Sallie Mae 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

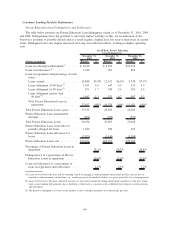

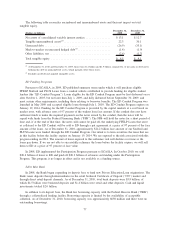

will enter repayment status as current and is expected to begin making their scheduled monthly payments on a

go-forward basis.

Forbearance may also be granted to borrowers who are delinquent in their payments. In these

circumstances, the forbearance cures the delinquency and the borrower is returned to a current repayment

status. In more limited instances, delinquent borrowers will also be granted additional forbearance time. As we

have obtained further experience about the effectiveness of forbearance, we have reduced the amount of time a

loan will spend in forbearance, thereby increasing our ongoing contact with the borrower to encourage

consistent repayment behavior once the loan is returned to a current repayment status. As a result, the balance

of loans in a forbearance status as of month-end has decreased since 2008. In addition, the monthly average

number of loans granted forbearance as a percentage of loans in repayment and forbearance declined to

5.3 percent in the fourth quarter of 2010 compared with the year-ago quarter of 5.6 percent. As of

December 31, 2010, 2.4 percent of loans in current status were delinquent as of the end of the prior month,

but were granted a forbearance that made them current as of December 31, 2010 (borrowers made payments

on approximately 20 percent of these loans prior to being granted forbearance).

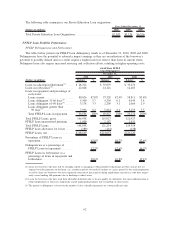

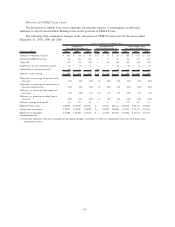

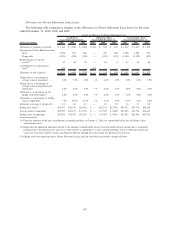

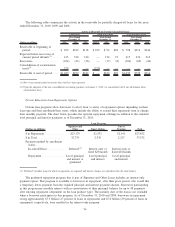

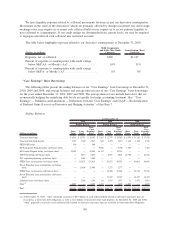

The table below reflects the historical effectiveness of using forbearance. Our experience has shown that

three years after being granted forbearance for the first time, 68 percent of the loans are current, paid in full,

or receiving an in-school grace or deferment, and 17 percent have defaulted. The default experience associated

with loans which utilize forbearance is considered in our allowance for loan losses.

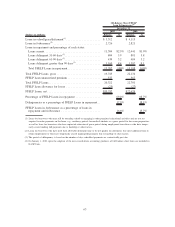

Status distribution

36 months after

being granted

forbearance

for the first time

Status distribution

36 months after

entering repayment

(all loans)

Status distribution

36 months after

entering repayment for

loans never entering

forbearance

Tracking by First Time in Forbearance Compared to All Loans Entering Repayment

In-school/grace/deferment .......... 9.2% 8.5% 4.1%

Current ........................ 50.2 57.4 64.1

Delinquent 31-60 days ............. 3.1 2.0 0.4

Delinquent 61-90 days ............. 1.9 1.1 0.2

Delinquent greater than 90 days ...... 4.8 2.7 0.3

Forbearance ..................... 4.7 3.5 —

Defaulted ...................... 17.4 9.1 4.8

Paid .......................... 8.7 15.7 26.1

Total .......................... 100% 100% 100%

71