Sallie Mae 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the GSE has been replaced primarily by securitizations. In addition to securitizations, we have access to a

number of additional sources of liquidity including an asset-backed commercial paper program, unsecured

revolving credit facilities, and other unsecured corporate debt and equity security issuances.

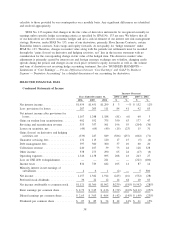

We manage our business through two primary operating segments: the Lending operating segment and the

DMO operating segment. Accordingly, the results of operations of the Company’s Lending and DMO

operating segments are presented separately below under “BUSINESS SEGMENTS.” These operating

segments are considered reportable segments under the Financial Accounting Standards Board’s (“FASB”)

Statement of Financial Accounting Standards (“SFAS”) No. 131, “Disclosures about Segments of an Enterprise

and Related Information,” based on quantitative thresholds applied to the Company’s financial statements.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s Discussion and Analysis of Financial Condition and Results of Operations addresses our

consolidated financial statements, which have been prepared in accordance with generally accepted accounting

principles in the United States of America (“GAAP”). The preparation of these financial statements requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

the reported amounts of income and expenses during the reporting periods. We base our estimates and

judgments on historical experience and on various other factors that we believe are reasonable under the

circumstances. Actual results may differ from these estimates under varying assumptions or conditions. Note 2

to the consolidated financial statements, “Significant Accounting Policies,” includes a summary of the

significant accounting policies and methods used in the preparation of our consolidated financial statements.

On a quarterly basis, management evaluates its estimates, particularly those that include the most difficult,

subjective or complex judgments and are often about matters that are inherently uncertain. These estimates

relate to the following accounting policies that are discussed in more detail below: application of the effective

interest method for loans (premiums, discounts and Borrower Benefits), securitization accounting and Retained

Interests, allowance for loan losses, and derivative accounting. In recent years, we have frequently updated a

number of estimates to account for the continued high level of FFELP Consolidation Loan activity. Also, a

number of these estimates affect life-of-loan calculations. Since our student loans have long average lives, the

cumulative effect of relatively small changes in estimates can be material.

Premiums, Discounts and Borrower Benefits

For both federally insured and Private Education Loans, we account for premiums paid, discounts

received, capitalized direct origination costs incurred on the origination of student loans, and the impact of

Borrower Benefits in accordance with SFAS No. 91, “Accounting for Nonrefundable Fees and Costs

Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases.” The unamortized portion

of the premiums and the discounts is included in the carrying value of the student loans on the consolidated

balance sheet. We recognize income on our student loan portfolio based on the expected yield of the student

loan after giving effect to the amortization of purchase premiums and accretion of student loan discounts, as

well as the impact of Borrower Benefits. Premiums, capitalized direct origination costs and discounts received

are amortized over the estimated life of the loan, which includes an estimate of prepayment speeds. Estimates

for future prepayments are incorporated in an estimated Constant Prepayment Rate (“CPR”), which is

primarily based upon the historical prepayments due to consolidation and defaults, extensions from the

utilization of forbearance, as well as, management’s expectation of future prepayments and extensions. For

Borrower Benefits, the estimates of their effect on student loan yield are based on analyses of historical

payment behavior of borrowers who are eligible for the incentives, and the evaluation of the ultimate

qualification rate for these incentives. We periodically evaluate the assumptions used to estimate the loan life

and qualification rates, and in instances where there are modifications to the assumptions, amortization is

adjusted on a cumulative basis to reflect the change.

The estimate of the CPR measures the rate at which loans in the portfolio pay before their stated maturity.

A number of factors can affect the CPR estimate such as the rate of consolidation activity and default rates.

Changes in CPR estimates are discussed in more detail below. The impact of Borrower Benefits is dependent

33