Sallie Mae 2010 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

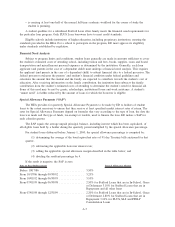

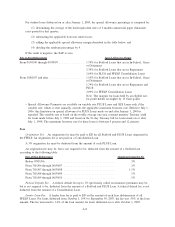

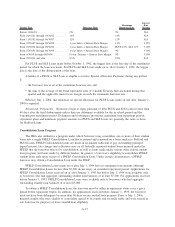

Loan Rebate Fee. A loan rebate fee of 1.05% is paid annually on the unpaid principal and interest of

each Consolidation Loan disbursed on or after October 1, 1993. This fee was reduced to .62% for loans made

from October 1, 1998 to January 31, 1999.

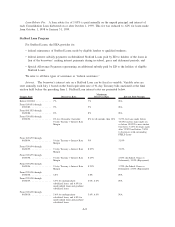

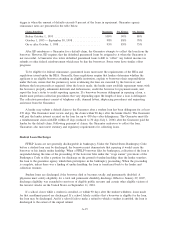

Stafford Loan Program

For Stafford Loans, the HEA provides for:

• federal reinsurance of Stafford Loans made by eligible lenders to qualified students;

• federal interest subsidy payments on Subsidized Stafford Loans paid by ED to holders of the loans in

lieu of the borrowers’ making interest payments during in-school, grace and deferment periods; and

• Special Allowance Payments representing an additional subsidy paid by ED to the holders of eligible

Stafford Loans.

We refer to all three types of assistance as “federal assistance.”

Interest. The borrower’s interest rate on a Stafford Loan can be fixed or variable. Variable rates are

reset annually each July 1 based on the bond equivalent rate of 91-day Treasury bills auctioned at the final

auction held before the preceding June 1. Stafford Loan interest rates are presented below.

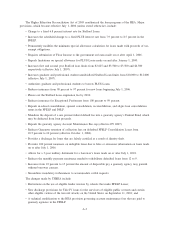

Trigger Date Borrower Rate

Maximum

Borrower Rate Interest Rate Margin

Before 01/01/81 . .......... 7% 7% N/A

From 01/01/81 through

09/12/83............... 9% 9% N/A

From 09/13/83 through

06/30/88............... 8% 8% N/A

From 07/01/88 through

09/30/92............... 8%for48months; thereafter,

91-day Treasury + Interest Rate

Margin

8% for 48 months, then 10% 3.25% for loans made before

7/23/92 and for loans made on

or before 10/1/92 to new student

borrowers; 3.10% for loans made

after 7/23/92 and before 7/1/94

to borrowers with outstanding

FFELP Loans

From 10/01/92 through

06/30/94............... 91-day Treasury + Interest Rate

Margin

9% 3.10%

From 07/01/94 through

06/30/95............... 91-day Treasury + Interest Rate

Margin

8.25% 3.10%

From 07/01/95 through

06/30/98............... 91-day Treasury + Interest Rate

Margin

8.25% 2.50% (In-School, Grace or

Deferment); 3.10% (Repayment)

From 07/01/98 through

06/30/06............... 91-day Treasury + Interest Rate

Margin

8.25% 1.70% (In-School, Grace or

Deferment); 2.30% (Repayment)

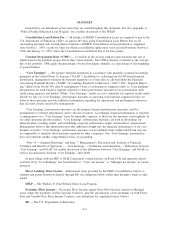

From 07/01/06 through

06/30/08............... 6.8% 6.8% N/A

From 07/01/08 through

06/30/09............... 6.0% for undergraduate

subsidized loans; and 6.8% for

unsubsidized loans and graduate

subsidized loans.

6.0%, 6.8% N/A

From 07/01/09 through

06/30/10............... 5.6% for undergraduate

subsidized loans; and 6.8% for

unsubsidized loans and graduate

subsidized loans.

5.6%, 6.8% N/A

A-9