Sallie Mae 2010 Annual Report Download - page 83

Download and view the complete annual report

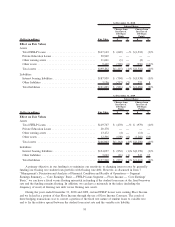

Please find page 83 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Off-Balance Sheet Lending Arrangements

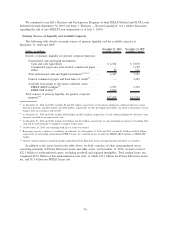

We have issued lending-related financial instruments, including lines of credit, to meet the financing

needs of our institutional customers. In connection with these agreements, we also enter into a participation

agreement with the institution to participate in the loans as they are originated. In the event that a line of

credit is drawn upon, the loan is collateralized by underlying student loans and is usually participated on the

same day. The contractual amount of these financial instruments, $50 million at December 31, 2010, represents

the maximum possible credit risk should the counterparty draw down the commitment, we do not participate

in the loan, and the counterparty subsequently fails to perform according to the terms of our contract. The

remaining total contractual amount available to be borrowed under these commitments is $50 million. All

commitments mature in 2011. We do not believe that these instruments are representative of our actual future

credit exposure; to the extent that the lines of credit are drawn upon, the balance outstanding is collateralized

by student loans. At December 31, 2010, there were no outstanding draws on lines of credit.

Critical Accounting Policies and Estimates

Management’s Discussion and Analysis of Financial Condition and Results of Operations addresses our

consolidated financial statements, which have been prepared in accordance with generally accepted accounting

principles in the United States of America (“GAAP”). “Note 2 — Significant Accounting Policies” includes a

summary of the significant accounting policies and methods used in the preparation of our consolidated

financial statements. The preparation of these financial statements requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and the reported amounts of income and

expenses during the reporting periods. Actual results may differ from these estimates under varying assump-

tions or conditions. On a quarterly basis, management evaluates its estimates, particularly those that include

the most difficult, subjective or complex judgments and are often about matters that are inherently uncertain.

The most significant judgments, estimates and assumptions relate to the following critical accounting policies

that are discussed in more detail below.

Allowance for Loan Losses

When calculating the allowance for loan loss for Private Education Loans we estimate the amount of our

customers who will default over the next two years and how much we will recover over time related to the

defaulted amount. Our historical experience indicates that, on average, the time between the date that a

borrower experiences a default causing event (e.g., the loss trigger event) and the date that we charge-off the

unrecoverable portion of that loan is two years. In estimating the amount of defaults we expect to have over

the next two years we divide the portfolio into categories of similar risk characteristics based on loan program

type, school type, loan status (in-school, grace, forbearance, repayment and delinquency), seasoning (number

of months in active repayment for which a scheduled payment was due), underwriting criteria (credit scores),

and existence or absence of a cosigner. The primary characteristics we use are school type, credit scores,

cosigner status, loan status and seasoning. We start with historical experience of customer default behavior.

We make judgments about which historical period to start with and then make further judgments about

whether that historical experience is representative of future expectations and whether additional adjustment

may be needed to those historical default rates. We also take into account the current and future economic

environment when calculating the allowance for loan loss. We analyze key economic statistics and the effect

they will have on future defaults. Key economic statistics analyzed as part of the allowance for loan loss are

unemployment rates (total and specific to college graduates) and other asset type delinquency rates (credit

cards, mortgages). Significantly more judgment has been required over the last three years, compared with

years prior, in light of the U.S. economy and its effect on our customer’s ability to pay their obligations. In

addition to making judgments about the amount of defaults that will occur over the next two years we also

make judgments about how much we will subsequently recover from a defaulted customer and when that

recovery will occur. Similar to estimating defaults, we begin with historical recovery performance when

projecting future recoveries and use judgment in determining whether historical performance is representative

of what we expect to recover in the future.

82