Sallie Mae 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

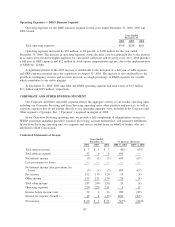

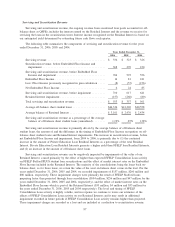

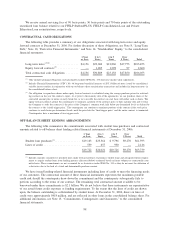

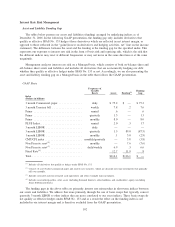

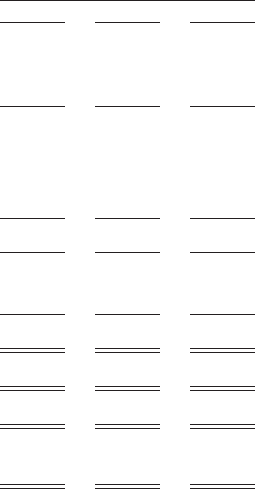

Servicing and Securitization Revenue

Servicing and securitization revenue, the ongoing revenue from securitized loan pools accounted for off-

balance sheet as QSPEs, includes the interest earned on the Residual Interest and the revenue we receive for

servicing the loans in the securitization trusts. Interest income recognized on the Residual Interest is based on

our anticipated yield determined by estimating future cash flows each quarter.

The following table summarizes the components of servicing and securitization revenue for the years

ended December 31, 2006, 2005 and 2004.

2006 2005 2004

Years Ended December 31,

Servicing revenue ..................................... $ 336 $ 323 $ 326

Securitization revenue, before Embedded Floor Income and

impairment . ....................................... 368 270 230

Servicing and securitization revenue, before Embedded Floor

Income and impairment ............................... 704 593 556

Embedded Floor Income ................................ 14 81 241

Less: Floor Income previously recognized in gain calculation ..... (8) (57) (156)

Net Embedded Floor Income ............................. 6 24 85

Servicing and securitization revenue, before impairment ......... 710 617 641

Retained Interest impairment ............................. (157) (260) (80)

Total servicing and securitization revenue .................... $ 553 $ 357 $ 561

Average off-balance sheet student loans ..................... $46,336 $41,220 $40,558

Average balance of Retained Interest ....................... $ 3,101 $ 2,476 $ 2,434

Servicing and securitization revenue as a percentage of the average

balance of off-balance sheet student loans (annualized) ........ 1.19% .87% 1.38%

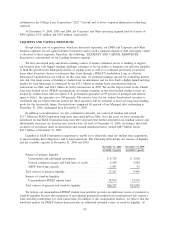

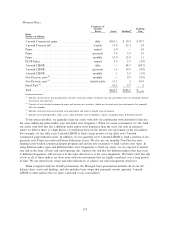

Servicing and securitization revenue is primarily driven by the average balance of off-balance sheet

student loans, the amount of and the difference in the timing of Embedded Floor Income recognition on off-

balance sheet student loans and Retained Interest impairments. The increase in securitization revenue, before

net Embedded Floor Income and impairment, from 2004 to 2006, is primarily due to (1) the continued

increase in the amount of Private Education Loan Residual Interests as a percentage of the total Residual

Interest. Private Education Loan Residual Interests generate a higher yield than FFELP loan Residual Interests,

and (2) an increase in the amount of off-balance sheet loans.

Servicing and securitization revenue can be negatively impacted by impairments of the value of our

Retained Interest, caused primarily by the effect of higher than expected FFELP Consolidation Loan activity

on FFELP Stafford/PLUS student loan securitizations and the effect of market interest rates on the Embedded

Floor Income included in the Retained Interest. The majority of the consolidations bring the loans back on-

balance sheet, so for those loans, we retain the value of the asset on-balance sheet versus in the trust. For the

years ended December 31, 2006, 2005 and 2004, we recorded impairments of $157 million, $260 million and

$80 million, respectively. These impairment charges were primarily the result of FFELP Stafford loans

prepaying faster than projected through loan consolidation ($104 million, $256 million and $47 million for the

years ended December 31, 2006, 2005 and 2004, respectively), and the effect of market interest rates on the

Embedded Floor Income which is part of the Retained Interest ($53 million, $4 million and $33 million for

the years ended December 31, 2006, 2005 and 2004 respectively). The level and timing of FFELP

Consolidation Loan activity is highly volatile, and in response we continue to revise our estimates of the

effects of FFELP Consolidation Loan activity on our Retained Interests and it may result in additional

impairment recorded in future periods if FFELP Consolidation Loan activity remains higher than projected.

These impairment charges are recorded as a loss and are included as a reduction to securitization revenue.

97