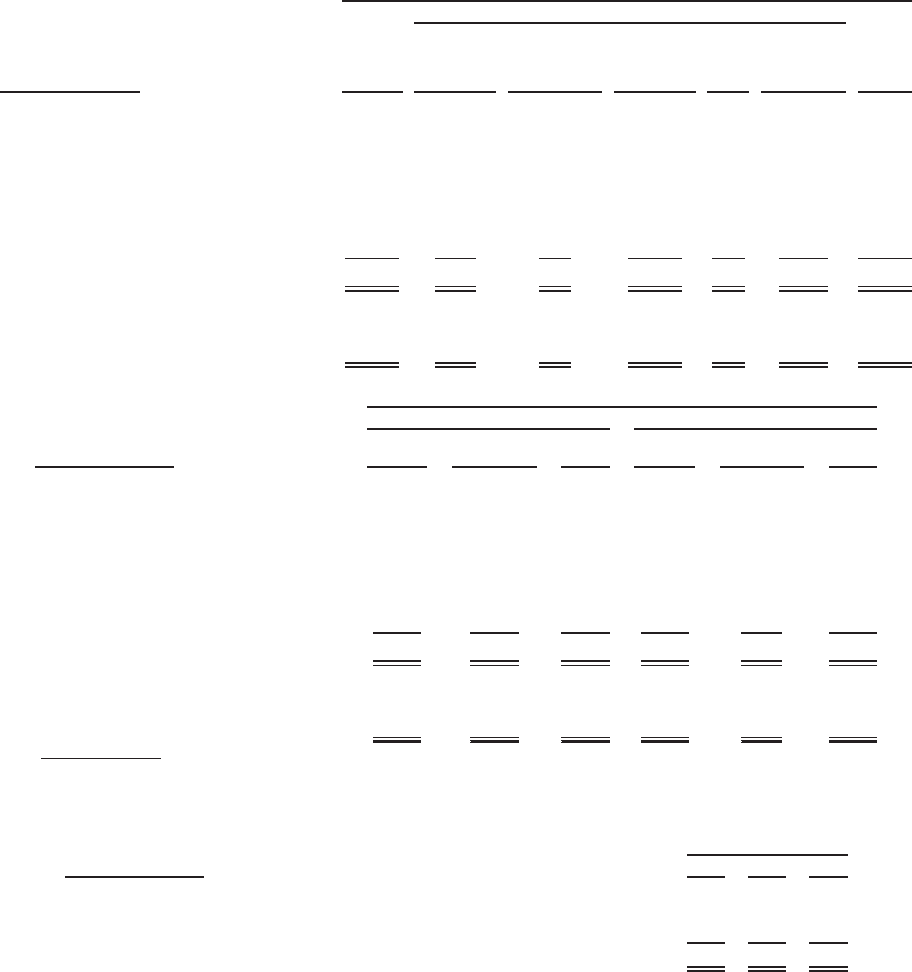

15. Fair Value Measurements (Continued)

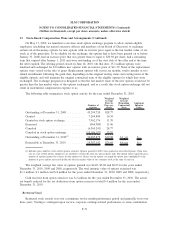

The following table summarizes the change in balance sheet carrying value associated with Level 3 financial

instruments carried at fair value on a recurring basis during the years ended December 31, 2010 and 2009.

(Dollars in millions)

Residual

Interests

Interest

Rate Swaps

Floor Income

Contracts

Cross

Currency

Interest

Rate Swaps Other

Total

Derivative

Instruments Total

Derivative instruments

Year Ended December 31, 2010

Balance, beginning of period ........... $1,828 $(272) $(54) $ 1,596 $(18) $1,252 $ 3,080

Total gains/(losses) (realized and unrealized):

Included in earnings

(1)

................ — 234 3 (834) 34 (563) (563)

Included in other comprehensive income . . . . — — — — — — —

Purchases, issuances and settlements . . . . . . — (52) 51 665 10 674 674

Removal of Residual Interests

(2)

......... (1,828) — — — — — (1,828)

Transfers in and/or out of level 3 . . ....... — — — — — — —

Balance, end of period ............... $ — $ (90) $ — $ 1,427 $ 26 $1,363 $ 1,363

Change in unrealized gains/(losses) relating

to instruments still held at the reporting

date

(3)

.......................... $ — $111 $— $(1,010) $ 36 $ (863) $ (863)

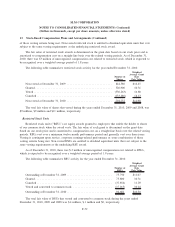

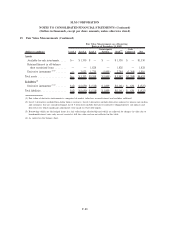

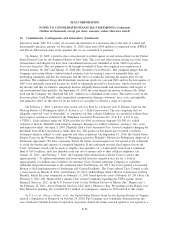

(Dollars in millions)

Residual

Interests

Derivative

Instruments Total

Residual

Interests

Derivative

Instruments Total

2009 2008

Years Ended December 31,

Balance, beginning of period .......... $2,200 $ (341) $1,859 $3,044 $ (71) $2,973

Total gains/(losses) (realized and

unrealized):

Included in earnings

(1)

............... 120 91 211 79 (314) (235)

Included in other comprehensive income . . . — — — — — —

Purchases, issuances and settlements. . . . . . (492) 434 (58) (923) 35 (888)

Transfers in and/or out of Level 3 . . . . . . . — 1,068 1,068 — 9 9

Balance, end of period .............. $1,828 $1,252 $3,080 $2,200 $(341) $1,859

Change in unrealized gains/(losses) relating

to instruments still held at the reporting

date . . . . ...................... $(330)

(4)

$ 439

(3)

$ 109 $ (424)

(2)

$(298)

(3)

$ (722)

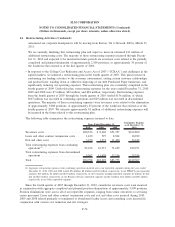

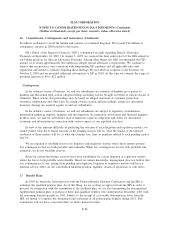

(1) “Included in earnings” is comprised of the following amounts recorded in the specified line item in the consolidated statements

of income:

(Dollars in millions) 2010 2009 2008

Years Ended

December 31,

Servicing and securitization revenue . .................................... $ — $120 $ 79

Gains (losses) on derivative and hedging activities, net ......................... (732) 298 (314)

Interest expense .................................................. 169 (207) —

Total . ........................................................ $(563) $ 211 $(235)

(2) Upon adoption of new consolidation accounting guidance on January 1, 2010, we consolidated all of our previously off-balance

sheet securitization trusts (see Note 2, “Significant Accounting Policies — Consolidation”).

(3) Recorded in “gains (losses) on derivative and hedging activities, net” in the consolidated statements of income.

(4) Recorded in “servicing and securitization revenue (loss)” in the consolidated statements of income.

F-81

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)