Sallie Mae 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.costs have risen 51 percent for four-year public institutions and 32 percent for four-year private institutions on

a constant, inflation-adjusted basis since the academic year (“AY”) 1996-1997 and are projected to continue to

rise at a pace greater than inflation. Management believes that these factors will drive growth in education

financing well into the next decade.

On March 22, 2005, the Company announced that it extended both its JPMorgan Chase and Bank One

student loan and loan purchase commitments to August 31, 2010. This comprehensive agreement provided for

the dissolution of the joint venture between Chase and Sallie Mae.

JPMorgan Chase will continue to sell substantially all student loans to the Company (whether made under

the Chase or Bank One brand) that are originated or serviced on our platforms. In addition, the agreement

provides that substantially all Chase-branded education loans made for the July 1, 2005 to June 30, 2006

academic year (and future loans made to these borrowers) will be sold to us, including certain loans that are

not originated or serviced on Sallie Mae platforms.

This agreement permits JPMorgan Chase to compete with us in the student loan marketplace and releases

the Company from its commitment to market the Bank One and Chase brands on campus. We will continue to

support its school customers through its comprehensive set of products and services, including its loan

origination and servicing platforms, its family of lending brands and strategic lending partners.

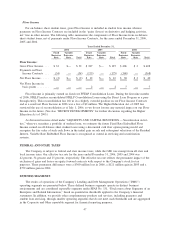

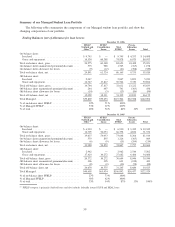

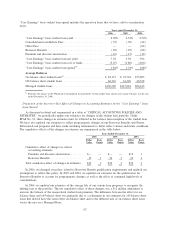

Over the past three years, we have experienced a surge in FFELP Consolidation Loan activity as a result

of historically low interest rates and aggressive marketing in the industry which has substantially changed the

composition of our student loan portfolio. A number of new competitors have entered into the FFELP

Consolidation Loan marketplace, as a result of very low barriers to entry for marketing and originating FFELP

Consolidation Loans. For example, access to customers does not require an on-campus presence, and a ready

and available secondary market exists for these loans. This, coupled with the repeal of the Single Holder Rule

have made the FFELP Consolidation Loans’ marketplace more competitive and has shortened the average life

of FFELP Stafford loans, making them less valuable.

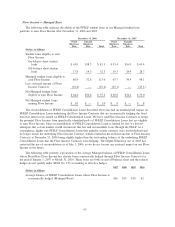

FFELP Consolidation Loans earn a lower yield than FFELP Stafford loans due primarily to the 105 basis

point Consolidation Loan Rebate Fee. This negative impact is somewhat mitigated by higher SAP spreads, the

longer average life of FFELP Consolidation Loans and the greater potential to earn Floor Income. Since

interest rates on FFELP Consolidation Loans originated prior to July 1, 2006 are fixed to term for the

borrower, older FFELP Consolidation Loans with higher borrower rates can earn Floor Income over an

extended period of time. In both 2005 and 2006, substantially all Floor Income was earned on FFELP

Consolidation Loans. The Reconciliation Legislation requires lenders to rebate Floor Income on all FFELP

loans originated on or after April 1, 2006, so this benefit will gradually decrease over time. During 2006,

$15.8 billion of FFELP Stafford loans in our Managed loan portfolio consolidated either with us ($11.3 billion)

or with other lenders ($4.5 billion). In addition, we consolidated $4.1 billion of loans from other lenders and

had $2.7 billion of our FFELP Consolidation Loans reconsolidated with other lenders. The net result of

consolidation activity in 2006 was a net portfolio loss of $3.1 billion. FFELP Consolidation Loans now

represent 71 percent of our on-balance sheet federally guaranteed student loan portfolio and over 66 percent of

our Managed federally guaranteed portfolio.

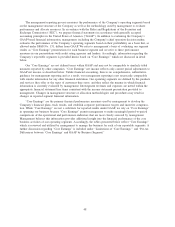

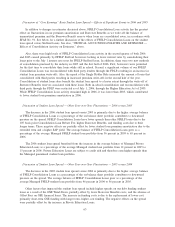

The increase in consolidations to third parties during 2006 is due to FFELP lenders reconsolidating

FFELP Consolidation Loans using the Direct Loan Program as a pass-through entity to circumvent the

statutory prohibition on the reconsolidation of FFELP Consolidation Loans and to the repeal of the Single

Holder Rule as of June 15, 2006. The Higher Education Reconciliation Act of 2005 restricted reconsolidation,

and as of July 1, 2006, borrowers with a FFELP Consolidation Loan may only reconsolidate with the FDLP if

they are delinquent, referred to the guaranty agency for default aversion activity, and enter into the income

contingent repayment program (“ICR”) in the FDLP. Borrowers may also reconsolidate an existing FFELP

Consolidation Loan with a new FFELP Stafford loan.

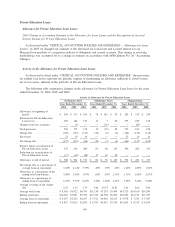

To meet the increasing cost of higher education, students and parents have turned to alternative sources of

education financing outside of the FFELP. A large and growing source of this supplemental education

financing is provided by Private Education Loans, for which we are the largest provider. These loans are still

56