Sallie Mae 2010 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

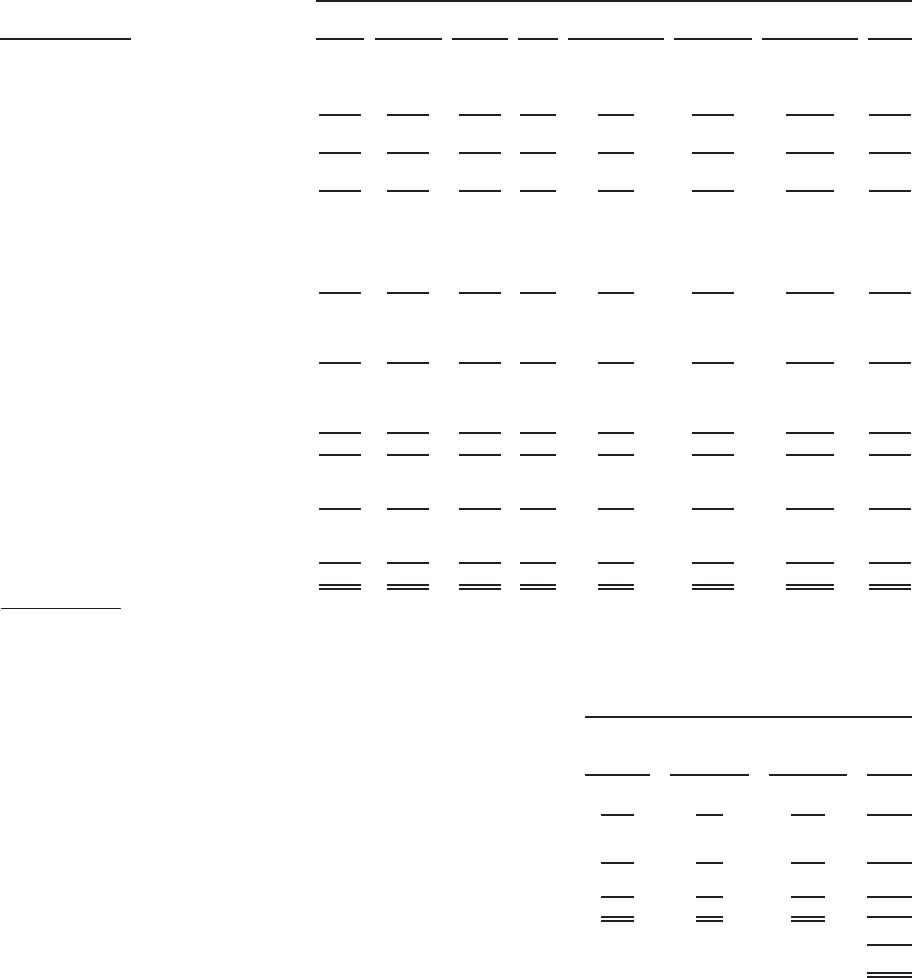

19. Segment Reporting (Continued)

(Dollars in millions)

FFELP

Loans

Consumer

Lending

Business

Services Other Eliminations

(1)

Total “Core

Earnings” Adjustments

(2)

Total

GAAP

Year Ended December 31, 2008

Interest income:

Student loans ....................... $6,052 $2,752 $ — $ — $ — $8,804 $(1,893) $6,911

Other loans ........................ — — — 83 — 83 — 83

Cash and investments .................. 156 79 26 95 (26) 330 (54) 276

Total interest income .................. 6,208 2,831 26 178 (26) 9,217 (1,947) 7,270

Total interest expense.................. 5,294 1,280 — 161 (26) 6,709 (804) 5,905

Net interest income (loss) ............... 914 1,551 26 17 — 2,508 (1,143) 1,365

Less: provisions for loan losses ........... 127 874 — 28 — 1,029 (309) 720

Net interest income (loss) after provisions for

loan losses ....................... 787 677 26 (11) — 1,479 (834) 645

Servicing revenue .................. 77 65 897 1 (632) 408 — 408

Contingency revenue ................ — — 330 — — 330 — 330

Gains on debt repurchases ............. — — — 64 — 64 — 64

Other income ..................... (42) 1 52 14 — 25 (355) (330)

Total other income ................... 35 66 1,279 79 (632) 827 (355) 472

Expenses:

Direct operating expenses ............... 745 201 462 17 (632) 793 — 793

Overhead expenses ................... — — — 236 — 236 — 236

Operating expenses ................. 745 201 462 253 (632) 1,029 — 1,029

Goodwill and acquired intangible assets

impairment and amortization ........... — — — — — — 50 50

Restructuring expenses ................. 42 25 10 (5) — 72 — 72

Total expenses ...................... 787 226 472 248 (632) 1,101 50 1,151

Income (loss) from continuing operations, before

income tax expense (benefit) ........... 35 517 833 (180) — 1,205 (1,239) (34)

Income tax expense (benefit)

(3)

............ 13 186 300 (65) — 434 (470) (36)

Net income (loss) from continuing operations . . 22 331 533 (115) — 771 (769) 2

Loss from discontinued operations, net of

taxes .......................... — — — (188) — (188) (27) (215)

Net income (loss) .................... $ 22 $ 331 $ 533 $(303) $ — $ 583 $ (796) $ (213)

(1) The eliminations in servicing revenue and direct operating expense represent the elimination of intercompany servicing revenue where

the Business Services segment performs the loan servicing function for the FFELP Loans segment.

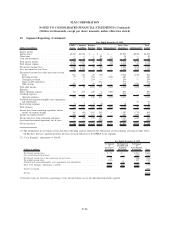

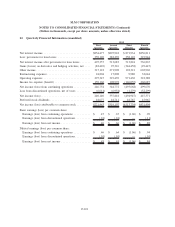

(2) “Core Earnings” adjustments to GAAP:

Net Impact

of

Derivative

Accounting

Net Impact of

Goodwill and

Acquired

Intangibles

Net Impact

of

Securitization

Accounting Total

Year Ended December 31, 2008

Net interest income (loss) .......................................... $(271) $ — $(872) $(1,143)

Less: provisions for loan losses ...................................... — — (309) (309)

Net interest income (loss) after provisions for loan losses ....................... (271) — (563) (834)

Total other income (loss) .......................................... (476) — 121 (355)

Goodwill and acquired intangible assets impairment and amortization . .............. — 50 — 50

Loss from continuing operations, before income tax expense . . ................... (747) (50) (442) (1,239)

Loss from discontinued operations, net of taxes. ............................ (4) (23) — (27)

Total “Core Earnings” adjustments to GAAP . . ............................ $(751) $(73) $(442) (1,266)

Income tax benefit . . . ........................................... (470)

Net loss .................................................... $ (796)

(3) Income taxes are based on a percentage of net income before tax for the individual reportable segment.

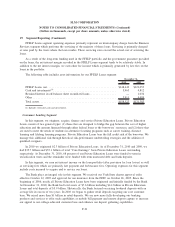

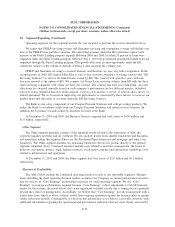

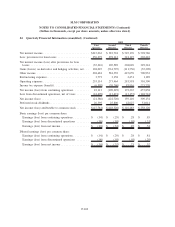

Summary of “Core Earnings” Adjustments to GAAP

The adjustments required to reconcile from our “Core Earnings” results to our GAAP results of

operations relate to differing treatments for securitization transactions, derivatives, Floor Income, and certain

F-97

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)