Sallie Mae 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

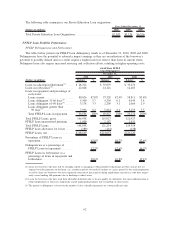

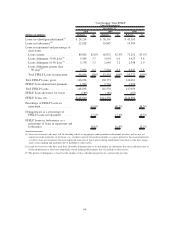

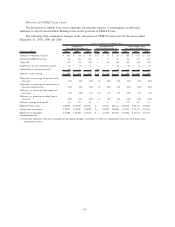

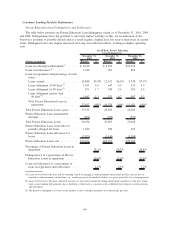

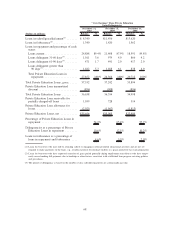

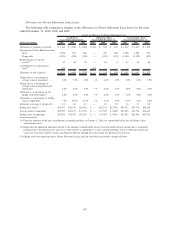

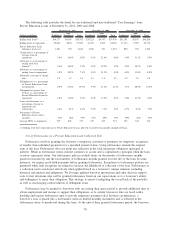

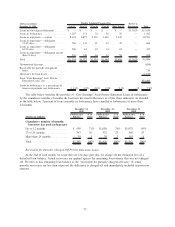

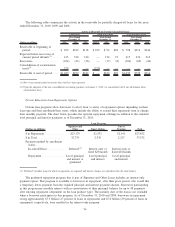

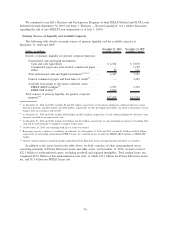

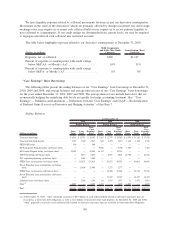

The tables below show the composition and status of the “Core Earnings” basis Private Education Loan

portfolio aged by number of months in active repayment status (months for which a scheduled monthly

payment was due). As indicated in the tables, the percentage of loans in forbearance status decreases the

longer the loans have been in active repayment status. At December 31, 2010, loans in forbearance status as a

percentage of loans in repayment and forbearance were 6.2 percent for loans that have been in active

repayment status for less than 25 months. The percentage drops to 1.9 percent for loans that have been in

active repayment status for more than 48 months. Approximately 79 percent of our “Core Earnings” basis

Private Education Loans in forbearance status has been in active repayment status less than 25 months.

(Dollars in millions)

December 31, 2010 1 to 12 13 to 24 25 to 36 37 to 48 More than 48

Not Yet in

Repayment Total

Monthly Scheduled Payments Due

Loans in-school/grace/deferment . . . . . . . . $ — $ — $ — $ — $ — $8,340 $ 8,340

Loans in forbearance . . . . . . . . . . . . . . . . 845 211 127 70 87 — 1,340

Loans in repayment — current. . . . . . . . . . 7,716 5,976 4,181 2,764 4,251 — 24,888

Loans in repayment — delinquent

31-60 days . . . . . . . . . . . . . . . . . . . . . 476 247 127 68 93 — 1,011

Loans in repayment — delinquent

61-90 days . . . . . . . . . . . . . . . . . . . . . 232 106 60 31 42 — 471

Loans in repayment — delinquent greater

than 90 days . . . . . . . . . . . . . . . . . . . . 694 411 180 86 111 — 1,482

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,963 $6,951 $4,675 $3,019 $4,584 $8,340 37,532

Unamortized discount. . . . . . . . . . . . . . . . (894)

Receivable for partially charged-off loans . . 1,039

Allowance for loan losses . . . . . . . . . . . . . (2,021)

Total “Core Earnings” basis Private

Education Loans, net . . . . . . . . . . . . . . $35,656

Loans in forbearance as a percentage of

loans in repayment and forbearance . . . . 8.5% 3.0% 2.7% 2.3% 1.9% —% 4.6%

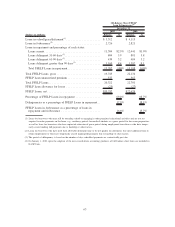

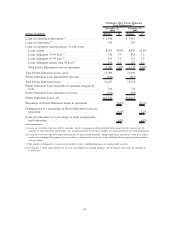

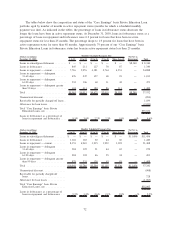

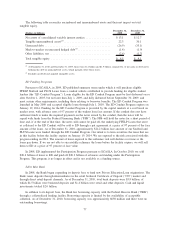

(Dollars in millions)

December 31, 2009 1 to 12 13 to 24 25 to 36 37 to 48 More than 48

Not Yet in

Repayment Total

Monthly Scheduled Payments Due

Loans in-school/grace/deferment . . . . . . . $ — $ — $ — $ — $ — $11,456 $11,456

Loans in forbearance . . . . . . . . . . . . . . . 1,041 183 92 44 60 — 1,420

Loans in repayment — current . . . . . . . . . 8,153 4,969 3,235 1,959 3,092 — 21,408

Loans in repayment — delinquent

31-60 days. . . . . . . . . . . . . . . . . . . . . 584 195 91 44 65 — 979

Loans in repayment — delinquent

61-90 days. . . . . . . . . . . . . . . . . . . . . 284 102 46 25 34 — 491

Loans in repayment — delinquent greater

than 90 days . . . . . . . . . . . . . . . . . . . 879 331 130 63 85 — 1,488

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $10,941 $5,780 $3,594 $2,135 $3,336 $11,456 37,242

Unamortized discount . . . . . . . . . . . . . . . (908)

Receivable for partially charged-off

loans . . . . . . . . . . . . . . . . . . . . . . . . . 728

Allowance for loan losses . . . . . . . . . . . . (1,967)

Total “Core Earnings” basis Private

Education Loans, net . . . . . . . . . . . . . $35,095

Loans in forbearance as a percentage of

loans in repayment and forbearance . . . 9.5% 3.2% 2.6% 2.1% 1.8% —% 5.5%

72