Sallie Mae 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

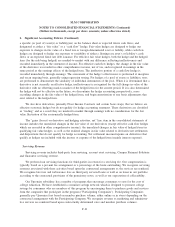

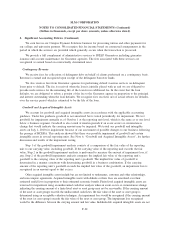

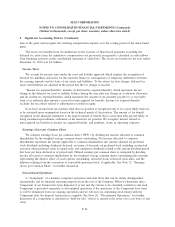

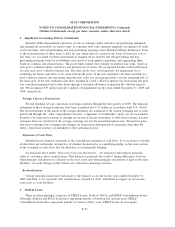

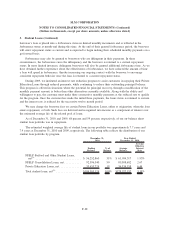

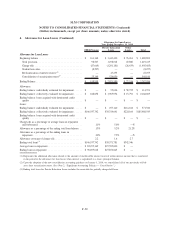

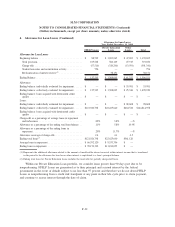

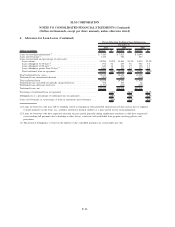

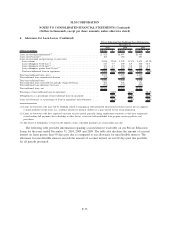

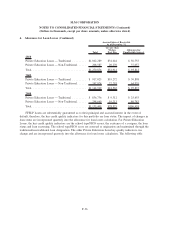

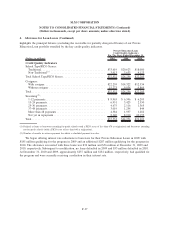

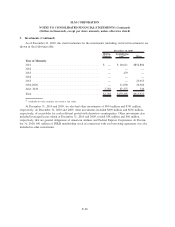

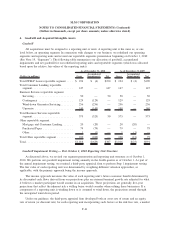

4. Allowance for Loan Losses (Continued)

FFELP Loans

Private Education

Loans

Other

Loans Total

Allowance for Loan Losses

Year Ended December 31, 2009

Allowance for Loan Losses

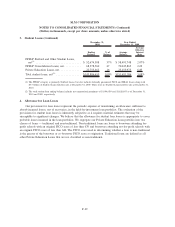

Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 137,543 $ 1,308,043 $ 61,325 $ 1,506,911

Total provision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106,221 966,591 46,148 1,118,960

Charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (78,861) (875,667) (31,212) (985,740)

Student loan sales and securitization activity . . . . . . . . . . . (3,735) — — (3,735)

Reclassification of interest reserve

(1)

. . . . . . . . . . . . . . . . — 44,473 — 44,473

Ending Balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 161,168 $ 1,443,440 $ 76,261 $ 1,680,869

Allowance:

Ending balance: individually evaluated for impairment. . . . . . $ — $ 32,473 $ 56,760 $ 89,233

Ending balance: collectively evaluated for impairment . . . . . . $ 161,168 $ 1,410,967 $ 19,501 $ 1,591,636

Ending balance: loans acquired with deteriorated credit

quality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $ —

Loans:

Ending balance: individually evaluated for impairment. . . . . . $ — $ 181,254 $128,080 $ 309,334

Ending balance: collectively evaluated for impairment . . . . . . $119,026,931 $24,574,344 $310,176 $143,911,451

Ending balance: loans acquired with deteriorated credit

quality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $ —

Charge-offs as a percentage of average loans in repayment

and forbearance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11% 7.2% —%

Allowance as a percentage of the ending total loan balance . . .14% 5.8% 17.4%

Allowance as a percentage of the ending loans in

repayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23% 10.0% —%

Allowance coverage of charge-offs . . . . . . . . . . . . . . . . . . . 2.0 1.6 2.4

Ending total loans

(2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $119,026,931 $24,755,598 $438,256

Average loans in repayment . . . . . . . . . . . . . . . . . . . . . . . . $ 69,020,295 $12,137,430 $ —

Ending loans in repayment . . . . . . . . . . . . . . . . . . . . . . . . $ 69,826,790 $14,379,102 $ —

(1) Represents the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred

in the period to the allowance for loan losses when interest is capitalized to a loan’s principal balance.

(2) Ending total loans for Private Education Loans includes the receivable for partially charged-off loans.

F-31

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)