Sallie Mae 2010 Annual Report Download - page 156

Download and view the complete annual report

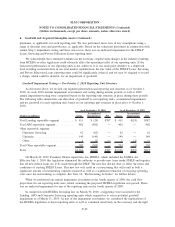

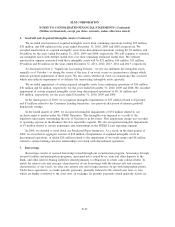

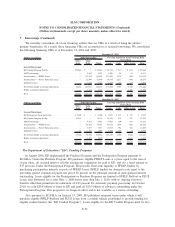

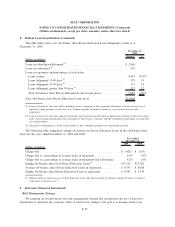

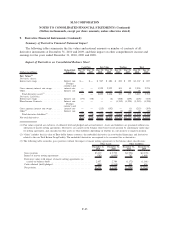

Please find page 156 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

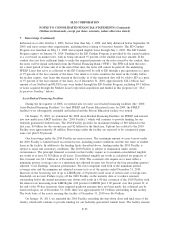

disbursed on or after October 1, 2003, but not later than July 1, 2009, and fully disbursed before September 30,

2009, and meet certain other requirements, including those relating to borrower benefits. The ED Conduit

Program was launched on May 11, 2009 and accepted eligible loans through July 1, 2010. The ED Conduit

Program expires on January 19, 2014. Funding for the ED Conduit Program is provided by the capital markets

at a cost based on market rates, with us being advanced 97 percent of the student loan face amount. If the

conduit does not have sufficient funds to make the required payments on the notes issued by the conduit, then

the notes will be repaid with funds from the Federal Financing Bank (“FFB”). The FFB will hold the notes

for a short period of time and, if at the end of that time, the notes still cannot be paid off, the underlying

FFELP Loans that serve as collateral to the ED Conduit will be sold to ED through a put agreement at a price

of 97 percent of the face amount of the loans. Our intent is to term securitize the loans in the facility before

the facility expires. Any loans that remain in the facility as of the expiration date will be sold to ED at a price

of 97 percent of the face amount of the loans. As of December 31, 2010, approximately $24.2 billion face

amount of our Stafford and PLUS Loans were funded through the ED Conduit Program, including $9.3 billion

of loans acquired through the Student Loan Corporation acquisition and funded in this program (see “SLC

Acquisition Funding” below).

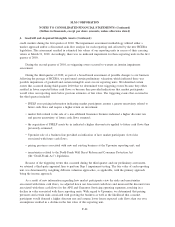

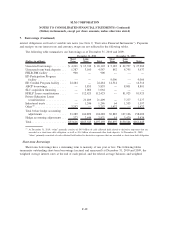

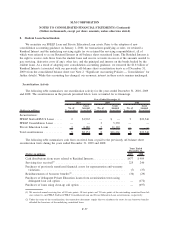

Asset-Backed Financing Facilities

During the first quarter of 2008, we entered into two new asset-backed financing facilities (the “2008

Asset-Backed Financing Facilities”) to fund FFELP and Private Education Loans. In 2009, the FFELP

facilities were subsequently amended and reduced and the Private Education facility was retired.

On January 15, 2010, we terminated the 2008 Asset-Backed Financing Facilities for FFELP and entered

into new multi-year ABCP facilities (the “2010 Facility”) which will continue to provide funding for our

federally guaranteed student loans. The 2010 Facility provides for maximum funding of $10 billion for the

first year, $5 billion for the second year and $2 billion for the third year. Upfront fees related to the 2010

Facility were approximately $4 million. Borrowings under the facility are expected to be commercial paper

issue cost plus 0.50 percent.

Our borrowings under the 2010 Facility are non-recourse. The maximum amount we may borrow under

the 2010 Facility is limited based on certain factors, including market conditions and the fair value of student

loans in the facility. In addition to the funding limits described above, funding under the 2010 Facility is

subject to usual and customary conditions. The 2010 Facility is subject to termination under certain

circumstances. The principal financial covenants in this facility require us to maintain consolidated tangible

net worth of at least $1.38 billion at all times. Consolidated tangible net worth as calculated for purposes of

this covenant was $3.1 billion as of December 31, 2010. The covenants also require us to meet either a

minimum interest coverage ratio or a minimum net adjusted revenue test based on the four preceding quarters’

adjusted “Core Earnings” financial performance. We were compliant with both of the minimum interest

coverage ratio and the minimum net adjusted revenue tests as of the quarter ended December 31, 2010.

Increases in the borrowing rate of up to LIBOR plus 4.50 percent could occur if certain asset coverage ratio

thresholds are not met. Failure to pay off the 2010 Facility on the maturity date or to reduce amounts

outstanding below the annual maximum step downs will result in a 90-day extension of the 2010 Facility with

the interest rate increasing from LIBOR plus 2.00 percent to LIBOR plus 3.00 percent over that period. If, at

the end of the 90-day extension, these required paydown amounts have not been made, the collateral can be

foreclosed upon. As of December 31, 2010, there was approximately $5.9 billion outstanding in this facility.

The book basis of the assets securing this facility at December 31, 2010 was $6.4 billion.

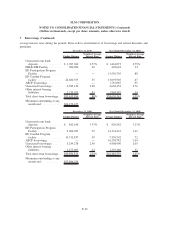

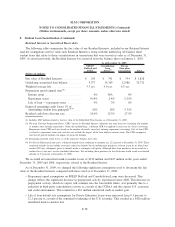

On January 14, 2011, we amended the 2010 Facility extending the step-down dates and final term of the

facility, which will continue to provide funding for our federally-guaranteed student loans. The facility amount

F-53

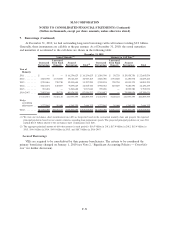

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)