Sallie Mae 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Competition

The private sector collections industry is highly fragmented with few large companies and a large number

of small scale companies. The DMO businesses that provide third party collections services for ED, FFELP

guarantors and other federal holders of defaulted debt are highly competitive. In addition to competing with

other collection enterprises, we also compete with credit grantors who each have unique mixes of internal

collections, outsourced collections, and debt sales. Although the scale, diversification, and performance of our

DMO business has been a competitive advantage, the trend in the collections industry is for credit grantors to

sell portfolios rather than to manage contingency collections.

In the purchased paper business, the marketplace is trending more toward open market competitive

bidding rather than solicitation by sellers to a select group of potential buyers. Price inflation and the

availability of capital in the sector contribute to this trend. Unlike many of our competitors, our DMO business

does not rely solely on purchased portfolio revenue. This enables us to maintain pricing discipline and

purchase only those portfolios that are expected to meet our profitability and strategic goals. Portfolios are

purchased individually on a spot basis or through contractual relationships with sellers to periodically purchase

portfolios at set prices. We compete primarily on price, but also on the basis of our reputation, industry

experience and relationships.

CORPORATE AND OTHER BUSINESS SEGMENT

Guarantor Services

We earn fees for providing a full complement of administrative services to FFELP guarantors. FFELP

student loans are guaranteed by these agencies, with ED providing reinsurance to the guarantor. The guarantors

are non-profit institutions or state agencies that, in addition to providing the primary guarantee on FFELP

loans, are responsible for other activities including:

• guarantee issuance — the initial approval of loan terms and guarantee eligibility;

• account maintenance — maintaining and updating of records on guaranteed loans; and

• guarantee fulfillment — review and processing of guarantee claims.

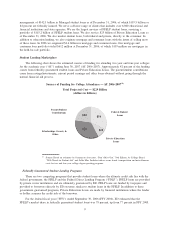

Currently, we provide a variety of these services to nine guarantors and, in AY 2005-2006, we processed

$15.1 billion in new FFELP loan guarantees, of which $11.6 billion was for USA Funds, the nation’s largest

guarantor. We processed guarantees for approximately 29 percent of the FFELP loan market in AY 2005-2006.

Guarantor servicing fee revenue, which included guarantee issuance and account maintenance fees, was

$132 million for the year ended December 31, 2006, 83 percent of which we earned from services performed

on behalf of USA Funds. Under some of our guarantee services agreements, including our agreement with

USA Funds, we receive certain scheduled fees for the services that we provide under such agreements. The

payment for these services includes a contractually agreed upon set percentage of the account maintenance

fees that the guarantors receive from ED.

Our primary non-profit competitors in guarantor servicing are state and non-profit guarantee agencies that

provide third party outsourcing to other guarantors.

(See APPENDIX A, “FEDERAL FAMILY EDUCATION LOAN PROGRAM — Guarantor Funding” for

details of the fees paid to guarantors.)

Acquisitions

On August 22, 2006, the Company completed the acquisition of Upromise. Upromise’s popular rewards

service — one of the largest rewards marketing coalitions in the U.S. — has more than seven million members

who have joined Upromise to save for college when they and their families buy gas or groceries, dine out, or

purchase other goods and services from more than 450 participating companies. Upromise’s subsidiary,

Upromise Investments, Inc., is also the largest administrator of direct-to-consumer 529 college savings plans,

administering approximately 1.2 million college savings accounts and over $15 billion in assets with tax-

17