Sallie Mae 2010 Annual Report Download - page 147

Download and view the complete annual report

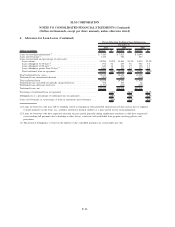

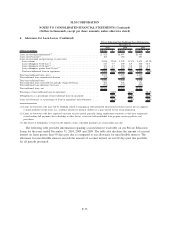

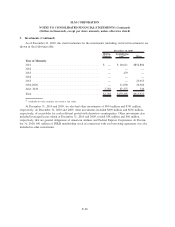

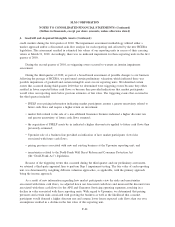

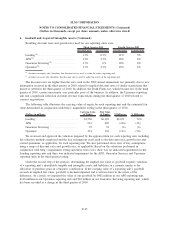

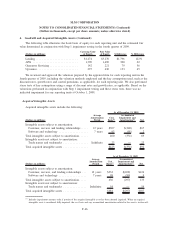

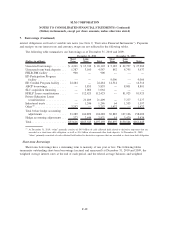

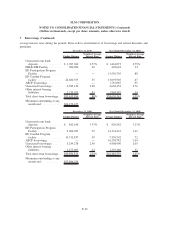

Please find page 147 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6. Goodwill and Acquired Intangible Assets (Continued)

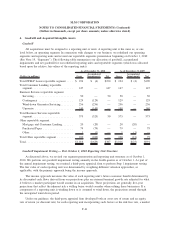

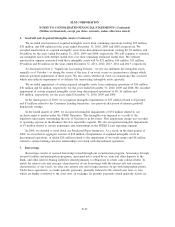

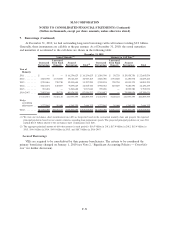

credit markets during the first quarter of 2010. The impairment assessment methodology utilized either a

market approach and/or a discounted cash flow analysis for each reporting unit affected by the new HCERA

legislation. This assessment resulted in estimated fair values of our reporting units in excess of their carrying

values at March 31, 2010. Accordingly, there was no indicated impairment for these reporting units in the first

quarter of 2010.

During the second quarter of 2010, no triggering event occurred to warrant an interim impairment

assessment.

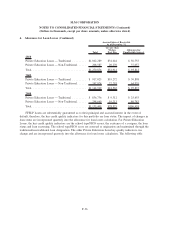

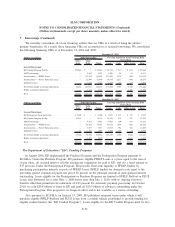

During the third quarter of 2010, as part of a broad-based assessment of possible changes to our business

following the passage of HCERA, we performed certain preliminary valuations which indicated there was

possible impairment of goodwill and certain intangible assets in our reporting units. We identified certain

events that occurred during third quarter 2010 that we determined were triggering events because they either

resulted in lower expected future cash flows or because they provided indications that market participants

would value our reporting units below previous estimates of fair value. The triggering events that occurred in

the third quarter included:

• FFELP asset pricing information indicating market participants assume a greater uncertainty related to

future cash flows and require a higher return on investment;

• market bids related to the sale of a non-affiliated Guarantor business indicated a higher discount rate

and greater uncertainty of future cash flows assumed;

• the acquisition of FFELP assets by us indicated a higher discount rate applied to future cash flows than

previously estimated;

• Upromise sale of a business line provided an indication of how market participants view risks

associated with future cash flows;

• pricing pressures associated with new and existing business at the Upromise reporting unit; and

• uncertainties related to the Dodd-Frank Wall Street Reform and Consumer Protection Act

(the “Dodd-Frank Act”) legislation.

Because of the triggering events that occurred during the third quarter and our preliminary assessment,

we retained a third-party appraisal firm to perform Step 1 impairment testing. The fair value of each reporting

unit was determined by weighting different valuation approaches, as applicable, with the primary approach

being the income approach.

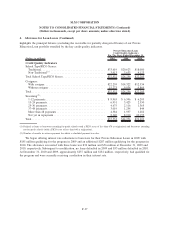

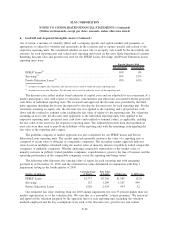

As a result of new information regarding how market participants view the risks and uncertainties

associated with future cash flows, we adjusted down our forecasted cash flows and increased the discount rates

associated with these cash flows for the APG and Guarantor Servicing operating segments, resulting in a

decline in value associated with these reporting units. With regard to Upromise, we determined that pricing

pressures and certain risks associated with growing the business as well as the likelihood that a market

participant would demand a higher discount rate and assume lower future expected cash flows than our own

assumptions resulted in a decline in the fair value of this reporting unit.

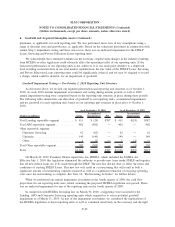

F-44

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)