Sallie Mae 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

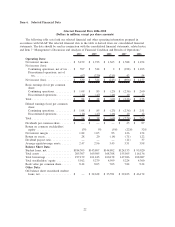

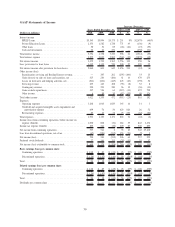

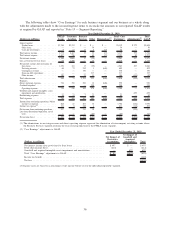

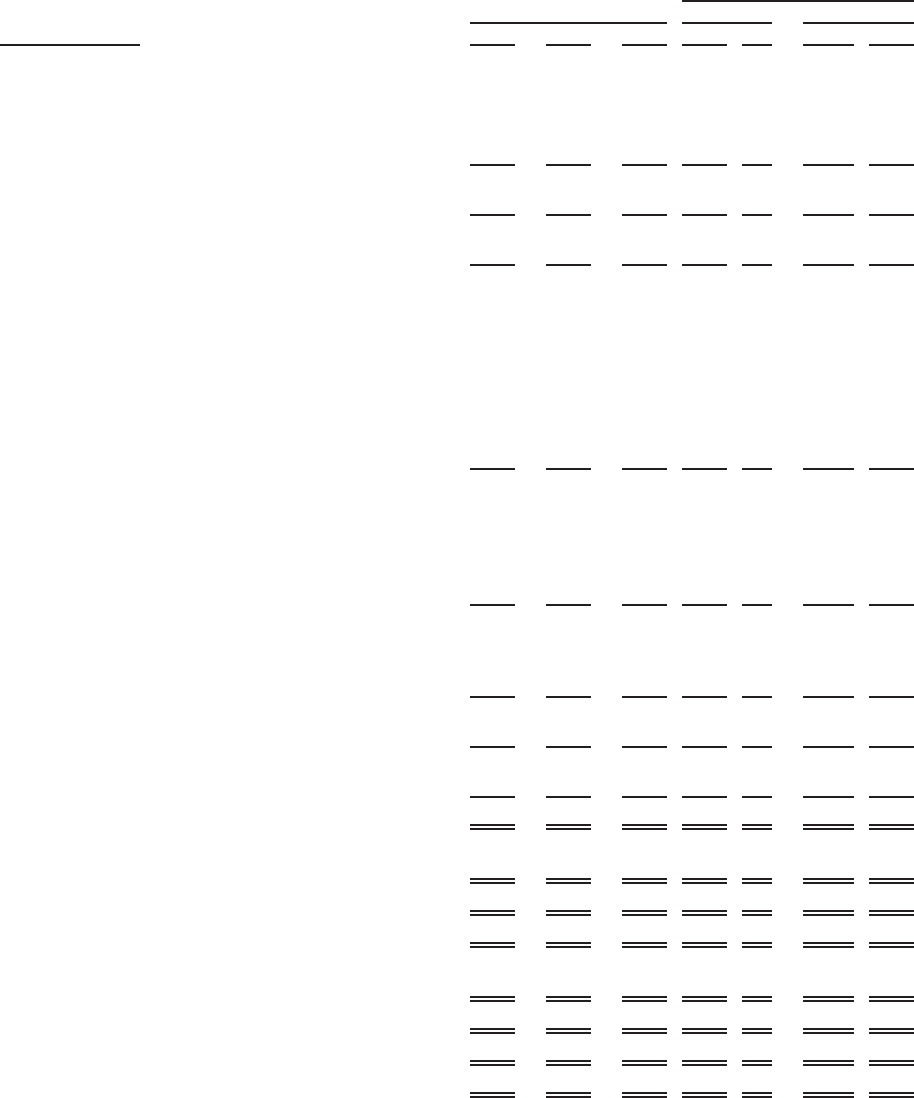

GAAP Statements of Income

(Dollars in millions) 2010 2009 2008 $ % $ %

Years Ended December 31, 2010 vs. 2009 2009 vs. 2008

Increase (Decrease)

Interest income

FFELP Loans . . ................................. $3,345 $3,094 $5,173 $ 251 8% $(2,079) (40)%

Private Education Loans ............................ 2,353 1,582 1,738 771 49 (156) (9)

Other loans . . . ................................. 30 56 83 (26) (46) (27) (33)

Cash and investments. . ............................ 26 26 276 — — (250) (91)

Total interest income ................................ 5,754 4,758 7,270 996 21 (2,512) (35)

Total interest expense . . . ............................ 2,275 3,035 5,905 (760) (25) (2,870) (49)

Net interest income................................. 3,479 1,723 1,365 1,756 102 358 26

Less: provisions for loan losses . . ....................... 1,419 1,119 720 300 27 399 55

Net interest income after provisions for loan losses ............ 2,060 604 645 1,456 241 (41) (6)

Other income (loss):

Securitization servicing and Residual Interest revenue. ........ — 295 262 (295) (100) 33 13

Gains (losses) on sales of loans and securities, net . . . ........ 325 284 (186) 41 14 470 253

Losses on derivative and hedging activities, net ............. (361) (604) (445) 243 (40) (159) 36

Servicing revenue ................................ 405 440 408 (35) (8) 32 8

Contingency revenue . . ............................ 330 294 330 36 12 (36) (11)

Gains on debt repurchases........................... 317 536 64 (219) (41) 472 738

Other income . . ................................. 6 88 39 (82) (93) 49 126

Total other income ................................. 1,022 1,333 472 (311) (23) 861 182

Expenses:

Operating expenses . . . ............................ 1,208 1,043 1,029 165 16 14 1

Goodwill and acquired intangible assets impairment and

amortization expense ............................ 699 76 50 623 820 26 52

Restructuring expenses . ............................ 85 10 72 75 750 (62) (86)

Total expenses . . . ................................. 1,992 1,129 1,151 863 76 (22) (2)

Income (loss) from continuing operations, before income tax

expense (benefit)................................. 1,090 808 (34) 282 35 842 2,476

Income tax expense (benefit) . . . ....................... 493 264 (36) 229 87 300 833

Net income from continuing operations . . .................. 597 544 2 53 10 542 27,100

Loss from discontinued operations, net of tax. . . ............. (67) (220) (215) 153 (70) (5) 2

Net income (loss) . ................................. 530 324 (213) 206 64 537 252

Preferred stock dividends . ............................ 72 146 111 (74) (51) 35 32

Net income (loss) attributable to common stock . ............. $ 458 $ 178 $(324) $ 280 157% $ 502 155%

Basic earnings (loss) per common share:

Continuing operations . ............................ $ 1.08 $ .85 $ (.23) $ .23 27% $ 1.08 470%

Discontinued operations ............................ $ (.14) $ (.47) $ (.46) $ .33 (70)% $ (.01) 2%

Total .......................................... $ .94 $ .38 $ (.69) $ .56 147% $ 1.07 155%

Diluted earnings (loss) per common share:

Continuing operations . ............................ $ 1.08 $ .85 $ (.23) $ .23 27% $ 1.08 470%

Discontinued operations ............................ $ (.14) $ (.47) $ (.46) $ .33 (70)% $ (.01) 2%

Total .......................................... $ .94 $ .38 $ (.69) $ .56 147% $ 1.07 155%

Dividends per common share . . . ....................... $ — $ — $ — $ — —% $ — —%

30