Sallie Mae 2006 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

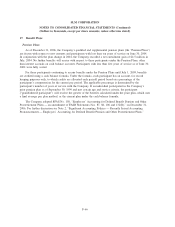

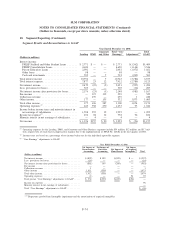

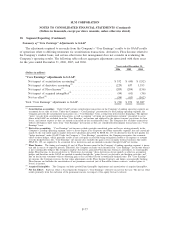

18. Segment Reporting (Continued)

Lending DMO

Corporate

and Other

Total “Core

Earnings” Adjustments

(2)

Total

GAAP

Year Ended December 31, 2005

(Dollars in millions)

Interest income:

FFELP Stafford and Other Student Loans . . $2,298 $ — $ — $2,298 $(1,283) $1,015

FFELP Consolidation Loans . . . ......... 3,014 — — 3,014 (514) 2,500

Private Education Loans ............... 1,160 — — 1,160 (526) 634

Other loans......................... 85 — — 85 — 85

Cash and investments ................. 396 — 5 401 (125) 276

Total interest income ................... 6,953 — 5 6,958 (2,448) 4,510

Total interest expense ................... 4,798 19 6 4,823 (1,764) 3,059

Net interest income .................... 2,155 (19) (1) 2,135 (684) 1,451

Less: provisions for losses ............... 138 — — 138 65 203

Net interest income after provisions for

losses ............................. 2,017 (19) (1) 1,997 (749) 1,248

Fee income .......................... — 360 115 475 — 475

Collections revenue .................... — 167 — 167 — 167

Other income ......................... 111 — 125 236 1,129 1,365

Total other income ..................... 111 527 240 878 1,129 2,007

Operating expenses..................... 547 288 235 1,070 68 1,138

Income before income taxes and minority

interest in net earnings of subsidiaries ..... 1,581 220 4 1,805 312 2,117

Income tax expense

(1)

................... 586 81 1 668 61 729

Minority interest in net earnings of

subsidiaries......................... 2 4 — 6 — 6

Net income .......................... $ 993 $135 $ 3 $1,131 $ 251 $1,382

(1)

Income taxes are based on a percentage of net income before tax for the individual reportable segment.

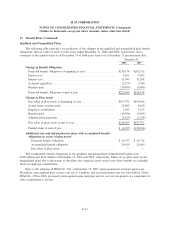

(2)

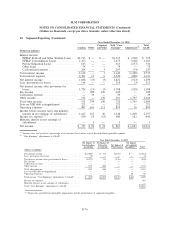

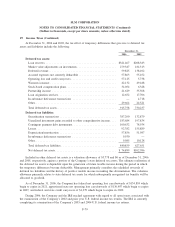

“Core Earnings” adjustments to GAAP:

Net Impact of

Securitization

Accounting

Net Impact of

Derivative

Accounting

Net Impact of

Floor Income

Net Impact

of Acquired

Intangibles

(A)

Total

Year Ended December 31, 2005

(Dollars in millions)

Net interest income . . . ....................... $(867) $387 $(204) $ — $ (684)

Less: provisions for losses ...................... 65 — — — 65

Net interest income after provisions for losses . ........ (932) 387 (204) — (749)

Fee income . . . ............................ — — — — —

Collections revenue . . . ....................... — — — —

Other income . . ............................ 879 250 — — 1,129

Total other income ........................... 879 250 — — 1,129

Operating expenses . . . ....................... 7 — — 61 68

Total pre-tax “Core Earnings” adjustments to GAAP . . . . . $ (60) $637 $(204) $(61) 312

Income tax expense . . . ....................... 61

Minority interest in net earnings of subsidiaries ........ —

Total “Core Earnings” adjustments to GAAP . . . ....... $ 251

(A)

Represents goodwill and intangible impairment and the amortization of acquired intangibles.

F-75

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)