Sallie Mae 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

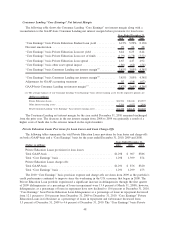

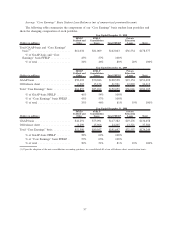

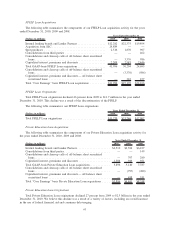

Financial Condition

This section provides additional information regarding the changes related to our loan portfolio assets and

related liabilities as well as credit performance indicators related to our loan portfolio. Many of these

disclosures will show both GAAP-basis as well as “Core Earnings” basis disclosures. Because certain trusts

were not consolidated prior to the adoption of the new consolidation accounting guidance on January 1, 2010,

these trusts were treated as off-balance sheet for GAAP purposes but we considered them on-balance sheet for

“Core Earnings” purposes. Subsequent to the adoption of the new consolidation accounting guidance on

January 1, 2010, this difference no longer exists because all of our trusts are treated as on-balance sheet for

GAAP purposes. Below and elsewhere in the document, “Core Earnings” basis disclosures include all

historically (pre-January 1, 2010) off-balance sheet trusts as though they were on-balance sheet. We believe

that providing “Core Earnings” basis disclosures is meaningful because when we evaluate the performance and

risk characteristics of the Company we have always considered the effect of any off-balance sheet trusts as

though they were on-balance sheet.

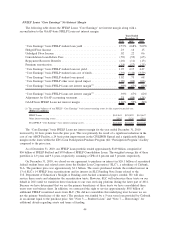

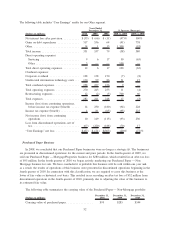

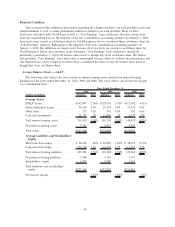

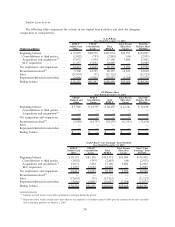

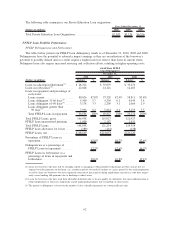

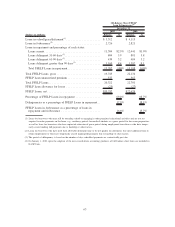

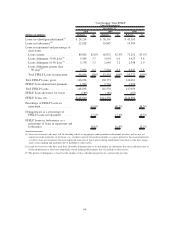

Average Balance Sheets — GAAP

The following table reflects the rates earned on interest-earning assets and paid on interest-bearing

liabilities for the years ended December 31, 2010, 2009 and 2008. This table reflects our net interest margin

on a consolidated basis.

(Dollars in millions) Balance Rate Balance Rate Balance Rate

2010 2009 2008

Years Ended December 31,

Average Assets

FFELP Loans .................... $142,043 2.36% $128,538 2.41% $117,382 4.41%

Private Education Loans ............ 36,534 6.44 23,154 6.83 19,276 9.01

Other loans...................... 323 9.20 561 9.98 955 8.66

Cash and investments . ............. 12,729 .20 11,046 .24 9,279 2.98

Total interest-earning assets.......... 191,629 3.00% 163,299 2.91% 146,892 4.95%

Non-interest-earning assets .......... 5,931 8,693 9,999

Total assets...................... $197,560 $171,992 $156,891

Average Liabilities and Stockholders’

Equity

Short-term borrowings ............. $ 38,634 .86% $ 44,485 1.84% $ 36,059 4.73%

Long-term borrowings. ............. 150,768 1.29 118,699 1.87 111,625 3.76

Total interest-bearing liabilities ....... 189,402 1.20% 163,184 1.86% 147,684 4.00%

Non-interest-bearing liabilities........ 3,280 3,719 3,797

Stockholders’ equity . . ............. 4,878 5,089 5,410

Total liabilities and stockholders’

equity ........................ $197,560 $171,992 $156,891

Net interest margin . . . ............. 1.82% 1.05% .93%

54