Sallie Mae 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

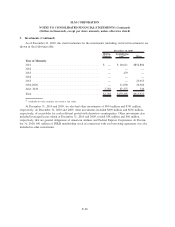

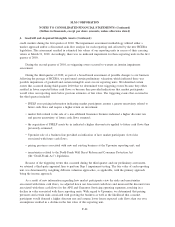

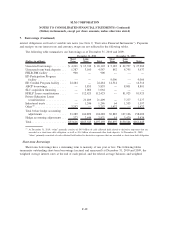

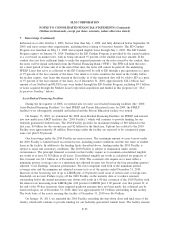

7. Borrowings (Continued)

interest obligations on fixed or variable rate notes (see Note 9, “Derivative Financial Instruments”). Payments

and receipts on our interest rate and currency swaps are not reflected in the following tables.

The following table summarizes our borrowings as of December 31, 2010 and 2009.

(Dollars in millions)

Short

Term

Long

Term Total

Short

Term

Long

Term Total

December 31, 2010 December 31, 2009

Unsecured borrowings . ........ $ 4,361 $ 15,742 $ 20,103 $ 5,185 $ 22,797 $ 27,982

Unsecured term bank deposits . . . 1,387 3,160 4,547 842 4,795 5,637

FHLB-DM facility . . . ........ 900 — 900 — — —

ED Participation Program

facility .................. — — — 9,006 — 9,006

ED Conduit Program facility .... 24,484 — 24,484 14,314 — 14,314

ABCP borrowings ............ — 5,853 5,853 — 8,801 8,801

SLC acquisition financing ...... — 1,064 1,064 — — —

FFELP Loans securitizations .... — 112,425 112,425 — 81,923 81,923

Private Education Loans

securitizations ............. — 21,409 21,409 — 7,277 7,277

Indentured trusts ............. — 1,246 1,246 64 1,533 1,597

Other

(1)

.................... 2,257 — 2,257 1,472 — 1,472

Total before hedge accounting

adjustments ............... 33,389 160,899 194,288 30,883 127,126 158,009

Hedge accounting adjustments . . . 227 2,644 2,871 14 3,420 3,434

Total ...................... $33,616 $163,543 $197,159 $30,897 $130,546 $161,443

(1)

At December 31, 2010, “other” primarily consists of $0.9 billion of cash collateral held related to derivative exposures that are

recorded as a short-term debt obligation, as well as $1.4 billion of unsecured other bank deposits. At December 31, 2009,

“other” primarily consisted of cash collateral held related to derivative exposures that are recorded as short-term debt obligation.

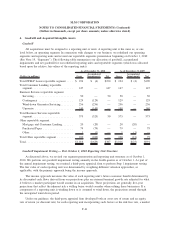

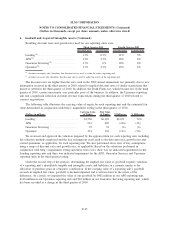

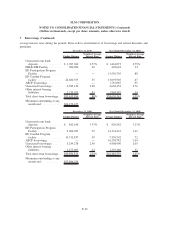

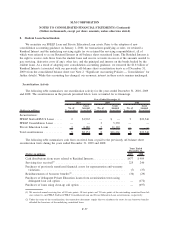

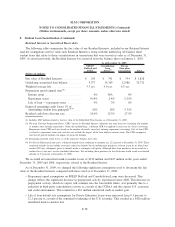

Short-term Borrowings

Short-term borrowings have a remaining term to maturity of one year or less. The following tables

summarize outstanding short-term borrowings (secured and unsecured) at December 31, 2010 and 2009, the

weighted average interest rates at the end of each period, and the related average balances and weighted

F-48

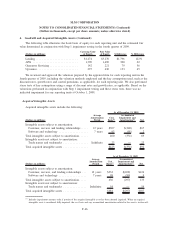

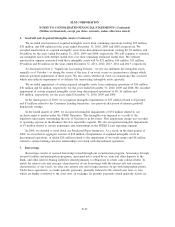

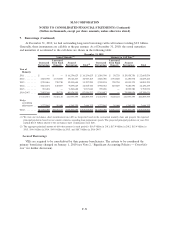

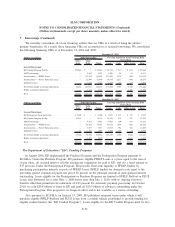

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)