Sallie Mae 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

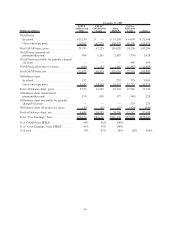

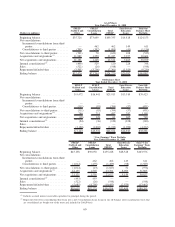

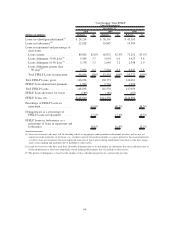

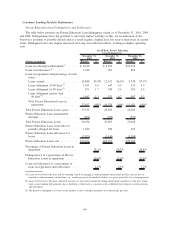

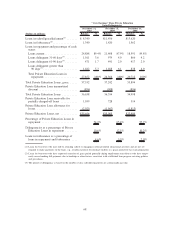

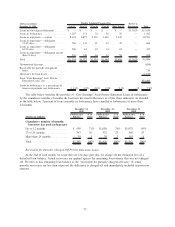

Consumer Lending Portfolio Performance

Private Education Loan Delinquencies and Forbearance

The table below presents our Private Education Loan delinquency trends as of December 31, 2010, 2009

and 2008. Delinquencies have the potential to adversely impact earnings as they are an indication of the

borrower’s potential to possibly default and as a result require a higher loan loss reserve than loans in current

status. Delinquent loans also require increased servicing and collection efforts, resulting in higher operating

costs.

(Dollars in millions) Balance % Balance % Balance %

December 31,

2010

December 31,

2009

December 31,

2008

GAAP-Basis Private Education

Loan Delinquencies

Loans in-school/grace/deferment

(1)

....... $ 8,340 $ 8,910 $10,159

Loans in forbearance

(2)

................ 1,340 967 862

Loans in repayment and percentage of each

status:

Loans current ..................... 24,888 89.4% 12,421 86.4% 9,748 87.2%

Loans delinquent 31-60 days

(3)

........ 1,011 3.6 647 4.5 551 4.9

Loans delinquent 61-90 days

(3)

........ 471 1.7 340 2.4 296 2.6

Loans delinquent greater than

90 days

(3)

...................... 1,482 5.3 971 6.7 587 5.3

Total Private Education Loans in

repayment...................... 27,852 100% 14,379 100% 11,182 100%

Total Private Education Loans, gross...... 37,532 24,256 22,203

Private Education Loan unamortized

discount ......................... (894) (559) (535)

Total Private Education Loans .......... 36,638 23,697 21,668

Private Education Loan receivable for

partially charged-off loans ........... 1,039 499 222

Private Education Loan allowance for

losses ........................... (2,021) (1,443) (1,308)

Private Education Loans, net ........... $35,656 $22,753 $20,582

Percentage of Private Education Loans in

repayment ....................... 74.2% 59.3% 50.4%

Delinquencies as a percentage of Private

Education Loans in repayment ........ 10.6% 13.6% 12.8%

Loans in forbearance as a percentage of

loans in repayment and forbearance .... 4.6% 6.3% 7.2%

(1) Loans for borrowers who may still be attending school or engaging in other permitted educational activities and are not yet

required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2) Loans for borrowers who have requested extension of grace period generally during employment transition or who have tempo-

rarily ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies

and procedures.

(3) The period of delinquency is based on the number of days scheduled payments are contractually past due.

66